The JSE closed weaker on Wednesday in a session that was characterised by high volatility amongst the blue-chip constituents.

The JSE All-Share Index retraced significantly from its session lows but it still closed lower nonetheless. More details of China’s retaliation to US tariffs were released today and as a result global equity indices came under more pressure. The ALSI futures index had big swings which saw it lose more than 1600 points at its lowest point today, only to recoup most of its losses to trade at 48 474 points at 17.00 CAT, down 0.41% for the day.

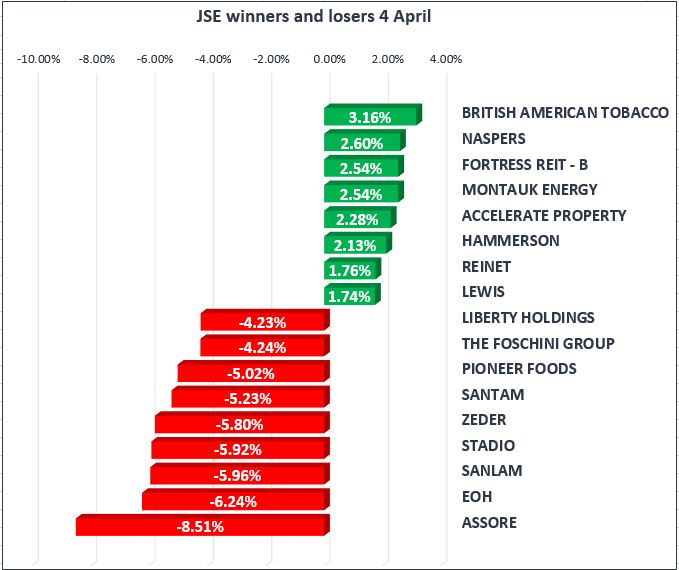

A few blue-chip stocks were trading in the green with notable movers of the day being British American Tobacco [JSE:BTI] and Reinet [JSE:RNI] which gained 3.16% and 1.76% respectively. The biggest example of today’s volatility was probably seen in Naspers [JSE:NPN] which lost more than 6% to reach a session low of R2680.01 per share. The stock paired all of its losses and eventually closed 2.6% firmer at R2956.84 per share.

On the broader index Fortress B [JSE:FFB] and Accelerate Property Fund [JSE:APF] were amongst the top gainers after they closed 2.54% and 2.28% firmer. Other listed property stocks such as NEPI Rockcastle [JSE:NRP], Intu Properties [JSE:ITU] and Hammerson [JSE:HMN] gained 1.11%, 1.13% and 2.13% respectively.

Steinhoff International [JSE:SNH] came under pressure following the news of the revaluation of its property assets downwards. The stock lost 9.85% to close at R3.02 per share. Assore [JSE:ASR], Sanlam [JSE:SLM] and Stadio [JSE:SDO] were among the biggest losers of the day as they lost 8.51%, 5.96% and 5.92% respectively. Platinum miners Northam Platinum [JSE:NHM] and Lonmin [JSE:LON] traded weaker to close the day 4.02% and 2.17% softer.

Retailers and banking stocks came under pressure as a result of the weaker Rand. Retailers such as Mr Price [JSE:MRP] and The Foschini Group [JSE:TFG] lost 3.92% and 4.24% respectively, whilst banking stocks such as Nedbank [JSE:NED] and First Rand [JSE:FSR] shed 2.53% and 0.94% respectively. PPC Limited [JSE:PPC] and WBHO [JSE:WBO] ended the day 3.13% and 2.01% weaker.

The blue-chip JSE Top-40 Index eventually closed 0.27% weaker, whilst the broader All-Share Index lost 0.48%. The Industrials Index ended the day firmer as it recorded gains of 0.5%, however the Resources and the Financials Indices lost 1.39% and 1.68% respectively.

The Rand traded softer against the US dollar to reach a session low of R11.94/$. At 17.00 CAT it had retraced back to trade at R11.90/$.

The US dollar traded relatively flat in today’s session and as a result Gold had a minor rally to peak to a session high of $1348.30/Oz. It retraced significantly from its high to trade at $1335.86/Oz at 17.00 CAT.

Contrary to the trend in Gold, Platinum and Palladium were trading softer in today’s session. At 17.00 CAT Platinum was trading at $914.95/Oz, whilst Palladium was recorded at $921.28/Oz. Brent Crude also traded under pressure and at 17.00 CAT it was down 1.2% for the day, trading at $67.61/barrel.