Market sentiment were upbeat going into Wednesday as the earnings season kicked off with J.P Morgan beating estimates by some margin and positive news on the vaccine front.

The tit-for-tat disputes are bringing back volatility to the markets with President Trump ordering an end to Hong Kong's special status under U.S. law and Beijing vowed to retaliate.

In this note you will find the technical analysis from our Market Analyst, Barry Dumas:

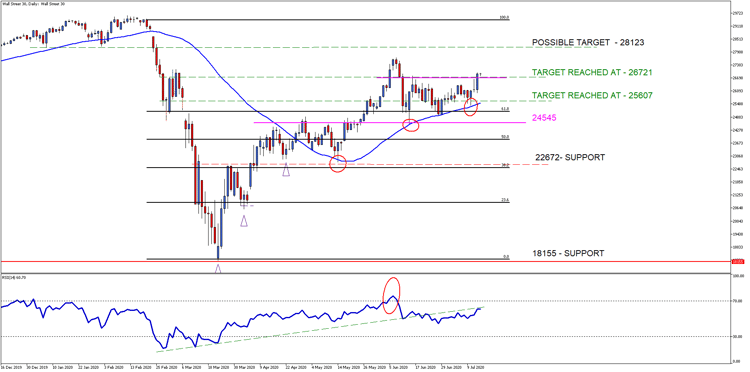

The Wall Street 30 Technical Analysis

The price action on the Wall Street 30 Index has pushed higher and closed above our point of interest the 26721-resistance level (pink line). This level as mentioned in our previous Wall Street 30 Technical Analysis note is a level of interest which needs to hold for another leg higher. Volume has spiked higher as our expected “Big” move realized to the upside and above our point of interest.

The price action on the Wall Street 30 needs to push higher and close above the next resistance level of 27568 to negate the COVID-19 downtrend and push to our 3rd possible target of 28123. News events like negative earnings and the U.S-China sanctions could put a damper on the price action.

Technical points to look out for on the Daily Wall Street 30:

-

The price action has closed above our point of interest resistance at 26721 and needs to hold to support another leg higher.

-

The 50-day SMA (blue line) is continuing to act as support to the price action and now also becomes an indicator of interest to keep an eye on.

-

The Relative Strength Index (RSI) has started to tick higher ever so slightly and is above the midpoint (50) now.

Chart Source: Wall Street 30 Daily Timeframe GT247 MT5 Trading Platform

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 15th of July 2020) U.S Market open.

Sources – MetaTrader5, Reuters

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.