The JSE closed weaker on Friday even as rand hedge stocks rose on the back of the weaker rand.

The rand along with other emerging market currencies came under significant pressure following the implosion of the Turkish lira. Investors sold-off the lira as concerns over the Turkish president’s influence on monetary policy saw the lira reaching a new all-time low of 6.87/$ by 17.00 CAT. Concerns also increased after Donald Trump announced his intention to double tariffs on steel and aluminium products from Turkey.

The Euro also weakened against the greenback as the market weighed the potential contagion on the European bloc of the lira’s slump. The dollar was buoyant as investors fled to safety and subsequently the US dollar index climbed above 96 index points.

The rand slumped by more than 2.5%, breaching R14/$ to reach a session low of R14.14 against the US dollar. At 17.00 CAT, the rand had retreated marginally to trade at R14.02/$.

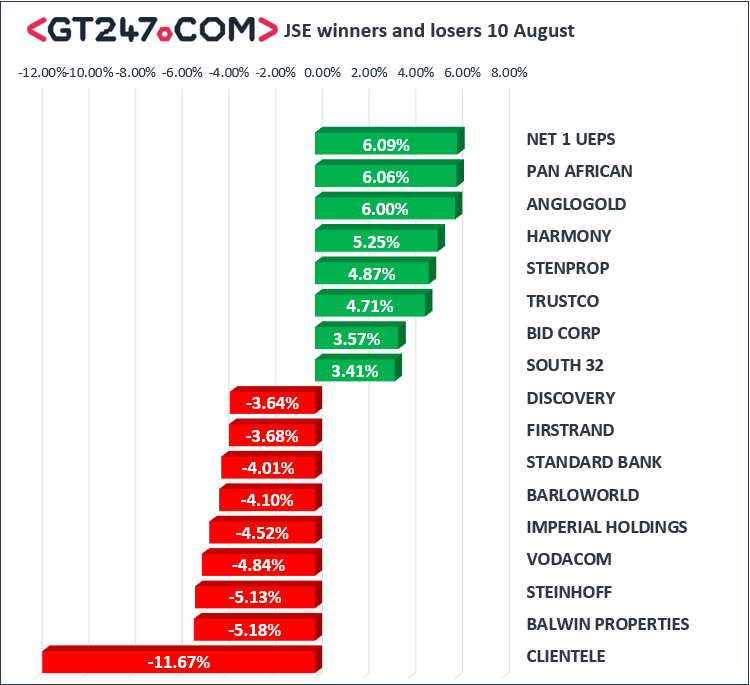

The JSE struggled for direction as negative global sentiment weighed on the bourse whilst rand hedges offset the weakness by firming due to a weaker rand. Gold miner, AngloGold Ashanti [JSE:ANG] jumped 6% to close at R120.48, while Harmony Gold [JSE:HAR] managed to add 5.25% to close at R22.85 per share.

British American Tobacco [JSE:BTI] added 2.87% to close at R743.81, while Richemont [JSE:CFR] firmed to R122.62 after the stock managed to add 2.73%. Bid Corporation [JSE:BID] climbed to R283.63 after the stock gained 3.57%, and diversified miner, BHP Billiton [JSE:BIL] closed 2.01% higher at R303.54 per share.

On the losers list, Vodacom [JSE:VOD] shed 4.84% to close at R126.94 per share, to end the day amongst the blue-chip index’s biggest losers. Barloworld [JSE:BAW] weakened by 4.1% to close at R126.71, while Imperial Holdings [JSE:IPL] lost 4.52% to end the day at R200.88 per share.

Steinhoff International [JSE:SNH] slumped by more than 13% in the morning session as investors reacted to the lawsuit filed against the company and some of its associates. The stock recovered somewhat but it still closed 5.13% weaker at R2.22 per share. FirstRand [JSE:FSR] and ABSA Group [JSE:ABG] closed 3.68% and 3.07% weaker respectively.

The JSE Top-40 index eventually closed the day down 0.07%, while the JSE All-Share index lost 0.14%. The Resources index was lifted by higher metal prices which saw it close 1.56% firmer. The Industrials index was flat after adding 0.06% while the Financials index came under significant pressure as it lost 2.56%.

Gold started the day weaker, but it managed to gain momentum in the afternoon session as the demand for safe-haven assets increased. The precious metal reached a session high of $1217.09/Oz before retracing marginally to trade at $1216.41/Oz at 17.00 CAT. Platinum was up 0.3% to trade at $835.45/Oz, while Palladium was 0.53% firmer to trade at $913.10/Oz.

Brent crude got off to a slow start as trade concerns weighed on the commodity. It eventually managed to gain momentum to trade 1.28% firmer at $72.99/barrel just after the JSE close.

At 17.00 CAT, Bitcoin was down 1.31% to trade at $6419.50/coin, while Ethereum had lost 1.79% to trade at $358.89/coin.