The U.S economy is slowing down. It seems that President Trump's ongoing trade disputes with China might be finally coming home to roost.

U.S Economic Data

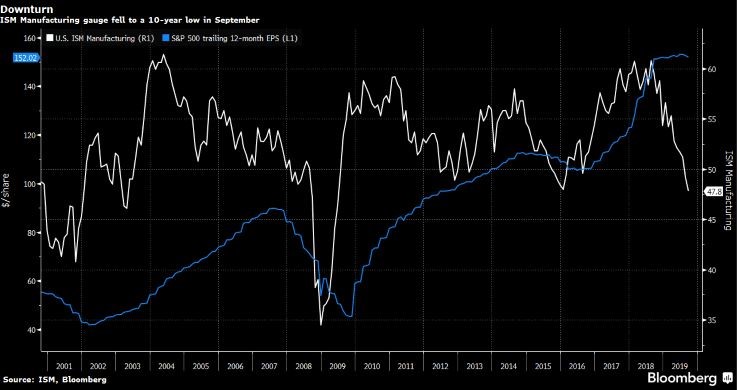

Yesterday's shock release of the U.S ISM Manufacturing PMI data (SEP) just showed we are not out of the woods yet, not even close. U.S ISM Manufacturing PMI data dropped 1.3 points to 47.8, the lowest point since June 2009. The manufacturing sector has now contracted for two consecutive periods with the reading below 50.

The U.S economy is indeed losing steam as signs of the ongoing trade disputes between China, and the U.S might finally be filtering through to the economy. This news comes just as the European economy is about to fall into a recession.

U.S Markets

The manufacturing data sparked a range of new concerns about the slowing of the U.S economy and the possibility of another interest rate cut by the Fed.

Dollar Index (DXY)

The U.S Dollar slowed after the news was released and might consolidate lower if rates come back into focus. The Dollar has been in a steady uptrend over the last couple of months and is stalling above the 99.01 support level.

Source – Bloomberg

Source – Bloomberg

S&P 500

Market participants widely expected the ISM Manufacturing PMI data to move above the 50 reading once again, which would have supported a move higher. Global markets slipped to one-month lows after the news broke.

The S&P 500 lost 1.23% sending the Index to 4-week lows and is back at the 2942 support level which coincides with the previous breakout. The 50-day SMA is also providing support which might be short-lived.

Source – Bloomberg

Source – Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.