What is 'Quantitative Easing'

Quantitative easing is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity. Quantitative easing is considered when short-term interest rates are at or approaching zero, and does not involve the printing of new banknotes.

QE Tapering

QE tapering has the exact opposite effect compared to QE. QE tapering creates a situation where in the speed at which new money was being supplied into the economy is reduced.

How do central banks do this?

A central bank can implement quantitative easing by purchasing government bonds from commercial banks and other private institutions, which should lower short-term interest rates and increase the capital available to institutions to promote increased lending and liquidity.

Examples

Forex

If the US implemented QE and South Africa does not. The number of dollars in circulation would increase but the number of rands would not. Therefore, the US dollar will lose its purchasing power relative to the rand and this will reflect in the Forex market via dropped prices.

Indices & Equities

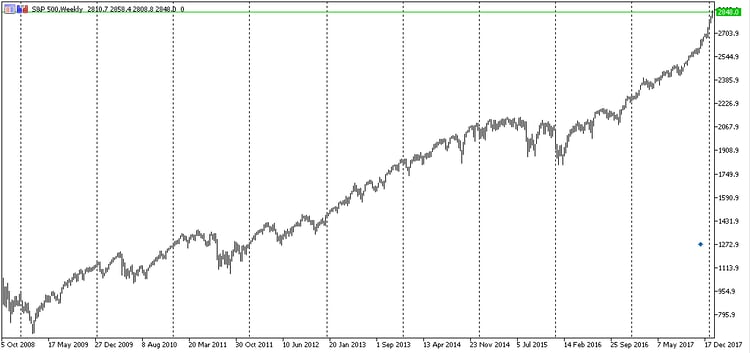

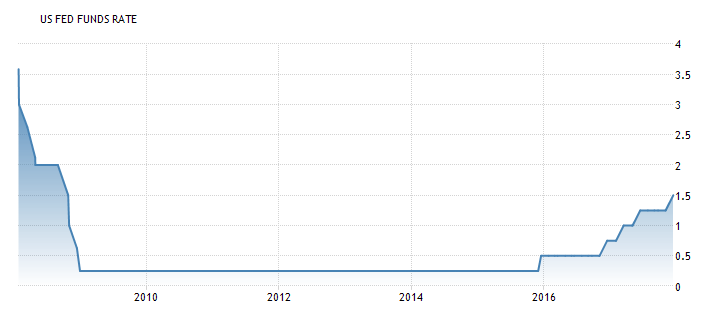

When QE is announced, the theory is demand should go up, interest rates should drop and the net effect on the stock market is positive.

We can see the effects below on the S&P and the US FED Fund Rates since the Fed introduced QE in 2009.

Fig. 1. S&P 500, Weekly (Source: GT247)

Fig. 2. US FED Funds Rate (Source: Trading Economics Federal Reserve)