U.S markets have been on a record run this Tuesday after strong sales growth numbers were reported by major retailers. The news saw the Nasdaq move to record highs with the S&P 500 also reaching new all-time highs, crossing levels last seen in February before the COVID-19 crises.

We might see some market headwinds in the shorter term despite positive data showing the housing sector strength while the U.S-China relations start to dwindle once again.

Reuters reported – “ABOARD AIR FORCE ONE, Aug 18 – No new high-level trade talks have been scheduled between the United States and China but the two sides remain in touch about implementing a Phase 1 deal, White House Chief of Staff Mark Meadows told reporters aboard Air Force One on Tuesday.” And “U.S. President Donald Trump earlier told reporters during a visit to Yuma, Arizona, that he had postponed an Aug. 15 review of the trade agreement signed with China in January given his frustration over Beijing's handling of the coronavirus pandemic.”

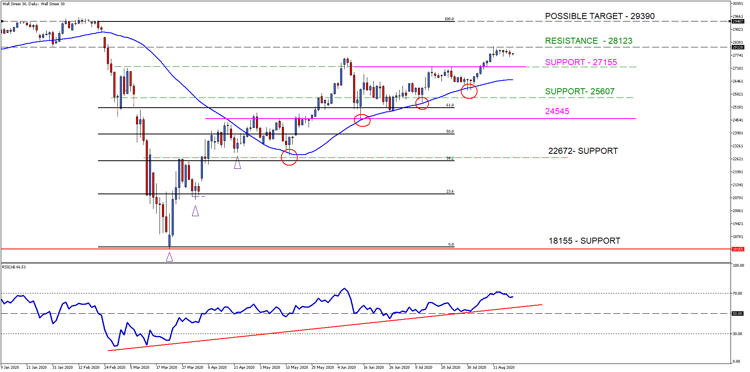

The Wall Street 30 Technical Analysis

The Dow has been lagging the other major Indicis in achieving new record highs which is raising some concerns for now. The price action needs to stay above our levels of support and the 50-day SMA to support another move higher. We have raised our one level of interest (pink line) to the support level at 27155 which could be tested in the short term.

Technical points to look out for on the Daily Wall Street 30:

- The price action needs to stay above the 27155-support level of interest (pink line) which becomes the next possible focal point for price.

- The 50-day SMA (blue line) will become the next focal point if the support at 27155 fails.

- The Relative Strength Index (RSI) has reached the overbought level which is very positive for the move to continue to the upside.

Chart Source: Wall Street 30 Daily Timeframe - GT247 MT5 Trading Platform

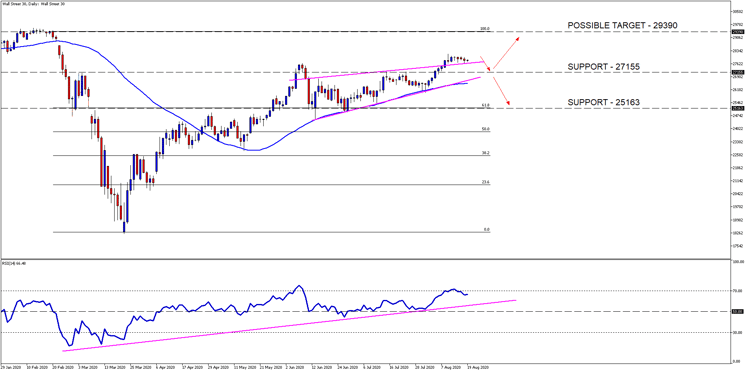

Technical insights – what the Beef is looking at now

Taking a closer look we might see price move back to test the failed wedge/ triangle breakout as mentioned in our previous Technical insights. I will be keeping a close eye on the 27155-support level for a bounce to our possible target price at the 29390-resistance level.

As mentioned, the Wall Street 30 Index has been lagging the Nasdaq and S&P 500 in reaching new highs which might mean trouble for the Dow if both these Indicis start to turn lower. We might expect to see the Wall Street 30 target lower levels at 25163 if this happens.

Chart Source: Wall Street 30 Daily Timeframe - GT247 MT5 Trading Platform

Take note: The outlook and levels might change as this outlook is released prior to the current day (Wednesday the 19th of August 2020) U.S Market open.

Sources – MetaTrader5, Reuters

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.