Global equity markets including the JSE came under pressure on Wednesday following new US Fed chairman Jerome Powell’s testimony before lawmakers on Tuesday.

The equity rout started in the Dow Jones and S&P500 indices in the USA which closed 1.16% and 1.27% lower respectively on Tuesday, continued in Asian markets trading on Wednesday where the Nikkei and Hang Seng lost 1.44% and 1.36% respectively. The JSE wasn’t spared as most of the blue chip constituents traded under pressure.

The US Fed chairman hinted at a gradual increase in interest rates as well as shrinking the Fed’s balance sheet to normal levels. He also hinted that he did not expect the strengthening US economy to be derailed by the recent sell-off in equity markets. The jitters in the financial markets were mainly as a result of the perceived likelihood of at least four rate hikes from the Fed this year, as well as the disappointing Chinese manufacturing data released this morning.

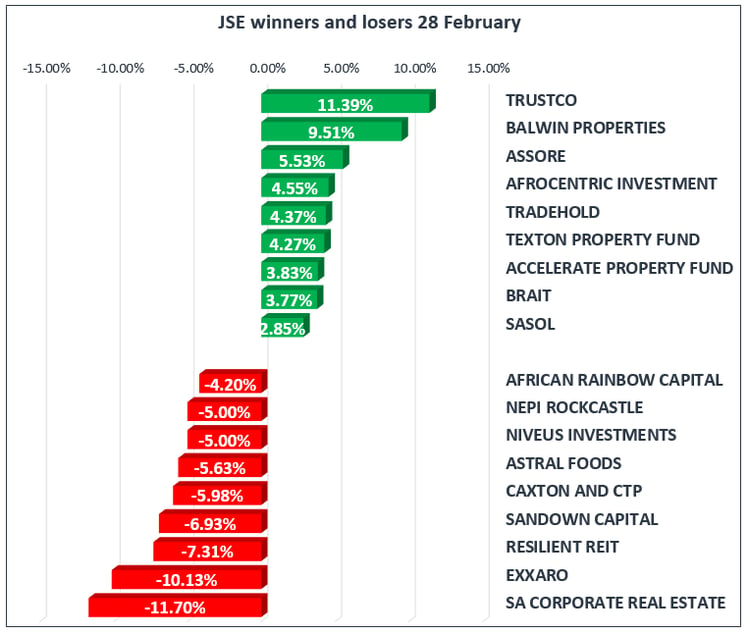

On the JSE, big gains were recorded in Balwin Properties [JSE:BWN], Brait [JSE:BAT] and Sasol [JSE:SOL] which ended the day up 9.51%, 3.77% and 2.85% respectively. Balwin Properties ended the day firmer despite the release of a trading statement earlier on today which highlighted tough operating conditions. Bidcorp [JSE:BID] and Assore [JSE:ASR] added 1.07% and 5.53% respectively.

However the overall trend for the local bourse was mainly downward and the biggest losers included SA Corp Real Estate [JSE:SAC], NEPI Rockcastle [JSE:NRP] and Resilient [JSE:RES] which lost 11.70%, 5.00% and 7.31% respectively. Mining stocks Anglo American PLC [JSE:AGL] and AngloGold Ashanti [JSE:ANG] traded weaker to shed 2.87% and 2.55% respectively, whilst retailers Truworths [JSE:TRU] and Mr Price [JSE:MRP] lost 2.74% and 2.59% respectively. Financials MMI Holdings [JSE:MMI], and Nedbank [JSE:NED] lost 2.06% and 3.62% respectively.

The JSE All-Share Index eventually ended the day 1.19% lower, whilst the JSE Top-40 Index lost 1.25%. It was mostly carnage across most of the major indices as they mostly traded weaker. The Industrials Index lost 1.20% and the Resources Index shed 0.96%. The biggest loser of the day was the Financials Index which lost 1.50%.

Brent Crude traded marginally firmer as it gained just over 0.1% to peak to an intra-day high of $66.81/barrel. Just after the close it was recorded at $66.71/barrel, up 0.12% on the day.

The strengthening of the US dollar resulted in Gold trading weaker earlier on. However the precious metal managed to pair the losses and traded firmer to reach an intra-day high of $1322.55/Oz. When the JSE closed Gold was trading at $1318.42/Oz.

Platinum traded mostly softer on the day but it did spike towards the JSE close to reach a day’s high of $986.87/Oz. It retraced to trade flat just after the close at $983.00/Oz up 0.01% for the day. Palladium traded firmer on the day to reach a day’s high of $1049.65/Oz before retracing to trade at $1042.55/Oz, up 0.37% for the day.