With international markets in a sort of limbo, mostly waiting on the outcome on the U.S Federal Government Shutdown we take a look at some potential moves in the EURUSD and EURGBP currency pairs.

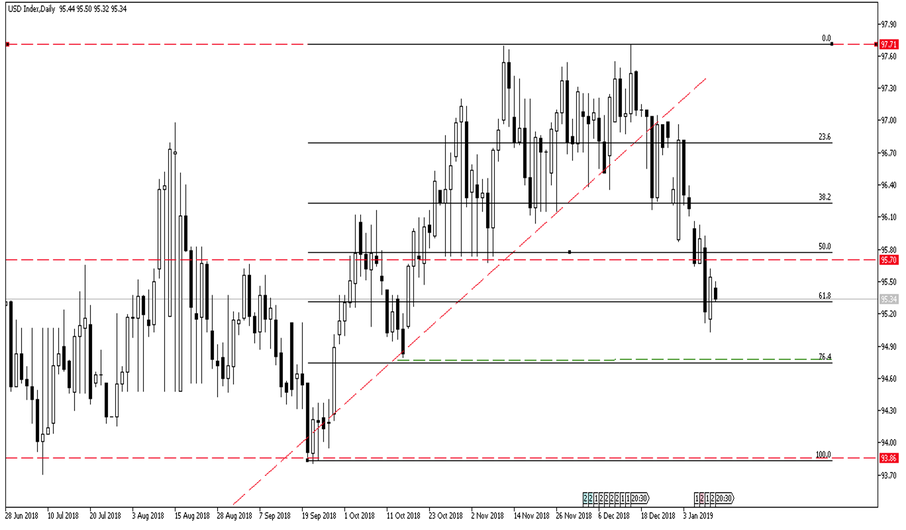

Dollar Index (DXY)

We can see that the Dollar Index has moved lower over the last couple of trading sessions as FED Chair Jerome Powell gave more clarity on the FED’s 2019 outlook. The Dollar Index is currently finding support at the 61.8 Fibonacci retracement level as we wait on the CPI data to be released. Higher than expected CPI number might give some strength to the dollar. If the FIB support does not hold then we can expect the Dollar to lose strength with first target at 94.77.

Source – MetaTrader5

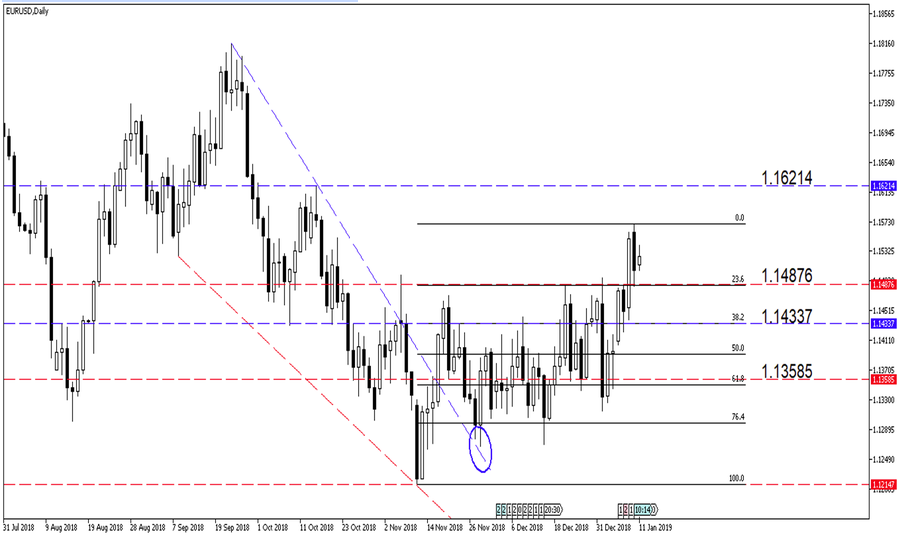

EURUSD

Earlier the week the EURUSD currency pair finally broke out and pushed higher from the 1.14876 price level. Currently the price action is muted as we await the inflation data from the US to see if the breakout can continue the EURUSD. We might just see a move lower from here to the 1.14337 price level as markets digest the data.

Source – MetaTrader5

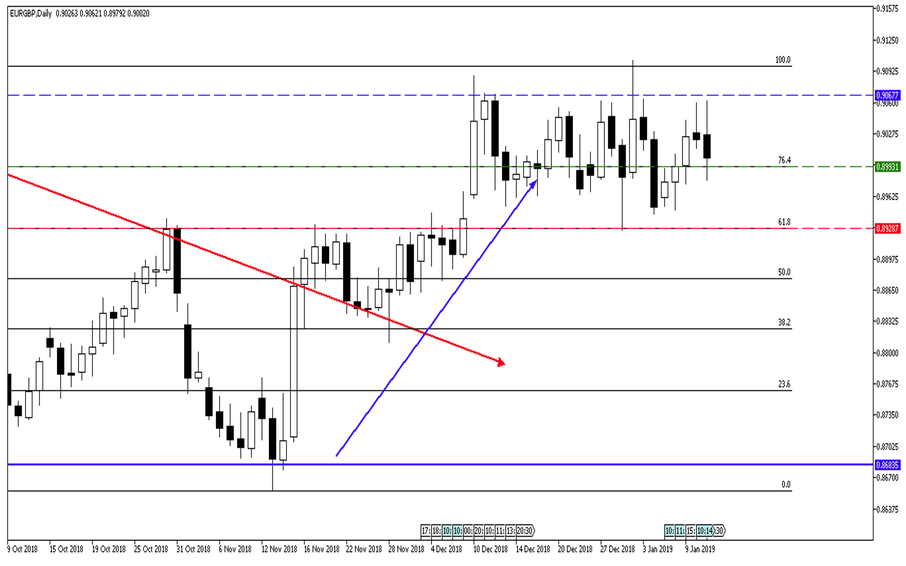

EURGBP

Our outlook from December 2018 played out nicely on the EURGBP currency pair pushing through the 0.89287 level. The price action is currently consolidating between the 0.90677 level acting as resistance and the 0.89287 support level. We eagerly anticipate the BREXIT events scheduled for next week to get some movement on the currency pair.

Source – MetaTrader5

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.