The JSE traded under pressure on Friday following the sharp sell-off in US equity markets in Thursday’s session.

US markets came under pressure on Thursday which saw the Dow Jones and S&P500 indices closing 4.15% and 3.75% lower respectively. Subsequently Asian markets also came under pressure which saw the Nikkei and Hang Seng losing 2.32% and 3.10% respectively.

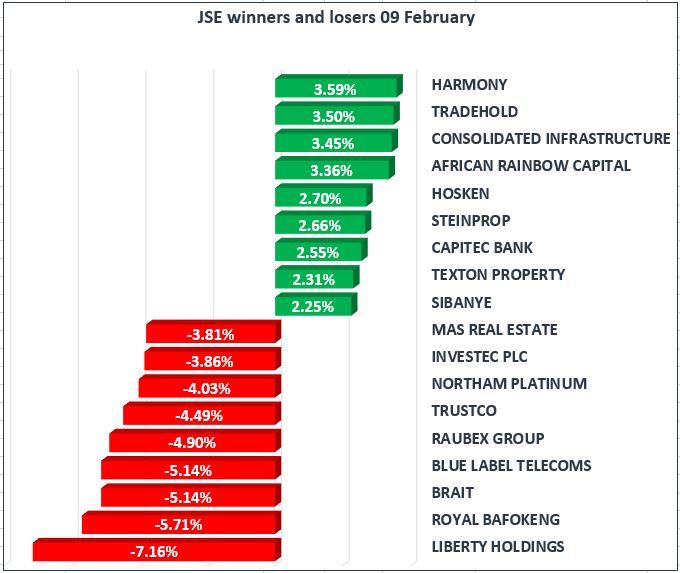

The JSE opened lower and continued to trade under pressure for the entirety of today’s trading session. Liberty Holdings [JSE:LBH] and Trustco [JSE:TTO] came under pressure to lose 7.16% and 4.49% respectively. Liberty Holdings did release a trading statement which indicated increases in EPS and HEPS, but this was mainly attributed to an accounting mismatch arising on the consolidation of Liberty Two Degrees [JSE:L2D] into the Liberty Holdings.

Gold miners continued to trade under pressure due to the weaker Gold price and as a result Gold Fields [JSE:GFI] and AngloGold Ashanti [JSE:ANG] lost 2.81% and 1.38% respectively. However Harmony Gold [JSE:HAR] closed up 3.59% following the release of a positive trading statement which indicated that they are expecting decent increases in profit for the 6 months ended 31 December 2017. Old Mutual [JSE:OML] lost 3.55% to close at R38.00 per share, whilst Naspers [JSE:NPN] ended the day 1.8% weaker.

Capitec Holdings [JSE:CPI] gained 2.55% to close at R831.32 per share whilst Woolworths [JSE:WHL] and Bidvest [JSE:BVT] gained 2.05% and 0.95% respectively. Consolidated Infrastructure [JSE:CIL] continued on its bullish run to end the day up 3.45%. Sibanye-Stillwater [JSE:SGL] and Lonmin [JSE:LON] eventually closed flat after trading firmer for most of the day.

The JSE Top-40 Index ended the day down 1.30% whilst the broader All-Share index was 1.29% lower. All the JSE major indices were trading in the red which saw the Industrials Index losing 1.39%, the Financials Index lost 1.21% and the Resources Index lost 0.98%.

The US dollar recorded gains overnight as the US 10-year Treasury yields rose to almost re-test their recent highs of 2.86%. As a result the Rand was softer against the greenback to reach an intra-day low of R12.05/$. At 5pm, the Rand was trading at R12.06/$.

The strength in the US dollar resulted in Gold sliding from its overnight highs to bottom out at $1312.25/Oz. The precious metal was trading at $1314.35/Oz just after the JSE close.

The slide in Palladium has persisted and today it slipped below Platinum’s trading price to reach a day’s low of $960.63/Oz. Palladium was trading at $962.51/Oz just after the close. Platinum had milder slide compared to Palladium and at 17.00 CAT it was trading at $965.13/Oz.

Brent Crude slid below $64/barrel to reach an intra-day low of $63.70/barrel. The commodity was trading was trading at $63.85/barrel just after the close.