The U.S. Federal Reserve's Federal Open Market Committee (FOMC) will announce whether the interest rates in the U.S. will decrease or remain unchanged tonight, 18th September at 20:00 SAST.

The Federal Funds rate is probably the most-watched and popular interest rate in the United States as it affects monetary and financial conditions.

This is what you can expect...

Market Outlook:

The FOMC is widely expected to cut its target rate by another 25 basis points for a second time this year amidst conflicting economic data. The White House has also made it clear that more can be done by the Federal Reserve to cut rates exponentially.

All this just as an unexpected turn of events saw the overnight borrowing costs jumped to the top end of the 2.25% target rate set by the FED at its previous sitting. First time since the Financial crisis-era a decade ago that the Federal Reserve injected capital into money markets.

This $75Billion injection into the banking system through Repurchase agreements or "Repos" was to pull down interest rates after technical factors led to a sudden shortfall of cash.

The cause of this? Well, some analysts believe it might be due to the developments in the short-term funding markets which indicates that the Fed had gone too far in reducing the size of its balance sheet in recent months.

Interest Rate Outlook:

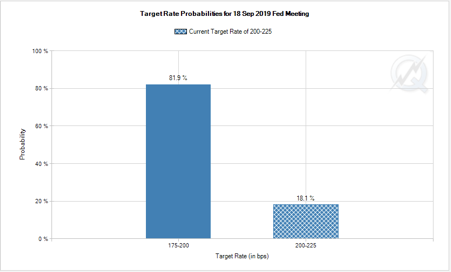

If the CME Group's Fed Watch Tool (below) is anything to go by, then there is a 56.5% chance that we might see a further easing of rates. This week's Economic and Geopolitical events have seen the rate cut go from an 81.9% certainty to today where it is close to a 50/50 chance that the Fed will cut rates.

Source – CME Group

Take note: that volatility is expected on the U.S Indices and all major markets over this week, especially today with the FOMC interest rate decision.

Dollar Index (DXY)

After the last FOMC interest rate announcement, which saw the central bank cut rates by 25 Basis points, the Dollar did the unexpected and started to gain strength. This can be attributed to the market conditions that reigned at the time which saw the U.S Dollar as the safe-haven of choice along with Gold.

Yesterday's unexpected "Repo" expenditure coupled with the uncertainty in the Oil market, has seen the U.S Dollar lose some steam. The greenback has been in a steady uptrend over the last couple of months but might lose some momentum if we see a rate cut. The 97.70 support level and the 98.85 resistance level will be watched closely as the rate decision nears.

Source – Bloomberg

Major U.S Stock Indices reactions:

The Wall Street 30 index is still holding above the critical 27000 support level before the rating announcement. We might see the Index target 27439 if the interest rates are lowered, but if the previous sitting is anything to go by the opposite will happen. A close eye will be on the 50-day SMA (Blueline) for support if the 27000 level does not hold.

Source – Bloomberg

Tech stocks have also not been spared from the wrath of the Trade War but has managed to claw their way back into the investor spotlight. The Nasdaq is currently pausing above the 50-day SMA as we wait for a possible easing of rates by the U.S Federal Reserve.

Source – Bloomberg

The S&P 500 is probably the most-watched U.S Index and is also just managing to stay above the 3000-support level. We might see all-time highs once more on the S&P 500 if interest rates are lowered later tonight SAST. A possible target level of 3050 might be reached as market participants start to jump on board later tonight into the Asian session.

Source – Bloomberg

Trading Strategies:

A decrease in U.S interest rates will possibly see the Dollar (USD) weaken, so look at the following:

South African instruments:

- Banking stocks.

- Retail stocks.

- Rand hedged stocks.

- Alsi (Index).

- USD/ZAR (Forex pair).

Major Forex pairs:

- EUR/USD.

- GBP/USD.

- USD/JPY.

- USD/MXN.

The inverse is applicable where there is a decrease in interest rates it might have a positive effect on equities, so look at the following Indices:

Major Indices:

- S&P 500.

- Wall Street 30.

- Nasdaq 100.

- Russell 2000

What time does the The U.S. Federal Reserve's Federal Open Market Committee (FOMC) announce interest rate decision? 18th September at 20:00 SAST.

Disclaimer: Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice./