So close, yet so far comes to mind as the U.S-China Tariff disputes start once more just before the two superpowers were close to reaching an agreement.

Friday saw President Trump’s new imposed tariffs of 25% on $200 billion worth of Chinese goods take effect which saw the major markets move lower. In responses to Trump the Chinese will set import tariffs against $60 Billion worth of U.S goods as reports came out on Monday.

DXY

The U.S Dollar has been under some pressure of late as the FED indecision in its guidance to interest rates and an ever-growing job market keeps on adding to the frustration. With the start to the renewed tariff dispute we might see investors run to safe havens like the Dollar and commodities like Gold once more. Technically we might see the DXY push higher from the upward sloping trend line back to 97.70.

Source – Bloomberg

Let’s take a closer look at two major currency pairs:

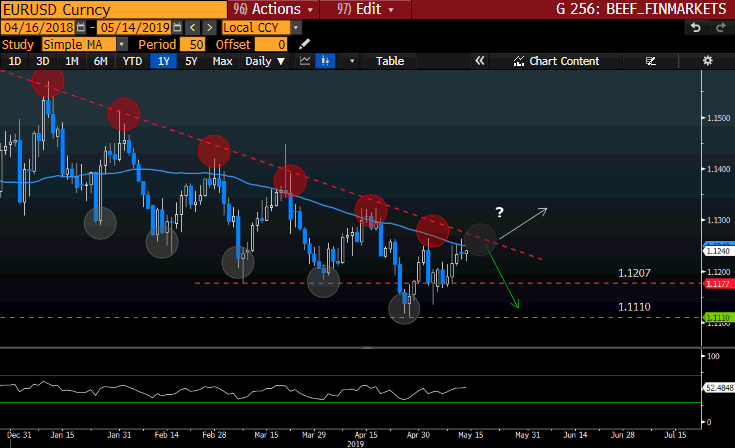

EURUSD

The EURUSD currency pair has been ticking lower over the last couple of months as the DXY has been moving higher. This inverse correlation should be taken note of and traded accordingly. With the continued overall pressure in the Eurozone it might just support a move lower on the currency pair as the Dollar (DXY) increases.

Some technical analysis points to look out for on the EURUSD:

- The price has been making lower highs and lower lows which supports the move lower and giving great shorting signals.

- The price is consolidating at the downward sloping trend line which will be watched closely for a breakout.

- The 50-day Simple Moving Average (SMA) (blue line) is acting as resistance currently and might push prices lower.

- If the DXY pushes higher we might see the EURUSD currency pair move lower to the 1.1207 support level.

Source – Bloomberg

GBPUSD

The Pound (GBP) has slumped to a two-week low against the Dollar and trading below 1.2979 as the U.S-China tariff disputes escalate. Brexit or the lack of is still weighing on the Pound (GBP) as a new wave of government party talks took place on Monday with no resolve.

Some technical analysis points to look out for on the USDGBP:

- The price action has given us a false breakout signal at the downward sloping trendline and has moved lower from there below the 1.2979 support level.

- Price might move lower to find new support at the 1.2854 price level in the short term.

- The 50-day Simple Moving Average (SMA) (blueline) is well above the price action which supports the move lower.

Source – Bloomberg

Outlook on an emerging market currency pair:

USDZAR

The South African Elections are over, and a new dawn is set for the country if the ruling party can get their act together. Unemployment is one of the main concerns and the latest jobless numbers will be released later today at 11:30 SAST.

Some technical analysis points to look out for on the USDZAR:

- The possible uptrend is still intact (between green lines) as the price action is testing the lower end of the channel boundary.

- If the channel does not hold, we might see the price action move lower to a target price of 13.86 (which would see the ZAR strengthen).

- The price needs to move higher from 14.55 and close above to see the bias toward the upside target of 14.77.

Source – Bloomberg

Economic event to look out for today while trading Forex:

- UK Claimant Count Change at 10:30 SAST.

- SA Unemployment rate at 11:30 SAST.

- OPEC Monthly Report at 13:00 SAST.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.