The U.S. Federal Reserve's Federal Open Market Committee (FOMC) will announce whether the interest rates in the U.S. will decrease or remain unchanged tonight, 30th of October at 20:00 SAST.

This is what you can expect...

Interest Rate Outlook:

The Federal Funds rate is probably the most-watched and popular interest rate in the United States as it affects monetary and financial conditions. This time around the Federal Reserve faces a dilemma, will they hit pause in what Fed chair Powell sees as a “mid-cycle adjustment” or will we see a third consecutive rate cut?

Some analysts say another interest rate cut should be enough to stimulate the economy, achieve the Fed’s objectives and hit pause after that for the rest of the year. On the other hand, if the FOMC signals a pause in easing now, we might see a negative market reaction, which it doesn’t want.

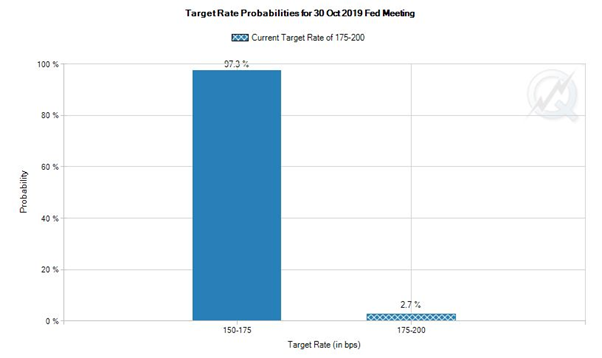

If the CME Group's Fed Watch Tool (below) is anything to go by, then there is a 97.3% chance that we might see a further easing of interest rates by 25 basis points later tonight. This will bring the Federal Funds target rate to between 150 - 175 basis points.

The FOMC Statement and Press Conference:

The Federal Open Market Committee (FOMC) statement communicates its monetary policy to investors and market participants. It also contains the outcome on the vote on interest rates and will be released around 20:00 SAST.

At the FOMC press conference this Wednesday the focus will turn to the statements that come from this sitting and comments by the Fed chair to see if the outlook has changed.

Dollar Index (DXY)

The Dollar Index (DXY) might head back to the 97.12 support level if the interest rates are indeed cut later today if not already priced in. A move lower on the greenback might just spark a revival in equity indices and push them higher for the last leg of the year.

Source - Bloomberg

Source - Bloomberg

Major U.S Stock Indices reactions:

S&P 500

The S&P 500 came close to our target price of 3050 yesterday but gave up gains later in the session and now firmly above the 3026-support level. If we see a break from this level, then the target lower would be the major 3000 psychological level once again.

Source - Bloomberg

Nasdaq 100

The Nasdaq is finding support at the 8035, a previous resistance level which will be watched closely as we might see lower levels targeted later today. If the support level holds them we might see the price action continue to make new all time highs.

Source - Bloomberg

Wall Street 30

The Wall Street 30 Index is holding above the 27000 level and awaiting on direction from the Fed with the 50-day SMA moving in as support. The Boeing hearings in congress yesterday put a damper on the Dow’s price action which is still lagging the rest of the major U.S Indices.

Source - Bloomberg

Trading Strategies:

A decrease in U.S interest rates will possibly see the Dollar (USD) weaken, so look at the following:

South African instruments:

- Banking stocks.

- Retail stocks.

- Rand hedged stocks.

- Alsi (Index).

- USD/ZAR (Forex pair).

Major Forex pairs:

- EUR/USD.

- GBP/USD.

- USD/JPY.

- USD/MXN.

The inverse is applicable where there is a decrease in interest rates it might have a positive effect on equities, so look at the following Indices:

Major Indices:

- S&P 500.

- Wall Street 30.

- Nasdaq 100.

- Russell 2000

What time does the U.S. Federal Reserve's Federal Open Market Committee (FOMC) announce interest rate decision? 30th of October 2019 at 20:00 SAST.

Disclaimer: Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice./