The JSE closed lower on Wednesday mainly on the back of profit-taking, as well as a flight to safety on the back of Donald Trump’s comments about Russia and Syria.

The local index traded softer for the entirety of today’s trading session but it did retrace marginally from its session lows towards the close. There was little to support a move higher on the JSE as most the blue-chip stocks were trading in the red.

The Rand remained range-bound despite the US dollar weakening further. The US dollar recorded a fourth consecutive session of losses and the Rand broke briefly below R12/$ to reach a session high of R11.97/$. At 17.00 CAT the Rand was trading at R12.01 against the greenback.

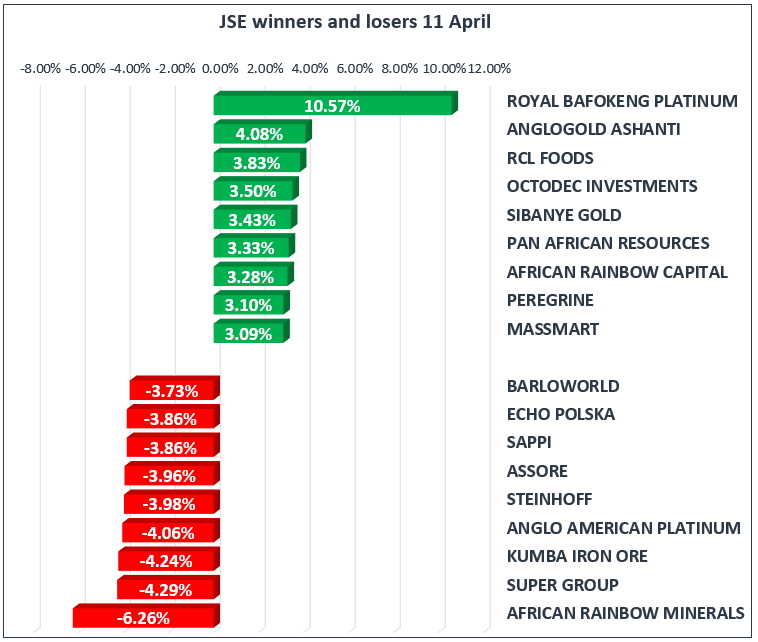

On the JSE, Steinhoff [JSE:SNH] reached a new all-time low of R2.05 per share as the most recent round of news surrounding the company continued to weigh on the stock. The stock lost another 3.98% to close at R2.41 per share. Other major moves lower on the broader index were recorded in African Rainbow Minerals [JSE:ARM] and Super Group [JSE:SPG] which lost 6.26% and 4.29% respectively. Anglo American Platinum [JSE:AMS] and Kumba Iron Ore [JSE:KIO] lost 4.06% and 4.24% respectively.

NEPI Rockcastle [JSE:NRP] was one of the biggest losers on the blue chip index after it lost 3.27% to close at R133.00 per share. Banking stocks such as Barclays Africa [JSE:BGA] and Nedbank [JSE:NED] lost 3.48% and 0.52% respectively, whilst Sappi [JSE:SAP] and Imperial Holdings [JSE:IPL] shed 3.86% and 2.39% respectively. Investment holding stocks Reinet [JSE:RNI] and Remgro [JSE:REM] lost 2.54% and 3.13% respectively.

The flight to safety by investors aided Gold mining stocks such as AngloGold Ashanti [JSE:ANG] and Gold Fields [JSE:GFI] which gained 4.08% and 1.36% respectively. This gain was mainly on the back of firmer Gold metal prices. Sibanye-Stillwater [JSE:SGL] added 3.43% to close at R10.94 per share, whilst Pan-African Resources climbed up 3.33%.

The list of gainers on the Top-40 Index was very small and it included retailers such as Woolworths [JSE:WHL] and Spar Group [JSE:SPP] which recorded gains of 0.42% and 0.2% respectively. BHP Billiton [JSE:BIL] was the other gainer as it ended the day up 1.09% to close at R246.86 per share.

The JSE Top-40 Index eventually closed the day down 1.13% whilst the broader All-Share Index lost 1.02%. The Financials Index took the biggest knock as it lost 1.72%, whilst the Resources and Industrials Indices lost 0.07% and 1.19% respectively.

Gold rallied as investors jumped into safe-haven assets on the back of Donald Trump’s comments on twitter about firing missiles into Syria. The precious metal peaked at a session high of $1359.17/Oz before retracing marginally to trade at $1358.87/Oz at 17.00 CAT. Similar rallies were recorded in Platinum and Palladium which gained more than 1% to trade at $940.25/Oz and $963.89/Oz at 17.00 CAT.

Brent Crude extended its gains to reach a new three-year high of $72.56/barrel. Trump’s pledge of a missile strike in Syria helped Brent Crude rally to these highs despite a build in US stockpiles for last week. The commodity was trading at $72.50/barrel just after the JSE close.