The infamous FAANG stocks have been under pressure of late but looking at the bigger picture, the Nasdaq 100 is still pushing higher ever so slightly.

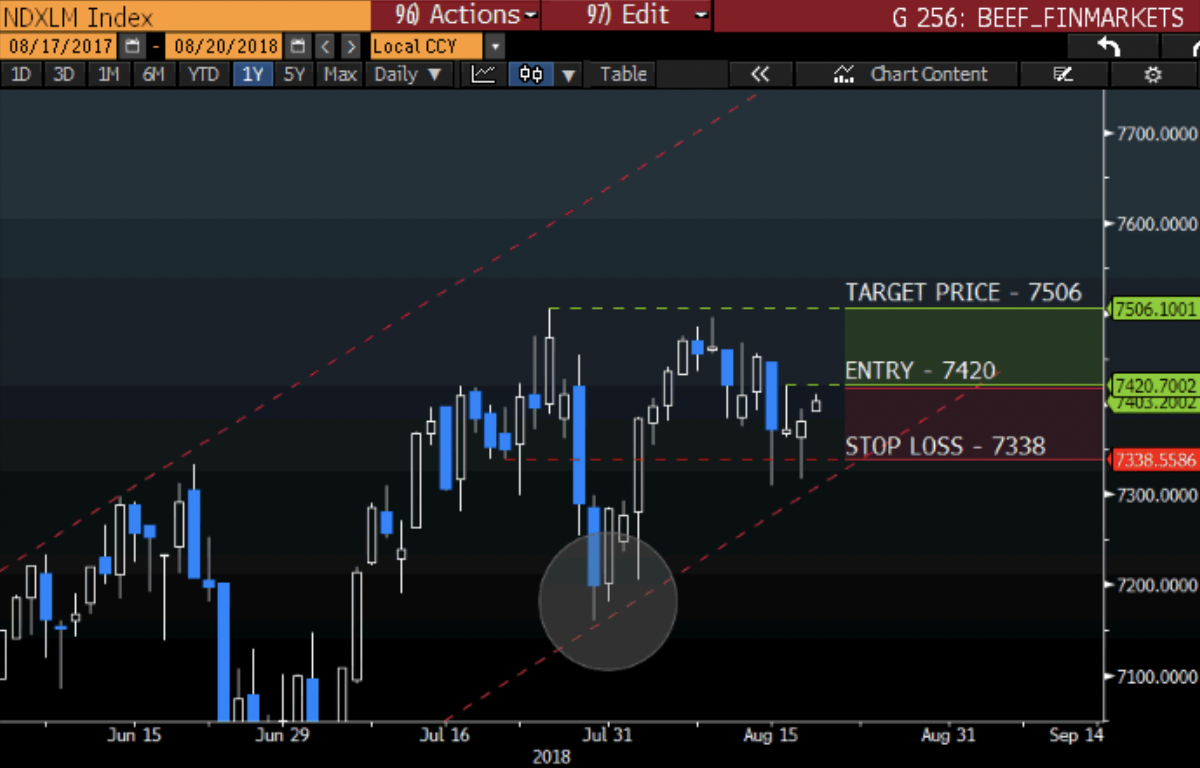

Looking at the chart below we can see the index has been in an uptrend from April and has given dip buyers great opportunities to buy from the support line (red dotted). We need to see the price move higher from current levels to support a positive outlook.

In this note you will find my technical charts and trade summary:

Technical outlook

Taking a closer look at the chart below we can see the price is still trading above the 50-day simple moving average (SMA) and that the Relative Strength Index (RSI) is pointing higher ever so slightly. The formation of a bull flag might also playout supporting a move higher from current levels.

Take note: if the support level does not hold then that will negate the outlook that the price will move higher back to all-time highs.

Source: Bloomberg

Trade: Nasdaq 100

- Entry (buy): 7420

- Stop loss: 7338

- Target price: 7506

Source: Bloomberg

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.