Non-Farm Payrolls are usually reported on the first Friday of the month, whereby the number of additional jobs added from the previous month is released. The US Non-Farm Payroll number for the month of January will be released locally on Friday the 1st of February at 15:30 SAST.

What happened previously?

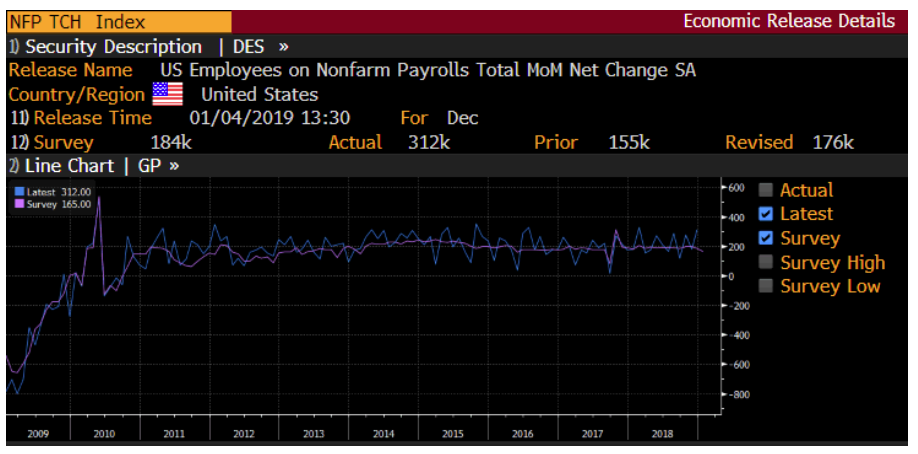

The Non-Farm Payrolls number came in much higher than expected at 312K Non-Farm jobs against the 175K Non-Farm jobs expected. The NFP number was also higher than the ADP Non-farm Employment Change number.

The Average hourly earnings (M/M) also impressed coming in higher at 0.4% over the expected 0.3% and the U.S Unemployment rate rose to 3.9%.

Why is the jobs number important?

The Non-Farm Payrolls report (NFP) is treated as an economic indicator for people employed during the previous month and the number being released will have a direct impact on the markets. In the United States consumer spending accounts for most of the economic activity and the Non-Farm Payrolls report represents 80% of the U.S workforce. Farmers are excluded from the employment figures due to the seasonality in farm jobs.

What is forecast this time?

With the announcement that the Federal Reserve's Federal Open Market Committee (FOMC) will not raise interest rates anytime soon the markets erupted. The S&P 500 gained 1.56%, the Dow increased over 1.7% and the Nasdaq rallied 2.2%. The FED’s outlook is to be patient which is a more cautious approach from the recent statements that the central bank would increase rates gradually over 2019.

The change in the FED’s outlook might be due to the fact that downside risk for the U.S and the global economy exists. Mainly since the global economy is slowing down, a sharp decline in consumer and business confidence and overall Market volatility.

The US Non-Farm Payroll data will be used by market participants to see if the strong growth on the U.S Jobs front can continue or if the economy is in fact slowing down.

U.S ADP Non-Farm Employment change:

The U.S. ADP Non-farm Employment Change is a very good predictor of the Non-Farm Payrolls report as the ADP Non-Farm Employment Change measures the monthly change in non-farm, private employment.

- The U.S. ADP Nonfarm Employment Change is released two days ahead of the NFP jobs number. The ADP number will be released on Wednesday at 15:15 SAST.

The change in private employment came in much higher at 213K from the expected forecast number of 180K for the month of January 2019. All eyes will look to tomorrows comprehensive Non-Farm Payrolls report (NFP), especially wage growth numbers.

Source – Bloomberg

Looking at the chart of Wall Street 30

The price action has gained momentum since the previous NFP jobs number was released and has moved well above the previous target of 23442. I have adjusted the sloping trend line (Green Dotted) upward to connect the points (Purple Dots). We can see that the price action of the Dow is finding some resistance.

Looking closer to tomorrows jobs number we might see the price action move higher to a target price of 25888 as shown in Point 1. Looking to Point 2, if the number disappoints we might see a short-term pullback lower to the 24089-support level.

- Take note that the outlook and levels might change as this outlook is released a day before NFP and before the current days U.S Market open.

Source – Bloomberg

What to trade internationally:

Major indices to look at will be the S&P 500, Wall Street 30, Nasdaq 100

Major Forex pairs to look at will be EUR/USD, GBP/USD and USD/JPY

Commodity to look at will be Gold.

What to trade locally:

Index to look at will be the ALSI

Forex pair to look at will be the USD/ZAR

Rand Hedges (BTI, CFR) and Rand Sensitives (Banks and Insurers)

How to trade the Non-Farm Payroll (NFP) report: The Strategies

There are many ways to trade the Non-Farm Payroll (NFP) report and here are a few strategies traders look at:

- The Early birds: traders who will take an early position before the jobs number is released in anticipation that the directional movement the event will cause will be in their favour.

- The Scalpers: as the data is released these traders will scalp and try and capitalize on the volatility that is created by the data, positively or negatively.

- The calm and calculated: as the market digest the results of the Non-Farm Payroll (NFP) report and after the volatility swings have occurred these traders will take a position on the markets momentum.

When and what time is the US NFP (Non-Farm Payroll) announced in South Africa?

1st of February 2019 at 15.30 SAST.

May your trading day be profitable!