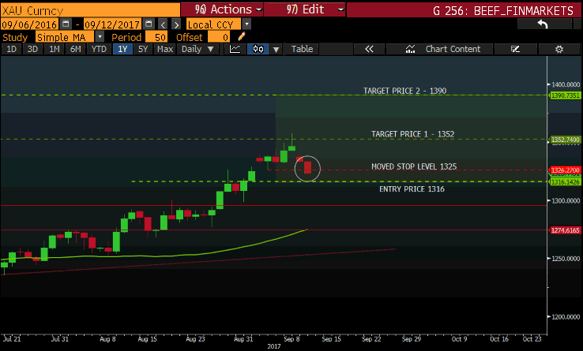

Update on Gold (XAU) 12/09/2017 - Chart Above

Gold has been moving lower since reaching my first target price of $1352/ ounce and started to move lower from there. The Gold price has been edging lower and finally reached my revised stop loss level at $1325/ ounce on 12/09/2017. The $1325/ ounce level is quite a significant level and Gold has been consolidating around this level.

Chart Source Bloomberg

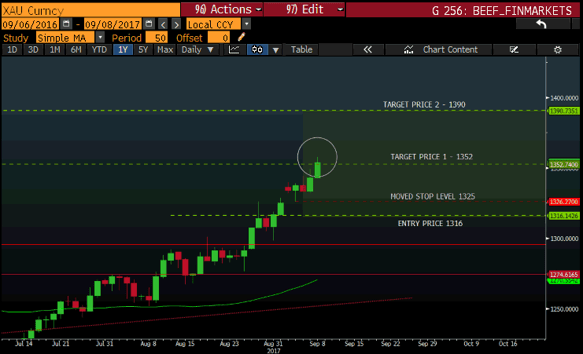

Previous Update 08/09/2017 below:

IN THE MONEY - UPDATE ON GOLD (XAU) 08/09/2017

Gold is in the money and my first target price of $ 1352/ ounce has been reached. This is a great opportunity to take some profits if you haven’t done so already.

NOTE:

- I will also be moving my stop locking in profit at a price level of $ 1325/ ounce.

- Next level to break for a move higher will be $ 1360/ ounce.

UPDATED TRADE: GOLD (XAU)

- ENTRY Long (Buy): $1316/ ounce

- STOP: $1325/ ounce

- TARGET PRICE 1: $1352/ ounce - Reached

- TARGET PRICE 2: $1390/ ounce

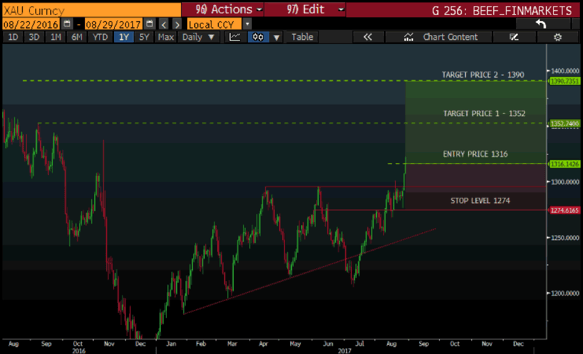

29/08/2017

Source: Bloomberg

Technical take on Gold (XAU)

Due to international political uncertainty, we have seen Gold break through the $1300/ ounce level as of yesterday, 28/08/2017. Today there have been reports of North Korea firing a missile over Japan which I would suspect will see the flight to safety escalate and the gold price increase.

Just take note that the price might retrace back to the $1300/ounce level, to find support and move higher from there.

Trade: Gold (XAU)

- ENTRY Long (Buy): $1316/ ounce

- STOP: $1274/ ounce

- TARGET PRICE 1: $1352/ ounce

- TARGET PRICE 2: $1390/ ounce

Always remember to apply your risk management measures before placing your trades as this will keep you trading in the markets.

Read more notes by Barry HERE.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108