Global markets take a breather as U.S Treasuries start to stabilize ahead of the U.S Non-Farm Payrolls (NFP) report this Friday at 15:30 SAST.

Asian markets were higher on Wednesday after U.S Futures start to negate the overnight downturn as imminent U.S stimulus is expected to ignite the global economic recovery.

Here is what’s expected this week:

This week’s U.S Non-Farm Payrolls report is widely anticipated to show a stagnant U.S jobs market although an increase in employment data is expected on Friday. It might take some time to get back to pre-pandemic levels of employment as declines in COVID-19 cases might take longer.

Here is what’s expected this week:

The U.S Non-Farm Payrolls (NFP)

Jobs number:

The number of new Non-Farm jobs for February is expected to come in significantly higher than the previous reading for January 2021 of 49K.

- U.S Non-Farm Payrolls data is expected increase to 180K employed for the month of February 2021.

Hourly earnings:

The Average hourly earnings (M/M) (Feb) data is expected to remain unchanged at 0.2% while the Average hourly earnings (Y/Y) (Feb) is expected to see a slight decline to 5.3% from the previous months number at 5.4%

U.S. Unemployment Rate:

The U.S. Unemployment Rate measures the percentage of the total workforce that is unemployed and actively seeking employment during the previous month.

- The U.S. Unemployment Rate is watched closely for signs of economic recovery and is expected to decrease to 6.3%.

Why is the jobs number important?

The Non-Farm Payrolls report (NFP) is treated as an economic indicator for people employed during the previous month, and the number being released will have a direct impact on the markets. In the United States, consumer spending accounts for most of the economic activity, and the Non-Farm Payrolls report represents 80% of the U.S. workforce. Farmers are excluded from the employment figures due to the seasonality in farm jobs.

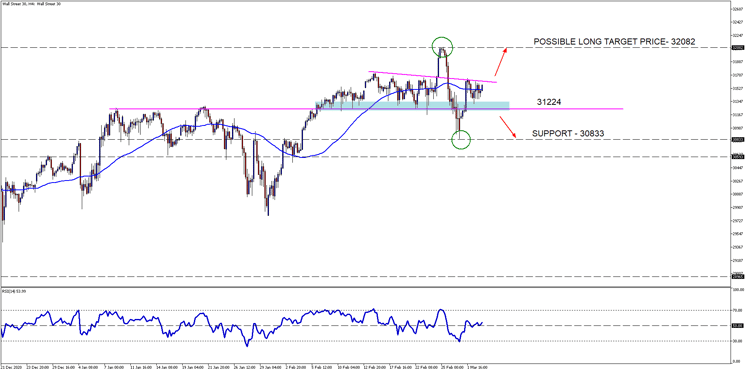

The Wall Street 30 Technical Analysis

It is not every day that the Bulls (longs) and Bears (short) can be satisfied all in one week as both our higher and lower target levels of interest were reached as discussed in last week’s WS30 note.

The defined support zone (blue box) on the 4H chart is still giving buyers opportunities and if stimulus rolls in, we could see higher prices reached at 32082. Our 31224-support zone is still a level of interest and a break of this level could again target 30833.

- Our new possible price target has been revised higher to the 32082-resistance area for bulls and for the bears we are keeping it at the 30833-support level.

- The 50-day SMA (blue line) is below price providing possible support on the 4H chart.

- The Relative Strength Index (RSI) is above the 50 mark and pointing higher.

Chart Source: Wall Street 4H Timeframe - GT247 MT5 Trading Platform

When will the NFP economic announcement take place?

U.S Non-Farm Payrolls (NFP) report this Friday, 5 March 2021, at 15:30 SAST .

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 3rd of March 2021) U.S Market open.

Sources – MetaTrader5, Reuters

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.