All eyes will be on sterling today as the Bank of England (BOE) monetary policy committee (MPC) will be announcing their interest rate decision. The data will be released later today at 14:00 SAST.

- The consensus is that The Bank of England (BOE) will keep interest rates unchanged at 0.75% and hopefully give some guidance as to where the British economy is headed.

Some of the major concerns for the Pound (GBP) might be that the BOE will signal an economic slowdown which might see the currency fall even further. With concerns mounting over the latest disappointing Services PMI data as well as Brexit, the outlook seems bleak.

Technical analysis of the GPBUSD and charts follow...

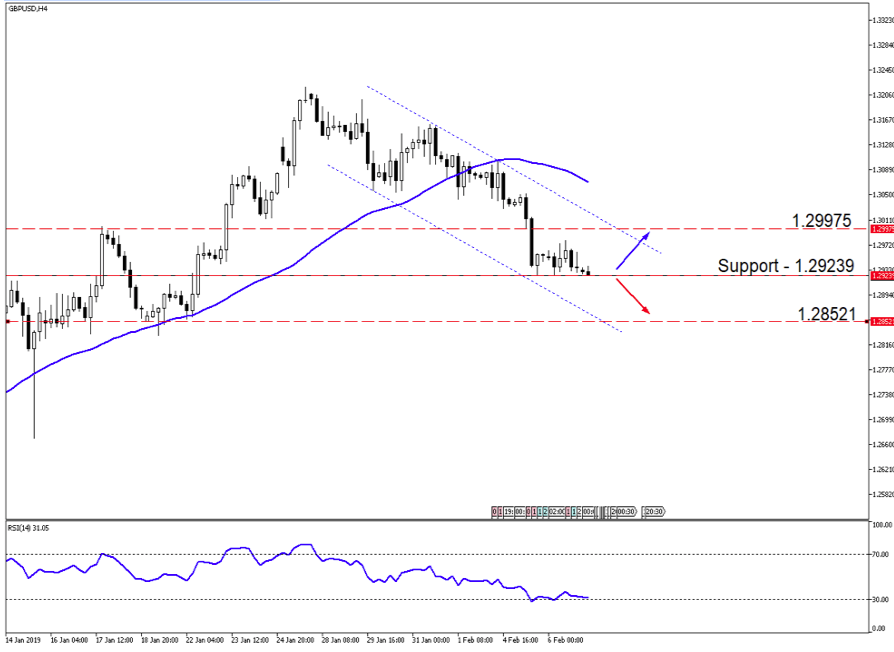

GBPUSD

Looking at the 4H chart of the GBPUSD currency pair we can see the price action is losing stream and has been trending lower over the last two weeks. The price is currently consolidating above the 1.29239 support level and might just move lower. If we see the BOE data disappoint then a possible target point lower might be on the cards at 1.28521.

On the flip side we might also see the currency pair move higher back to the top of the descending channel if the data surprises.

Source – MetaTrader5

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.