The JSE tracked lower on Wednesday in a session that was characterised by significant volatility.

The local bourse opened lower on the back of profit-taking, as well as a general bearish sentiment in global equities due to the fears surrounding US proposed steel and aluminium tariffs. The European Union pushed a final attempt to stop Donald Trump from imposing the tariffs, and at the same time indicated that they would respond firmly should the tariffs be triggered.

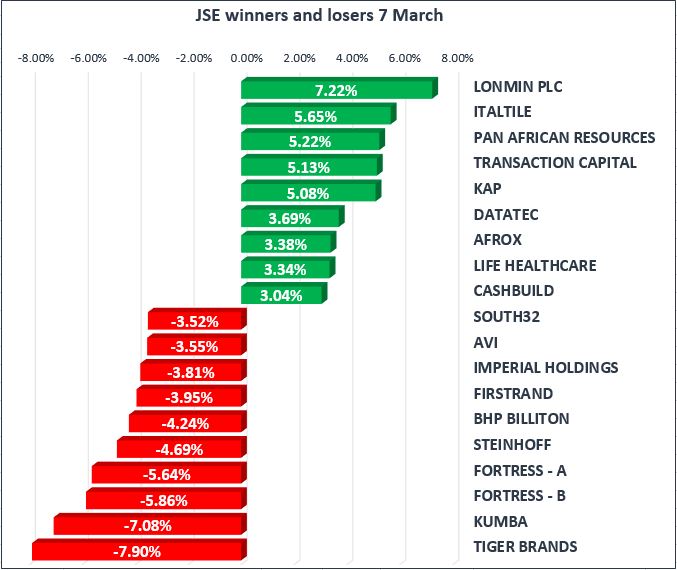

BHP Billiton [JSE:BIL], Kumba Iron Ore [JSE:KIO] and NEPI Rockcastle [JSE:NRP] were all trading ex-dividend on Wednesday which saw them shed 4.24%, 7.08% and 2.75% respectively. Other stocks which were also trading ex-dividend included Fortress A [JSE:FFA] and Fortress B [JSE:FFB] which shed 5.64% and 5.86% respectively. Tiger Brands [JSE:TBS] and Exxaro [JSE:EXX] weakened by 7.90% and 3.45% respectively, whilst MMI Holdings [JSE:MMI] lost 2.93% on the back of 6 months earnings results which did not impress.

Commodity prices retreated from the previous session’s rally, which resulted in most JSE listed miners trading softer on Wednesday. Impala Platinum [JSE:IMP] shed 1.43% to close at R29.00 per share, whilst Glencore [JSE:GLN] lost 0.89% to close at R60.07 per share. Despite earlier pressure some of the retailers reversed earlier losses to end the day in the green. Pick n Pay [JSE:PIK] ended the day 0.70% softer as it failed to complete its comeback.

Shoprite [JSE:SHP], Truworths [JSE:TRU] and Woolworths [JSE:WHL] reversed their losses to end the day up 0.24%, 0.16% and 0.26% respectively. Top gainers on the day included Life Healthcare [JSE:LHC] and KAP Industrial Holdings [JSE:KAP] which ended the day up 3.34% and 5.08% respectively. Listed property stock Resilient [JSE:RES] added 2.49% to close at R62.67 per share, whilst Bidvest [JSE:BVT] closed at R238.28 per share, up 1.76% for the day.

The JSE All-Share Index was down by more than 1% at some point during today’s session, but there was quite a reversal which saw it end the day only down 0.47%. The blue-chip Top-40 Index ended the day 0.48% lower. The major indices traded fairly mixed but in the end the momentum was still very much to the downside. The Industrials Index closed flat as it ended the day up 0.06%, whilst the Resources and Financials Indices lost 1.46% and 1.05% respectively.

The Rand weakened against the greenback mainly on the back of the marginal gains recorded in the US dollar against a basket of major currencies. The local currency weakened to a session low of R11.92/$ before rebounding marginally to trade at R11.86/$ at 17.00 CAT.

Gold firmed immediately after the open to peak at a session high of $1340.59/Oz. However it subsequently came under pressure to trade softer for the remainder of today’s trading session. The precious metal was trading at $1330.34/Oz just after the JSE close.

Platinum and Palladium also traded softer on Thursday as investors sold off commodities for the US dollar. Palladium in particular lost more than 1.5% to trade at $971.75/Oz just after the close, whilst Platinum was 1.12% softer at $958.43/Oz.

Brent Crude was trading softer for the entirety of today’s session, and just after the JSE close it was trading 0.62% softer, at $65.38/barrel.