The U.S. Federal Reserve's Federal Open Market Committee (FOMC) will announce whether the interest rates in the U.S. will decrease or remain unchanged tonight at 20:00 SAST.

- The Federal Funds rate is probably the most-watched and popular interest rate in the United States as it affects monetary and financial conditions.

HERE IS WHAT YOU CAN EXPECT...

Market Outlook:

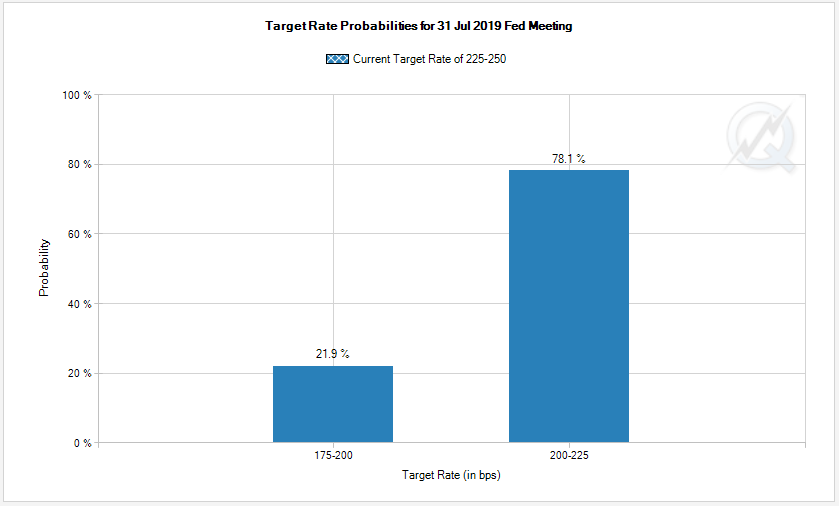

The market is all but set, that we will see an interest rate cut of 25 basis points later today. The CME Group's FED Watch Tool (below) has confirmed a 78.1% probability. This rate cut will see the Federal Funds Target Rate at 200-225 basis points as the FED enters its easing cycle. The latest U.S Gross Domestic Product (GDP) data, which was better than expected, has put into question whether the FED would enter a long easing cycle.

Source - CME Group

Source - CME Group

Take note: that volatility is expected on the U.S Indices and all major markets over this week, especially today with the FOMC interest rate decision.

The Dollar (DXY)

The Dollar has gained ground over the last week, reaching highs last seen two months ago from the better than expected U.S GDP data. With the FED set to lower interest rates for the first time in over a decade, we might see the greenback lose some momentum.

The 98.24 price level has acted as major resistance over the last couple of months, and with the rate cut on the cards, we might expect the Dollar to retreat from these levels once more. The 97.70 will be watched as the next support level and target level.

Source - Bloomberg

Source - Bloomberg

The Impact on South Africa

The South African government's decision to bail out Eskom once again has seen the Rand (ZAR) weaken significantly. The Rating agencies have also now entered the ring yet again showing their discomfort with the decision to bail out the failing power utility.

We might see some strength return to the Rand (ZAR) with the U.S FED easing interest rates which might see the Dollar (USD) weaken. This would be short-lived for the South African Rand as the debt to GDP in our local economy is on the increase and waning in negatively on future growth prospects.

The Rand (ZAR)

The Rand (ZAR) has been consolidating above the R13.83/USD support level but has come under pressure over the last couple of trading days due to the Eskom bailout announcement.

The USDZAR currency pair might move lower from R14.19/USD (current level) back to the R13.83/USD technical support in the short term. If the South African fundamentals continue to breakdown, then we might expect the currency pair to gain momentum to the R14.67/USD.

Source - Bloomberg

Source - Bloomberg

Economic factors to look out for today:

- Chinese Manufacturing PMI at 03:00 SAST.

- EU CPI at 11:00 SAST.

- South African Trade Balance at 14:00 SAST.

- US ADP Non-Farm Employment Change at 14:15 SAST.

- US FED Interest Rate Decision at 20:00 SAST.

Trading Strategies:

A decrease in U.S interest rates will possibly see the Dollar (USD) weaken, so look at the following:

South African instruments:

- Banking stocks.

- Retail stocks.

- Rand hedged stocks.

- Alsi (Index).

- USD/ZAR (Forex pair).

Major Forex pairs:

- EUR/USD.

- GBP/USD.

- USD/JPY.

- USD/MXN.

The inverse is applicable where there is a decrease in interest rates it might have a positive effect on equities so look at the following Indices:

Major Indices:

- S&P 500.

- Wall Street 30.

- Nasdaq 100.

- Russell 2000.

Disclaimer: Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice./