The JSE retreated to close weaker on Friday as it tracked other major global indices lower.

The moves lower across most equity markets were triggered by Donald Trump’s threat for increased tariffs against Mexico in retaliation to the influx of immigrants into the USA from Mexico. The USA is already in a full-fledged trade war with China, and this latest development with Mexico raises more concerns for investors who are struggling to fully comprehend the impact of that trade war with China.

In Japan the Nikkei fell 1.63%, in Hong Kong the Hang Seng lost 0.79% while in mainland China the Shanghai Composite Index lost 0.31%. In Europe all the major indices were down by more than 1% on average while the USA’s major indices opened considerably lower.

The rand managed to recoup some of the losses that it has taken over the past couple of sessions as it advanced on Friday. The strength in the rand was mainly due to the weakness that was recorded in the greenback as indicated by the US dollar index which traded marginally softer. The rand had peaked at a session high of R14.53/$ before it was recorded trading 1.09% firmer at R14.56/$ at 17.00 CAT.

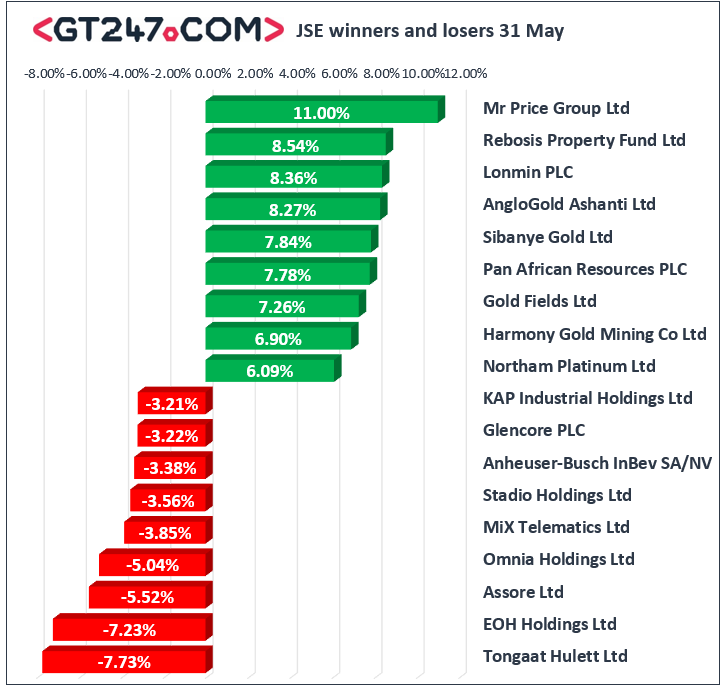

On the JSE, Tongaat Hulett [JSE:TON] came under significant pressure following the release of a strategic and financial review, in which the company stated that the financial statements for the year ended 31 March 2018 would need to be restated. The stock fell 7.73% to close at R16.70. EOH Holdings [JSE:EOH] also struggled on the day as it fell 7.23% to close at R19.25, while cement maker PPC Ltd [JSE:PPC] dropped 3.04% to close at R4.79. Losses on the resources index were led by diversified mining giant Anglo American PLC [JSE:AGL] which lost 2.68% to close at R348.15, while Kumba Iron Ore [JSE:KIO] fell 2.82% to close at R442.04. Oil and gas producer Sasol [JSE:SOL] closed 3.02% weaker at R366.59, while commodity trading giant Glencore [JSE:GLN] closed at R46.63 after losing 3.22%.

Mr Price [JSE:MRP] surged on the back of the release of its full-year results which showed positive growth in revenue and profitability. The stock eventually closed 11% firmer at R197.15. Massmart Holdings [JSE:MSM] also got a lift as it climbed 5.81% to end the day at R67.35, while Pick n Pay [JSE:PIK] gained 2.4% to close at R70.97. Gold miner AngloGold Ashanti [JSE:ANG] rose 8.27% to close at R194.68, while Gold Fields [JSE:GFI] added 7.26% to close at R65.44. Aspen Pharmacare [JSE:APN] managed to gain 4.18% as it closed at R97.94, while Famous Brands [JSE:FBR] lost 5.1% to close at R83.25.

The JSE All-Share index closed 0.31% lower while the blue-chip JSE Top-40 index lost 0.39%. The Resources index fell 1.42%, while the Financials and Industrials indices barely closed firmer as they added 0.27% and 0.02% respectively.

Brent crude weakened significantly because of Donald Trump’s tariff threats against Mexico. The commodity was trading 2.62% weaker at R63.62/barrel.

At 17.00 CAT, Gold was up 1.09% at $1302.49/Oz, Platinum was 0.36% weaker at $793.20/Oz, and Palladium had lost 1.97% to trade at $1342.20/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.