The U.S. Federal Reserve's Federal Open Market Committee (FOMC) will announce whether the interest rates in the U.S. will increase or remain unchanged on Wednesday at 20:00 SAST.

- The Federal Funds rate is probably the most watched and popular interest rate in the United States as it affects monetary and financial conditions.

HERE IS WHAT YOU CAN EXPECT...

Market Consensus:

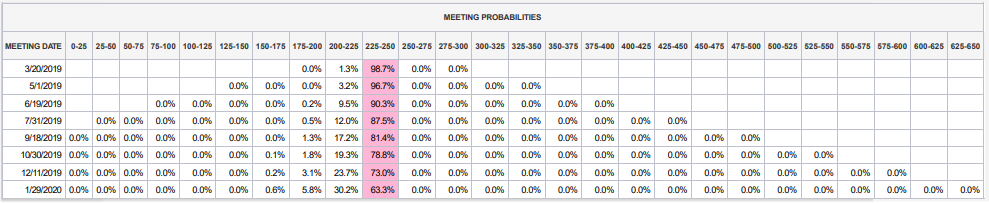

The market outlook is that the interest rate will remain unchanged later tonight as the FOMC will keep interest rates steady at 2.25%. The CME’s FedWatch Tool gives an indication that there is a higher probability of the U.S Federal Reserve (FED) easing rates by 0.25% later in the year than an interest rate hike.

Source – CME Group

The FOMC Statement and Press Conference:

The Federal Open Market Committee (FOMC) statement communicates its monetary policy to investors and market participants. It also contains the outcome on the vote on interest rates and will be released at 20:00 SAST.

Following the statement, a press conference is scheduled for the FED Chair Jerome Powell. The FOMC statement will be looked at for clues on future rate decisions as the press conference scheduled for 20:30 SAST.

The Dollar (DXY)

As the FED’s outlook is to tread carefully and by looking at all the data it seems that another interest rate hike is not likely for 2019. The Dollar (USD) has become a focal point of President Trump and his Trade negotiations and the FED’s dovish tone for the year will not help the greenback.

Impact on South Africa:

Pressure on the U.S Dollar might just give South Africa and other Emerging Market Currencies some breathing room in the short term.

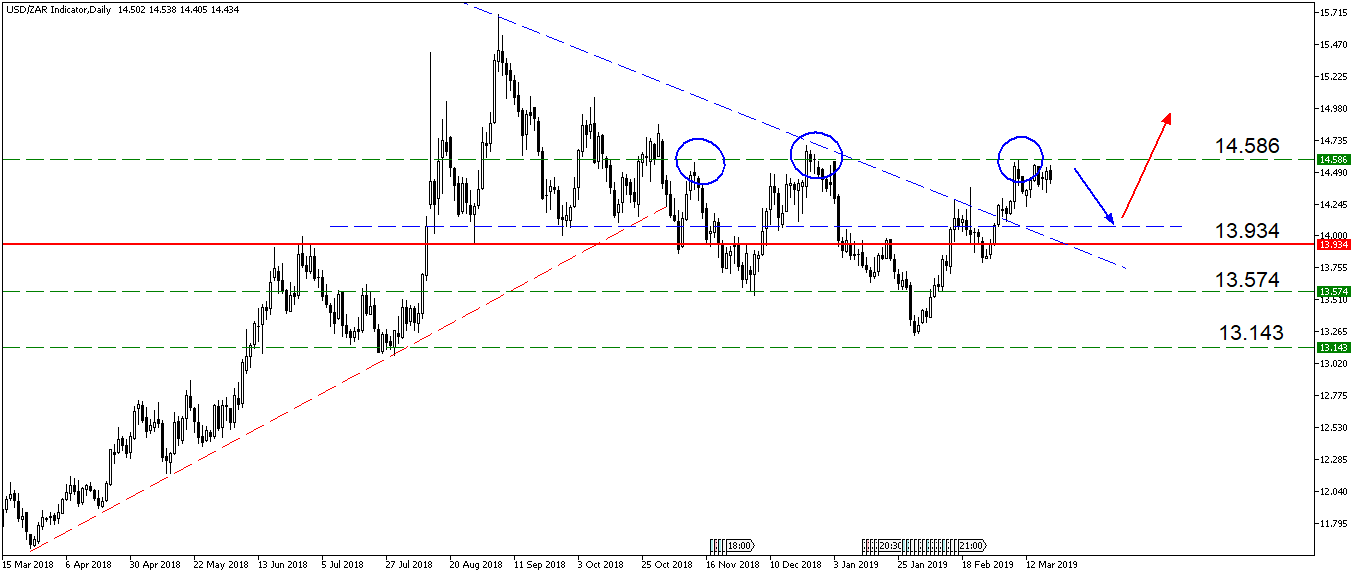

USD/ZAR

The Rand (ZAR) has been losing ground against the Dollar (USD) since the start to 2019 and seems to have reached the pivotal resistance line of R14.58 once more. The Dollar might lose some steam in the short term which might see the Rand strengthen depending on the FOMC statement later tonight. If the resistance line does not hold then we might see the Rand (ZAR) weaken even further as fundamental factors do not support a positive outlook for the South African economy.

Source – MetaTrader5

Economic factors to look out for today:

- South African CPI at 10:00 SAST.

- K CPI at 11:30 SAST.

- Crude Oil Inventories at 16:30 SAST.

- FED Interest Rate Decision at 20:00 SAST.

Source – Investing.com

Trading Strategies:

An increase in U.S interest rates will see the Dollar (USD) strengthen, so look at the following:

South African instruments:

- Bank stocks.

- Retail stocks.

- Rand hedged stocks.

- Alsi (Index).

- USD/ZAR (Forex pair).

Major Forex pairs:

- EUR/USD.

- GBP/USD.

- USD/JPY.

- USD/MXN.

The inverse is applicable where there is an increase in interest rates then that will have a negative effect on equities so look at the following:

Major Indices:

- S&P 500.

- Wall Street 30.

- Nasdaq 100.

- Russell 2000.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.