The JSE fell to a five-week low on Tuesday as industrial heavyweights dragged down the index.

The rand continued to strengthen on Tuesday, closing at R13.47 against the greenback, amid early indications that Deputy President Cyril Ramaphosa’s campaign to be next ANC leader was pulling ahead.

The stronger rand has muted any gains made by large cap dual-listed stocks, while supporting financials and retailers.

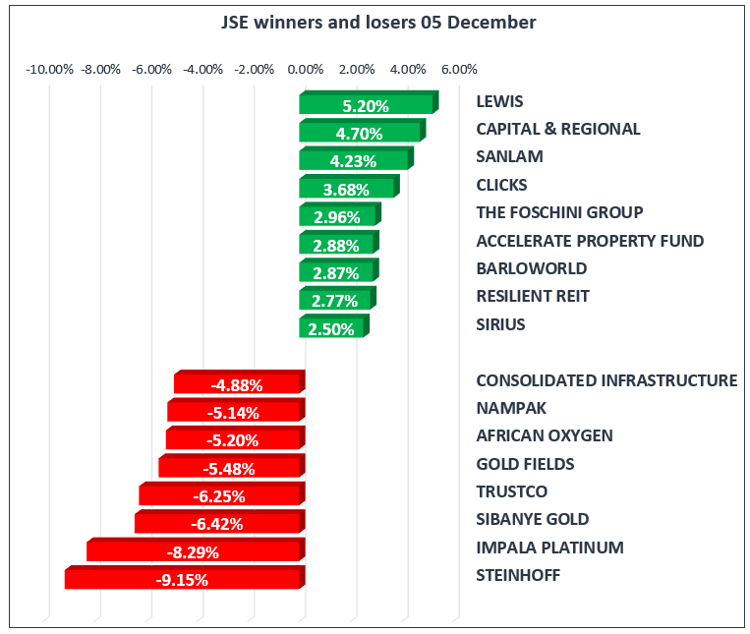

The All Share Index fell 1.06%, matched the blue-chip Top 40 slipping 1.25% - dragged down by a larger weighting in Naspers and Steinhoff. Financials emerged in the green with the overall index climbing 1.12% as Sanlam [JSE:SLM] gained 4.23% to R82.00 and Firstrand [JSE:FSR] firmed 2.47% to R58.49

Naspers [JSE:NPN] fell 3.03% to R3475.00, tracking the share price of Hong Kong-listed Tencent. The recent slide in the share price of Tencent accounts for majority of the move in Naspers.

Steinhoff [JSE:SNH] dropped 9.15% to R45.65, as distressed investors traded over 33 million shares, representing three times the normal volume.

The fall from grace was triggered by an unscheduled announcement by the company that its annual results for the year ending September – to be presented on Wednesday – would be unaudited. The announcement spooked investors, as the delay is not due to financial details but rather that the company’s auditors are grappling with regulatory and legal matters surrounding the company’s criminal and tax investigation in Germany.

In the UK, Sterling is heading for its worst day in over a month, falling 0.5% to $1.3415, on uncertainty over whether Britain can open talks on post-Brexit trade with the EU. Prime Minister Theresa May failed to clinch an agreement during a lunch in Brussels yesterday after a tentative deal with Dublin to keep EU rules in Northern Ireland angered her allies in Belfast.

Gold prices fell to $1264 as geopolitical tensions between North Korea and the US seem to be easing as UN chief diplomat Jeffrey Feltman travels to Pyongyang today for rare, high-level, political talks.