The start to the week saw new record highs and optimism return to the U.S markets as the U.S earnings starts winding down and economic data becomes the focal point. The significant increase in new home sales were overshadowed by consumer confidence data which dropped to a six-year low.

Some positive news on the U.S-China trade front is that both countries reaffirmed their commitment to the phase one trade deal which gave a boost to markets on Tuesday.

The latest is that “China is set to buy a record amount of American soybeans this year as lower prices help the Asian nation boost purchases pledged under the phase-one trade deal, according to people familiar with the matter.” - BloombergQuint

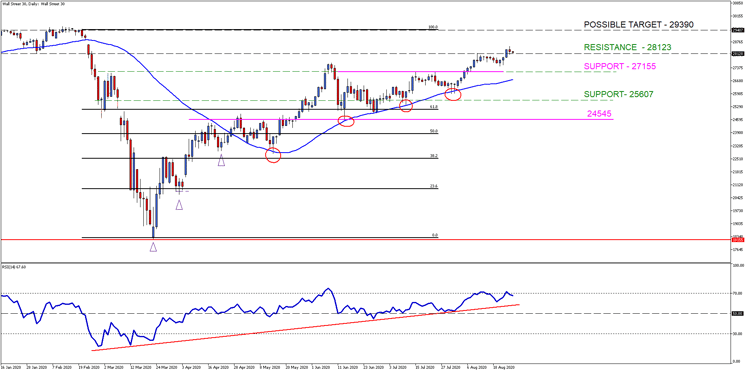

The Wall Street 30 Technical Analysis

The Dow is still lagging other major U.S Indices in reaching new all-time highs but that might change with the latest reshuffle. The removal of Exxon Mobil, Raytheon and Pfizer from the benchmark Index and replacing them with tech stocks, Salesforce, Amgen and Honeywell. These changes will take effect on the 31st of August 2020 and the tech additions might just see the Dow push higher.

Technical points to look out for on the Daily Wall Street 30:

The price action has made higher highs and higher lows since July and is currently stalling at our resistance area of 28123. We need to see this area turn into a support level to push prices higher back to all-time highs and our third target price at 29390.

- The current price action is above our resistance area at 28123 and I need to see price move higher from here to change my outlook from resistance to a support level.

- The price action needs to stay above the 27155-support level of interest (pink line) which becomes the next possible focal point for price if prices turn lower.

- The 50-day SMA (blue line) is still a focal point as a support level.

- The Relative Strength Index (RSI) has reached the overbought level at 70 and is very positive for the move to continue to the upside if it can remain there.

Chart Source: Wall Street 30 Daily Timeframe - GT247 MT5 Trading Platform

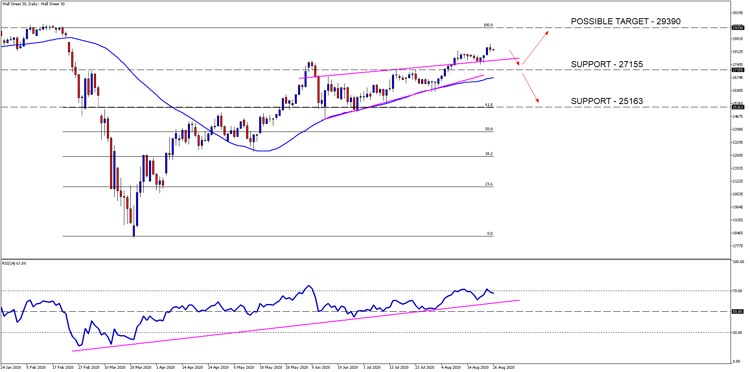

Technical insights – what the Beef is looking at now

The outlook here has not changed as I will still be keeping a close eye on the 27155-support level for a bounce to our possible target price at the 29390-resistance level if price moves lower from today.

Chart Source: Wall Street 30 Daily Timeframe - GT247 MT5 Trading Platform

Take note: The outlook and levels might change as this outlook is released prior to the current day (Wednesday the 26th of August 2020) U.S Market open.

Sources – MetaTrader5, Reuters, Market Insider, BloombergQuint

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.