The mood is starting to turn in September as Asian shares are just below their six-week high point in the Wednesday trading session as U.S growth slows down and worries start to creep in.

The U.S non-farm payroll (NFP) report did indeed deliver a surprise as suspected which has now placed the spotlight firmly back on economic growth, or the lack thereof. The NFP report indicated that the U.S Labour market may be slowing down as only 235K new jobs from the 750K expected were added in the month of August 2021.

The U.S Dollar has been strengthening since the start of the week, while 10-year U.S Treasury yields moved lower from an eight-week high. “Higher yields had hurt non-interest-bearing gold overnight, but the spot price gained 0.18% on Wednesday to $1798.03 per ounce, edging back towards $1800 having fallen below the level in the previous session. GOL/ Bitcoin paused for breath after plunging 17% on Monday to a low of around $43,000 before recovering. It was last at $47,000, little changed in Asian hours”. - Alun John

Here is what’s expected this week:

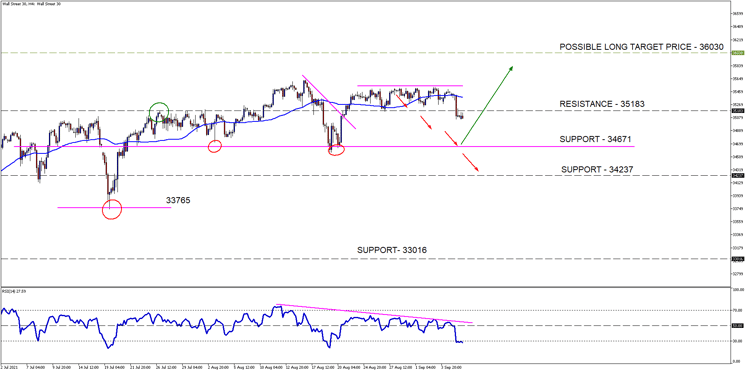

The Wall Street 30 Technical Analysis

The risk-averse mood which we might expect in September seems to be setting in after the dismal jobs report which could see prices move lower over the next two weeks. If the bears take control, then our support level of interest (pink line) at 34671 could be reached again.

- Volatility is expected to increase over the week, as the 344671-support level comes back into play.

- The 50-day SMA (blue line) is above price and acting as resistance.

- The Relative Strength Index (RSI) is at the oversold level on the 4H chart but this does not indicate a reversal in price, as oversold levels could persist for weeks on end.

Chart Source: Wall Street 4H Timeframe - GT247 MT5 Trading Platform

Trading Term of the day:

Risk-Averse:

The term risk-averse describes the investor who chooses the preservation of capital over the potential for a higher-than-average return. In investing, risk equals price volatility. A volatile investment can make you rich or devour your savings. A conservative investment will grow slowly and steadily over time. – Investopedia

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 8th of September 2021) U.S Market open.

Sources – MetaTrader5, Reuters, Investing.com.

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years of experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third-party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.