All is not “Gold” in the world as the precious metal has been under pressure of late due to record equity markets. All is not lost for gold as one sector still seems to be interested in the yellow metal and that is central banks.

Central banks have been growing their gold reserves with China and Russia increasing their reserves by 21.8 tonnes and 37.4 tonnes respectively. The reserve bank of India (RBI) is next in line and could purchase 46.7 tonnes of gold in 2019, or about 1.5 million ounces.

That’s all well and good but what about Africa and its gold? Well the growing pandemic which has seen the smuggling of gold out of Africa into the UAE is on the rise. Gold can be imported to Dubai with little documentation.

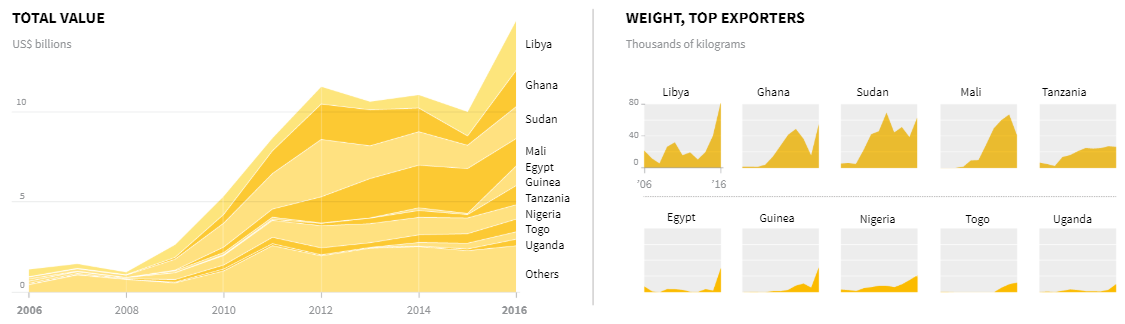

UAE and AFRICA’s GOLD

The United Arab Emirates has imported unrefined gold worth billions of dollars from African states since 2006, as rising gold prices after the 2008 financial crisis encouraged informal mining.

Source – Reuters, United Nations Comtrade, Natural Earth.

Much of the gold was not recorded in the exports of African states. Five trade economists interviewed by Reuters said this indicates large amounts of gold are leaving Africa with no taxes being paid to the states that produce them. – Reuters

South Africa

No big industrial companies including AngloGold Ashanti, Sibanye-Stillwater and Gold Fields – say they send gold there. While the big South African miners have local refining capacity, the main reason others gave is that no UAE refineries are accredited by the London Bullion Market Association (LBMA), the standard-setter for the industry in Western markets. – Reuters

The LBMA is “not comfortable dealing with the region” because of concerns about weaknesses in customs, cash transactions and hand-carried gold, its chief technical officer Neil Harby told Reuters. Investigators and people in the gold industry say the ease with which smugglers can carry gold in their hand-luggage on planes leaving Africa helps gold flow out unrecorded. Limited regulation in UAE means informally mined gold can be legally imported, tax-free. – Reuters

Some technical analysis to look out for on Gold (XAU):

- We have seen the price action make lower peaks and lower troughs which supports the down trend that we have seen over the last couple of months.

- The Price is currently equal to the support level at 1277 which might act as resistance if the price moves lower to a target price of $1251/ ounce.

- The Relative Strength Index (RSI) has also gradually moved lower from overbought levels but has not reached over sold levels by far.

- Gold is also trading below its 50-day Simple Moving Average (blue line) which supports the move lower.

- We would need to see the price of Gold close above $1302/ ounce to negate any downward pressure as it would indicate the bulls have taken control once more.

Source – Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.