Markets were somewhat muted ahead of the first U.S Presidential debate on Tuesday but soon turned lower as investors turn cautious with Jobs Friday still on the menu.

Equity Futures turned lower early on Wednesday after doubts creeped in that President Trump will not go peacefully if the election outcome is not in his favour. Safe havens like the Dollar and Yen become attractive once more despite positive PMI data out of China.

Events leading up to the U.S. Non-Farm Payrolls (NFP) release on Friday the 2nd of October 2020:

Wednesday, 30 September 2020:

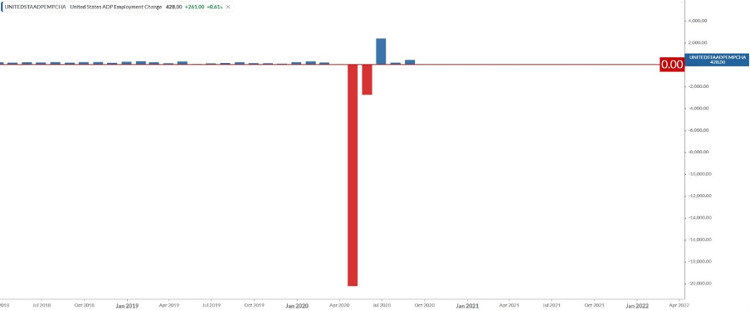

U.S. ADP Non-Farm Employment Change

The ADP Non-farm Employment Change is expected to come in much higher than the previous month’s number at 648K and the data is expected today the 30th of September 2020 at 14:15 SAST.

Chart - The U.S. ADP Non-farm Employment Change

Thursday, 1 October 2020:

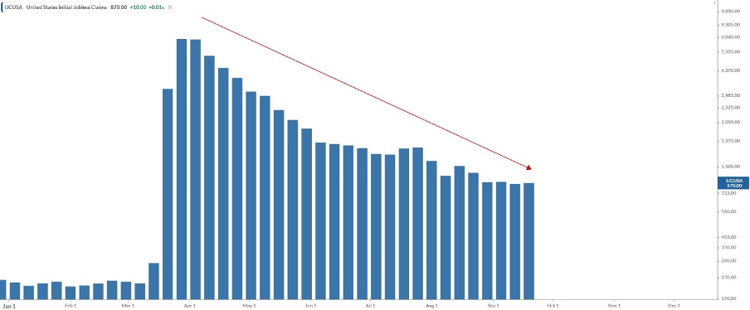

U.S Jobless claims:

Initial Jobless Claims - The initial jobless claims have been in a steady downtrend over the last couple of months since those record jobless claims numbers in April 2020. The Initial Jobless Claims number is expected to come in slightly lower than last week.

This week the Initial Jobless Claims data is expected to show initial jobless claims reduce to 850K and should be released on Thursday at 14:30 SAST.

Chart - Initial Jobless Claims

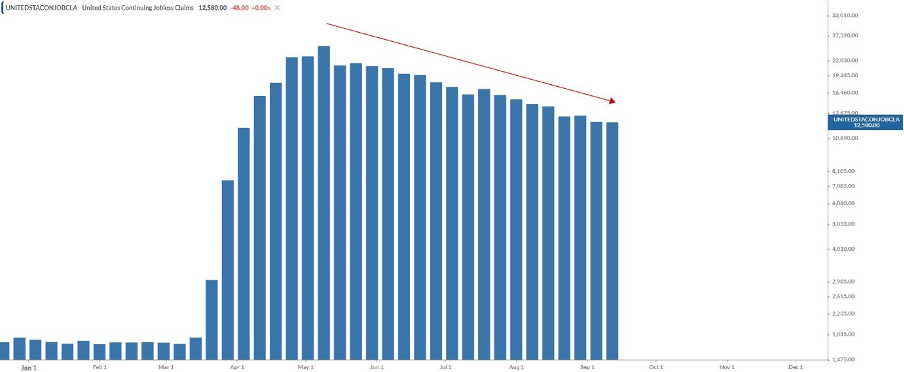

Continuing Jobless Claims – Continued claims have also become a focal point of interest and measures how many unemployed individuals qualify for benefits under jobless insurance. The data is also expected to see a slight decline in jobless claims to 12.22 million. The data will be released together with the Initial Jobless Claims on Thursday at 14:30 SAST.

Chart - Continuing Jobless Claims

Non-Farm Payrolls (NFP) outlook

With the first Presidential debate out of the way, market participants will turn their focus to the U.S. Non-Farm Payrolls this week. Economic growth and workforce employment are still a major concern as major corporations like The Walt Disney Company start to lay-off theme park workers.

Jobs number:

The number of new Non-Farm jobs added in the month of September is expected to be lower than the previous reading for August of 1.371 million. The U.S. Non-Farm Payrolls number is expected to remain in positive territory at 850K employed.

Hourly earnings:

The Average hourly earnings (M/M) data is expected to move lower to 0.2% from the previous months 0.4%. The Average hourly earnings (Y/Y) for September is expected to see an increase to 4.8% from the previous months number at 4.7%

U.S. Unemployment Rate:

The U.S. Unemployment Rate measures the percentage of the total workforce that is unemployed and actively seeking employment during the previous month.

The U.S. Unemployment Rate is watched closely for signs of economic recovery and is expected to show a decrease from the previous reading to 8.2%.

Why is the jobs number important?

The Non-Farm Payrolls report (NFP) is treated as an economic indicator for people employed during the previous month, and the number being released will have a direct impact on the markets. In the United States, consumer spending accounts for most of the economic activity, and the Non-Farm Payrolls report represents 80% of the U.S. workforce. Farmers are excluded from the employment figures due to the seasonality in farm jobs.

Technical Analysis outlook on U.S. Indices for the U.S Non-Farm Payrolls (NFP)

Wall Street 30

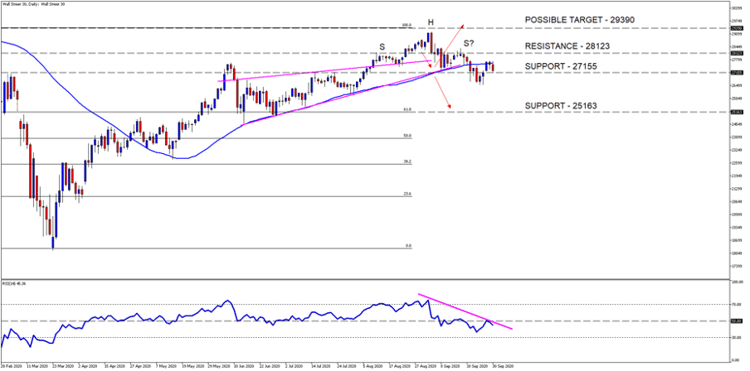

The Wall Street 30 was indeed at a tipping point last week as mentioned in our Technical insights and it looks like we might see more downside if buyers don’t step in.

The 27155 becomes a point of interest once again as the price action needs to stay above this level to negate the next down-trend and the formation of lower highs and lower lows.

Technical points to look out for on the Daily Wall Street 30:

- The price action needs to stay above the 27155-support level to negate the formation of lower highs and lower lows which confirm a downtrend.

- The 50-day SMA (blue line) is above the price action supporting a new downward trend.

- The Relative Strength Index (RSI) is also below the neutral level at 50 and trending lower.

Charting done on Metatrader5 GT247.com - WallStreet30 Daily

Take note: The outlook and levels might change as this outlook is released prior to the current day (Wednesday the 30th of September 2020) U.S Market open.

What to trade internationally:

-

Major indices to look at will be the S&P 500, Wall Street 30, Nasdaq 100

-

Major Forex pairs to look at will be EUR/USD, GBP/USD and USD/JPY

-

Commodity to look at will be Gold.

What to trade locally:

-

Index to look at will be the ALSI

-

Forex pair to look at will be the USD/ZAR

-

Rand Hedges (BTI, CFR) and Rand Sensitives (Banks and Insurers)

There are many ways to trade the Non-Farm Payroll (NFP) report, and here are a few strategies traders look at:

- The Early birds: traders who will take an early position before the jobs number is released in anticipation that the directional movement the event will cause will be in their favour.

- The Scalpers: as the data is released, these traders will scalp and try and capitalize on the volatility that is created by the data, positively or negatively.

- The calm and calculated: as the market digest the results of the Non-Farm Payroll (NFP) report and after the volatility swings have occurred, these traders will take a position on the momentum of the market.

When and what time is the US NFP (Non-Farm Payroll) announced in South Africa?

Non-Farm Payrolls are usually reported on the first Friday of the month, whereby the number of additional jobs added from the previous month is released. The US Non-Farm Payroll number will be released locally on Friday the 2 October 2020 at 14:30 SAST.

Sources – Reuters, MetaTrader5

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice. Past performance is not necessarily an indication of future performance. The value of a financial product is not guaranteed. The value of a financial product can go down or up due to various market factors. The graphs are for illustrative purposes only.