The JSE fell on Tuesday as the negative sentiment from the tech sell-off in the USA engulfed global markets.

The Nasdaq plummeted 3.03% in US trading on Monday, and it dragged with it the S&P 500 and Dow Jones which fell 1.66% and 1.56% respectively. In Asian markets trading on Tuesday, the mainland Chinese equity benchmark fell by 2.31% while the Hang Seng dropped 2.02%. In Japan, the Nikkei lost 1.09%.

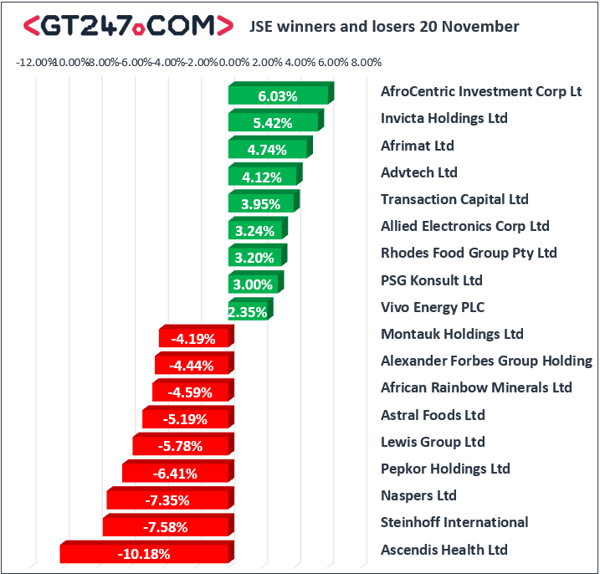

In Hong Kong, Tencent Holdings fell by 3.3% to close at $HK281.60 per share, which adversely affected Naspers [JSE:NPN] as it came under significant pressure in today’s session on the JSE. Naspers ended the day 7.35% weaker at R2617.37.

Pepkor Holdings [JSE:PPH] also came under pressure following the release of a trading statement in which the company flagged a potential decrease of between 32% and 42% in earnings for the full-year ended September 2018. The stock dropped 6.41% to close at R17.23. Astral Foods [JSE:ARL] could not catch a reprieve as it lost another 5.19% to end the day at R176.01, while Exxaro Resources [JSE:EXX] lost 4% to close at R146.45. Financials traded softer as the rand was marginally weaker due to a firming US dollar. Nedbank [JSE:NED] lost 3.13% to end the day at R257.15, and Standard Bank [JSE:SBK] dropped 3.29% to R166.05.

Transaction Capital [JSE:TCP] managed to close amongst the day’s biggest gainers as it was buoyed by the release of its full-year results which indicated a decent increase in earnings. The stock gained 3.95% to end the day at R18.95. Platinum miner, Lonmin [JSE:LON] managed to gain 1.78% to end the day at R8.01, while gold miner, AngloGold Ashanti [JSE;ANG] added 1.41% to close at R141.06. Nampak [JSE:NPK] rose 1.97% to close at R15.50.

The JSE All-Share index closed the day 2.59% weaker, while the blue-chip Top-40 index fell 2.91%. All the major indices on the JSE closed in the red. The Industrials index fell 3.38% while the Financials and Resources indices lost 2.2% and 1.91% respectively.

The rand was trading relatively flat against the US dollar, but it came under pressure following the release of better than expected US Housing data which lifted the US dollar. The rand was trading at R14.06 at 17.00 CAT however it quickly blew out thereafter along with other emerging market currencies.

The bearish sentiment surrounding brent crude saw the commodity drop 3.07% to trade at $64.74/barrel just after the JSE close.

At 17.00 CAT, Gold was down 0.05% at $1223.60/Oz, Platinum had lost 1.37% to trade at $841.81/Oz and Palladium was 1.63% weaker at $1145.98/Oz.

Bitcoin was down 7.69% at $4855.70/coin while Ethereum was 9.93% weaker at $143.74/coin.