Global equity markets were firmer on the day as stronger earnings out of Alphabet post the US market close gave the markets some much needed relief. Strong numbers out of Caterpillar [NYSE:CAT] today provided US markets some impetus to rally, CAT is generally used as a bench mark to show the general health of the world economy. Presidents Macron and Trump will sit down today and discuss trade agreement between France and the USA, however the main talking point will be Iran.

The local market opened the day firmer as the local bourse played catch up to moves made on world markets overnight. The major corporate update today was out of Anglo American PLC [JSE:AGL], providing production numbers for the group and its subsidiaries Kumba Iron [JSE:KIO] and Anglo American Platinum [JSE:AMS], for the quarter ended 31 March 2018. The diversified mining group indicated that their diamond business De beers had managed to rump up production for the last quarter in line with the groups expectations. The miner recorded weaker output figures out of their Brazilian Minas Rio mine due to repairs been done to a pipeline from their plant to the coast.

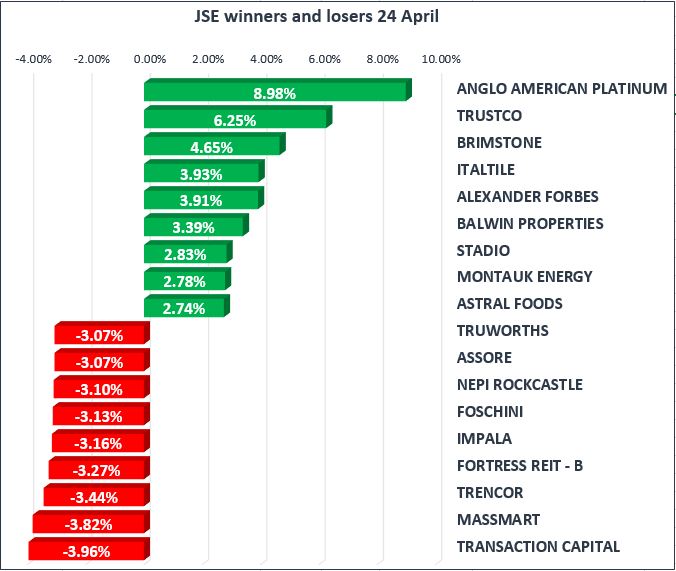

Anglo American Platinum [JSE: AMS] was firmer on the back of their production updated closing the day up 8.9%, Trustco holdings [JSE:TTO] made a sound recovery on the day to close 6.25% firmer. Sappi [JSE: SAP] Mondi [JSE: MND], Billiton [JSE: BIL] and Old Mutual [JSE: OML] were amongst some of the blue-chip shares that rallied on the day advancing 2.6%, 2.36%, 2.52%, and 2.4% respectively.

The financial shares were generally on the back foot today as the effects of the long bonds took their toll on the locally listed financial institutions. Standard Bank [JSE: SBK], released their three-month performance to ICBC, which showed that the pan-African had not been able to significantly increase asset growth within the review period. The banks African operations continue to show signs of improvement, however lest we forget the South African operations continue to be the mainstay of this operation. SBK closed the day down 5.01% to trade at 21613c, Firstrand [JSE: FSR], was also lower on the day easing 1.4% to trade at 6592c whilst RMB [JSE: RMH] and Nedbank [JSE: NED], were down 0.7% and 0.1% respectively.

South African retailers were not spared on the day as The Foschini Group [JSE:TFG] Truworths [JSE:TRU], Woolworths [JSE:WHL] and Mr Price [JSE:MRP] all retreated 3.1%, 3.07%, 2.7% and 1.76% respectively.

The JSE Top-40 Index was lower on the day to trade at 50871 points, whilst the broader JSE All-Share Index was down 0.01% to trade at 57675 points. The Resource20 Index was firmer by 1.24%, whilst the Industrial index was down 0.06% as the Financial Index eased 1.09%.

The Rand was softer today and was trading at R12.34/ $ at 17:00 CAT. The local unit continued to lose its footing against the major currencies on the day. South African 10-year bond (R186) yields were higher today and were bid at 8.22% up from 8.16% yesterday. US 10year treasury yields traded above the 3% mark for the first time since 2014. The US market appears to be forecasting higher inflation in the US market in the medium term, advancing towards the Federal Reserve’s(FED) target of 2%inflation. The FEDs pace in hiking intertest rates in the US could send a massive blow to US and global equity markets.

Bullion was firmer on the day with the precious metal staging a short-term bounce despite a steady dollar in the first session of US trade. At the time of writing Gold was trading at $1329/Oz.

Brent Crude was firmer on the day as more speculation around supply cuts out of key OPEC producers continued to make headlines. President Trump hinted of potential sanctions on Iran if their nuclear programme was ever restarted. A barrel of Brent crude was changing hands at 74.09/ barrel at 17:00 CAT having traded just shy of $75/barrel in earlier trade.