Volatility is still expected today as global markets hit the pause button ahead of the U.S Federal Reserve Bank (FED) interest rate decision later today.

Globally markets have been under pressure over the last week with U.S equities posting their worst week since 2020. The MSCI World Index is also set for its largest monthly decline since the COVID-19 pandemic started while Asian markets steadied today ahead of the U.S rate decision.

Here is what’s expected this week:

The FOMC Statement and Press Conference:

The Federal Open Market Committee (FOMC) statement communicates its monetary policy to investors and market participants and will be released around 21:00 SAST.

At the FOMC press conference scheduled for 21:30 SAST this Wednesday, market participants will be looking for any hints about faster monetary policy tightening from the U.S. Federal Reserve (FED). The first 25 basis point rate hike is only expected in March 2022, with three additional quarter-point increases expected before the year is done.

The Wall Street 30 Technical Analysis

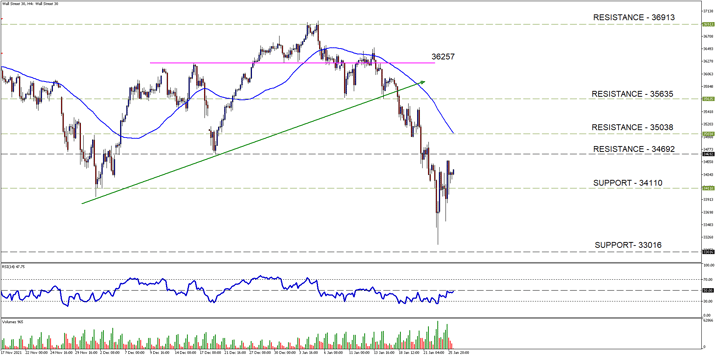

With the bears firmly in control over the last week, our lower levels were targeted as mentioned in the previous Wall Street 30 (WS30) note. As fear and panic selling increased, we even saw the 33016 technical support level from September targeted.

The price action has loads of resistance points it needs to clear to negate the current downtrend which is firmly in place. The WS30 is expected to remain volatile leading into and after the Fed decision and for the rest of the week. We would need to see price above the 35038-resistance level supported by positive fundamentals for the bulls to take control.

The 50-day simple moving average of price (blue line) is still on a downward slope supporting lower prices while the Relative Strength Index (RSI) has moved higher to the midpoint.

Current State / Chart Source: Wall Street 4H Timeframe - GT247 MT5 Trading Platform

Trading Term of the day:

Federal Open Market Committee (FOMC)

The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMOs). The committee is made up of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents on a rotating basis. – Investopedia.

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 26th of January 2022) U.S Market open.

Sources – MetaTrader5, Reuters, Stella Qiu, Alun John, Investing.com, Investopedia.

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years of experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third-party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.