The U.S markets have been on a roller coaster ride since the U.S Federal Reserve (FED)’s interest rate decision a week ago. The FED chair Jerome Powell stated before the Senate banking committee on Tuesday that the U.S economy faces significant uncertainty. This after the FED announced another round of stimulus and President Trump is weighing in on a $1 trillion infrastructure plan.

Markets were subdued in early Asia trade Wednesday morning as fears of a second round of global coronavirus cases are putting a damper on recovery. The new wave of COVID-19 cases poses the biggest risk to the equity markets even after we saw a record number in U.S Retail sales.

In this note you will find the technical analysis from our market analyst, Barry Dumas:

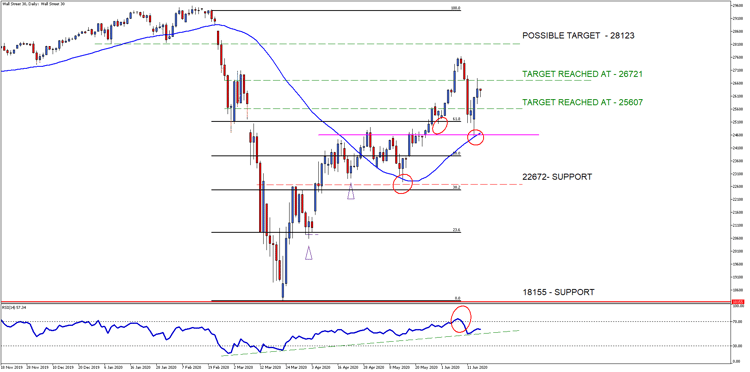

The Wall Street 30 Technical Analysis

The market saw a massive sell-off after the fed announcement and the price action moved lower back to our point of interest at 24545 (pink line). The price action also did not respect our support levels mentioned in last week’s Wall Street 30 Technical Analysis - 10 June 2020. We might need confirmation and a close above our previous target level price of 26721 which might act as resistance in the short term.

Technical points to look out for on the Daily Wall Street 30:

- The Wall Street 30 price action needs to close above the 26721 resistance, our previous target level to target the third possible target at 28123.

- The 50-day SMA (blue line) is acting as support to the price action and needs to be watched closely for failure in the future.

- The Relative Strength Index (RSI) is still trending higher back to overbought levels which supports the move higher.

Chart Source: Wall Street 30 Daily Timeframe GT247 MT5 Trading Platform

Take note: The outlook and levels might change as this outlook is released before the current days (Wednesday 17th of June 2020) U.S Market open.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.