The start to the week was filled with fear and anxiety as worries about the corona virus outbreak intensified which saw the Shanghai Composite open lower by 9% on Monday. This was the lowest opening plunge since an equity bubble burst back in 2015.

All eyes will turn to the JOBS number and manufacturing data set to be released this week in the U.S to see if the inflations targets set by the FED are idealistic. The U.S. Federal Reserve's Federal Open Market Committee (FOMC) kept the benchmark funds rate unchanged. The committee changed its language on inflation, and it’s geared towards “inflation returning to the Committee’s symmetric 2 percent objective” and not looking to get “near” the benchmark which was considered healthy for a growing economy.

Events leading up to the Jobs report on Friday are:

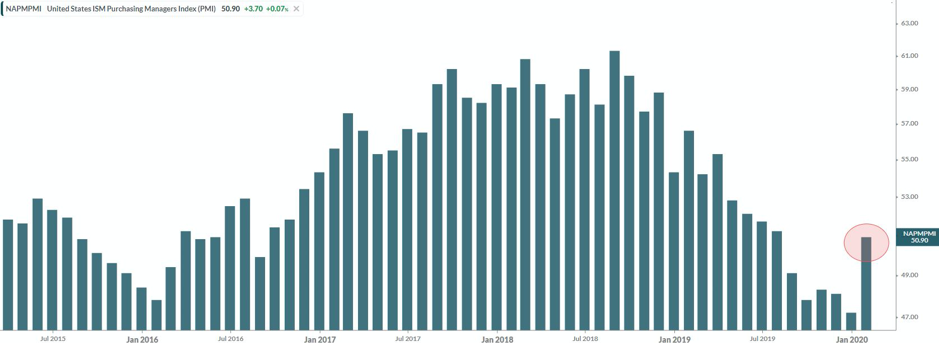

US ISM Manufacturing Purchasing Managers Index (PMI)

The ISM Manufacturing PMI data surprised to the upside to 50.9, beating analyst expectations of 48.5. This indicated that manufacturing activity expanded in January for the first time in six months, but it might be too early to celebrate a turnaround story.

Seasonal factors might come into play from next month as well as the aftereffects of the dreaded corona virus disruption on the manufacturing sector.

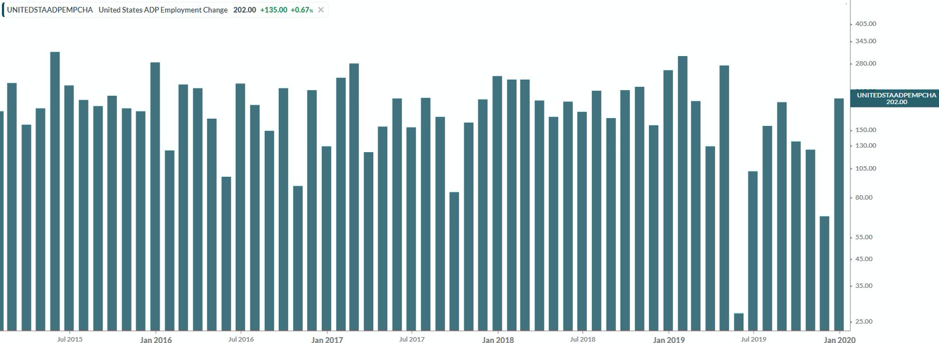

U.S. ADP Non-Farm Employment Change

The U.S. ADP Non-farm Employment Change is an excellent predictor of the Non-Farm Payrolls report as the ADP Non-Farm Employment Change measures the monthly change in non-farm, private employment.

The U.S. ADP Non-farm Employment Change is released two days ahead of the NFP jobs number. The ADP number is expected later today at 15:15 SAST. The ADP Non-farm Employment Change is expected to come in at 156K.

US ISM Non-Manufacturing Purchasing Managers Index (PMI)

The ISM Non-Manufacturing PMI report is a composite index that reports on business and measures Business Activity, New Orders, Employment and Supplier Deliveries. The index is also used as an indicator to judge how well the economy is performing. A reading above the 50 indicates that the Non-Manufacturing sector is expanding while a reading below 50 indicates a contraction.

The Non-Manufacturing PMI number is expected to come in at 55 and will be released on the 5th of February 2020 at 17:00 SAST.

.png?width=939&name=US%20ISM%20Non-Manufacturing%20Purchasing%20Managers%20Index%20(PMI).png)

Non-Farm Payrolls (NFP) outlook

Consensus is that we might expect a slight increase in the Non-Farm Payrolls (NFP) number this Friday compared to the previous months number. A better than expected number might drive markets higher to new all-time highs but we will have to wait and see.

Jobs number:

The number of new Non-Farm jobs is expected to increase to 150K from the previous month's less than enthusiastic 139K Non-Farm jobs.

Hourly earnings:

The Average hourly earnings (M/M) number is expected to increase to 0.3% from the previous month and the Average hourly earnings (Y/Y) is expected to increase slightly to 3.0%

This is a crucial figure to watch, and if this number disappoints, it will signal a weak wage inflation outlook in the U.S. Take note that the Average hourly earnings will be watched closely once more as the wage growth rate has been subdued.

U.S. Unemployment Rate:

The U.S. Unemployment Rate measures the percentage of the total workforce that is unemployed and actively seeking employment during the previous month. The U.S. Unemployment Rate is expected to remain unchanged from the previous reading at 3.5% unemployed.

Why is the jobs number important?

The Non-Farm Payrolls report (NFP) is treated as an economic indicator for people employed during the previous month, and the number being released will have a direct impact on the markets. In the United States, consumer spending accounts for most of the economic activity, and the Non-Farm Payrolls report represents 80% of the U.S. workforce. Farmers are excluded from the employment figures due to the seasonality in farm jobs.

Technical Analysis outlook on U.S. Indices for the U.S Non-Farm Payrolls (NFP)

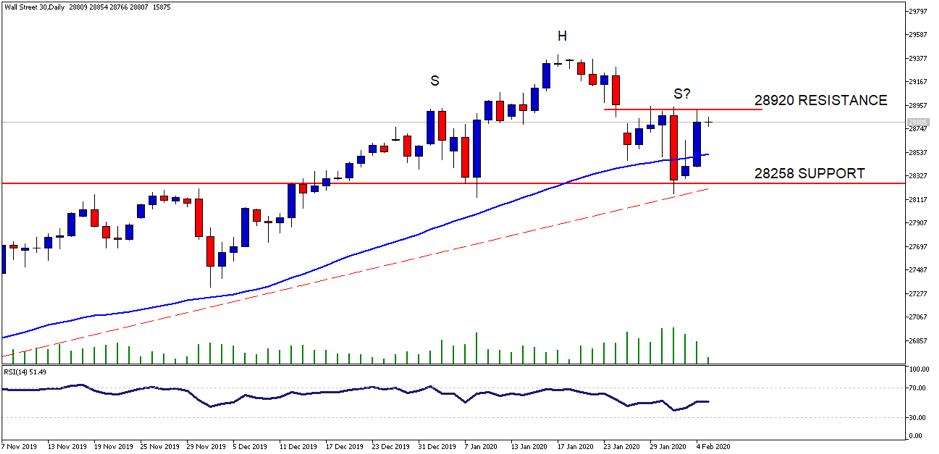

Wall Street 30

The Wall Street 30 index had a stellar run on Tuesday as capital flows back into the equity market, the S&P 500 rose 1.5% with the Nasdaq reaching all-time highs. The 28920-resistance level will be watched closely on the Wall Street 30 Index for a retest and breakout. More downside might be expected on the Dow if the 50-day SMA fails to support the price action.

Technical points to look out for on the Daily Wall Street 30:

- The long-term uptrend is still intact and acting as support to the price action.

- The Relative Strength Index (RSI) is pushing higher from lower levels but is currently at a neutral level.

- The 50-day SMA is also pointing higher supporting the upward movement and might act as support if price moves lower.

Scaling into a 4H chart of the Wall Street 30 we might see signal earlier which might provide better entries on this time frame. Here we can see why it is mentioned above to watch the 28920-resistance level closely.

Technical points to look out for on the 4H Wall Street 30:

- The price action is above the 50-day SMA which might provide support and drive price higher through the resistance level.

- Volume has moved lower while the price action has moved higher

- The Relative Strength Index (RSI) is pushing higher while price moved lower, which signalled a divergence in the price action.

Take note: that the outlook and levels might change as this outlook is released before NFP and before the current days (Wednesday 5th of February 2020) U.S Market open.

What to trade internationally:

- Major indices to look at will be the S&P 500, Wall Street 30, Nasdaq 100

- Major Forex pairs to look at will be EUR/USD, GBP/USD and USD/JPY

- Commodity to look at will be Gold.

What to trade locally:

- Index to look at will be the ALSI

- Forex pair to look at will be the USD/ZAR

- Rand Hedges (BTI, CFR) and Rand Sensitives (Banks and Insurers)

How to trade the Non-Farm Payroll (NFP) report: The Strategies

There are many ways to trade the Non-Farm Payroll (NFP) report, and here are a few strategies traders look at:

- The Early birds: traders who will take an early position before the jobs number is released in anticipation that the directional movement the event will cause will be in their favour.

- The Scalpers: as the data is released, these traders will scalp and try and capitalize on the volatility that is created by the data, positively or negatively.

- The calm and calculated: as the market digest the results of the Non-Farm Payroll (NFP) report and after the volatility swings have occurred, these traders will take a position on the momentum of the market.

When and what time is the US NFP (Non-Farm Payroll) announced in South Africa?

Non-Farm Payrolls are usually reported on the first Friday of the month, whereby the number of additional jobs added from the previous month is released. The US Non-Farm Payroll number will be released locally on Friday the 7th of February 2020 at 15:30 SAST.

Sources – Bloomberg, KOYFIN, CNBC, MetaTrader5

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice. Past performance is not necessarily an indication of future performance. The value of a financial product is not guaranteed. The value of a financial product can go down or up due to various market factors. The graphs are for illustrative purposes only.