Global equity markets were unchanged on Wednesday morning as market participants await the U.S Federal Reserve’s interest rate decision. The U.S. Federal Reserve's Federal Open Market Committee (FOMC) will announce its interest rate decision tonight at 20:00 SAST.

Here is what’s expected this week:

Interest Rate Outlook

The Fed is widely expected to ramp up its fight against inflation with a 50-basis point rate hike later this evening and trim its balance sheet by as much as $95 billion a month.

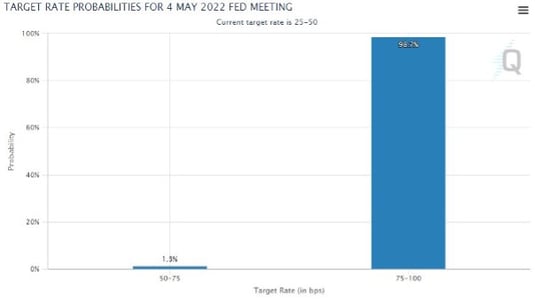

The Target Rate Probabilities according to the CME Group's Fedwatch Tool (below) is almost certain with a 98.7% probability that the target rate will fall between 75 – 100 basis points.

The FOMC Statement and Press Conference:

At the FOMC press conference scheduled for 20:30 SAST, Fed chair Powell will give clues on how far the Fed’s hawkish is prepared to go to try and stabilize the U.S economy. Investors have also priced in a couple of rate hikes throughout this year and well into 2023 which have some saying a recession is all but definite.

The U.S Non-Farm Payrolls (NFP)

The Economic calendar is filled to the brim this week and not only will we see an interest decision but also get the lates payrolls data for April this Friday. The latest labour data is suggesting that the labour market is tightening as employment cost surge and the “great resignation” takes effect.

Key events to watch ahead of the U.S non-farm payroll (NFP) report:

- The U.S ADP Nonfarm Employment Change (Apr) – Today 14:15 SAST

- ISM Non-Manufacturing PMI (Apr) – Today 16:00 SAST

- Crude Oil Inventories – Today 16:30 SAST

- Fed Interest Rate Decision – Today 20:00 SAST

- FOMC Press Conference – Today 20:30 SAST

- US Initial Jobless Claims – Thursday 14:30 SAST

The U.S non-farm payroll (NFP) report for April will be released this Friday the 6th of May at 14:30 SAST and these are the data expectations:

- Jobs number: 400k expected vs 431K previous

- Hourly earnings (YoY) (Apr): 5.5% expected vs 5.6% previous

- Hourly earnings (MoM): 0.4% expected vs 0.4% previous

- S Unemployment Rate (Apr): 3.5% expected vs 3.6% previous

The Wall Street 30 Technical Analysis

The Wall Street 30 (WS30) pushed through the 35038-resistance level as discussed in our previous WS30 note but could not quite reach our possible target level at the 35635-resistance.

The price action has trended lower over the last week reaching the 32456-support level and is muted between the support and 33855-resistance level.

We might see the price action trend lower if the Fed appears to be more hawkish than anticipated and that might send prices back down to the 32456 level. For the bull case we are seeing divergence between the relative strength index (RSI) and price which will be watched closely for a break higher.

![Wall Street 30H4[74]](https://blog.gt247.com/hs-fs/hubfs/Wall%20Street%2030H4%5B74%5D.png?width=751&name=Wall%20Street%2030H4%5B74%5D.png)

Current State / Chart Source: Wall Street 4H Timeframe - GT247 MT5 Trading Platform

Why is the jobs number important?

The Non-Farm Payrolls report (NFP) is treated as an economic indicator for people employed during the previous month, and the number being released will have a direct impact on the markets. In the United States, consumer spending accounts for most of the economic activity, and the Non-Farm Payrolls report represents 80% of the U.S. workforce. Farmers are excluded from the employment figures due to the seasonality of farm jobs.

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 4th of May 2022) U.S Market open.

Sources – MetaTrader5, Reuters, Ann Saphir, Huw Jones.

When does the Non-Farm Payroll Announcement take place in South African time?

U.S Non-Farm Payrolls (NFP) report is live this Friday the 6th May 2022 at 14:30 SAST

Barry Dumas | Market Analyst at GT247.com

Barry has 13 years of experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third-party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.