Markets might be set for another day of losses bringing a five-day winning streak to an end as new coronavirus cases around the globe awaken fears over an economic recovery.

Markets were driven largely by positive economic data and we might see some consolidation ahead of U.S earnings season, which starts next week. Gold should come back into focus as safe havens assets become attractive while crude oil might see some over supply pressure.

In this note you will find the technical analysis from our Market Analyst, Barry Dumas:

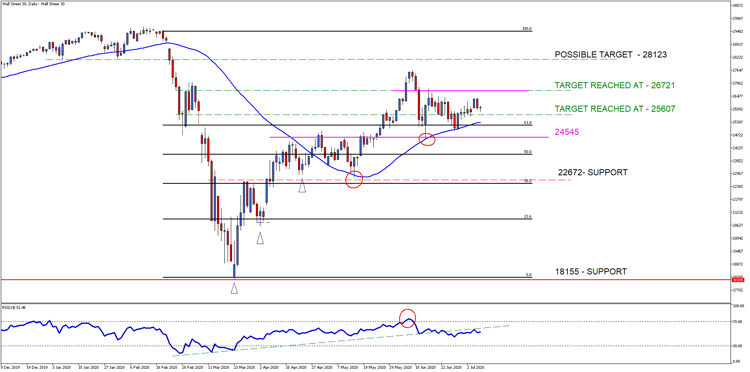

The Wall Street 30 Technical Analysis

The Wall Street 30 Index has been consolidating between our points of interest (pink lines) for close to a month now which might mean that the market is possibly waiting on another form of stimulus. Volume is moving lower on the Index, which could indicate another “big” move might be on the cards which brings back our 26721 resistance (pink line) into focus and the 24545 support.

The price action on both the Wall Street 30 and S&P 500 have not surpassed their all-time highs like the Nasdaq which does raise some concerns. Both these Indices should breakout above these highs to negate the Bear case which could still be in play.

Technical points to look out for on the Daily Wall Street 30:

- Our points of interest for a move higher could be a close above the 26721 resistance (pink line) with a possible target point of 28123.

- Our point of interest for a move lower could be a close below the 24545 support (pink line) with a possible target point of 23858.

- The 50-day SMA (blue line) is closing in on the price action which could continue to act as support and will be watched closely for failure.

- The Relative Strength Index (RSI) has remained at neutral levels over the last week, also an indication that the market is consolidating.

Chart Source: Wall Street 30 Daily Timeframe GT247 MT5 Trading Platform

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 8th of July 2020) U.S Market open.

Sources – MetaTrader5, Reuters

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.