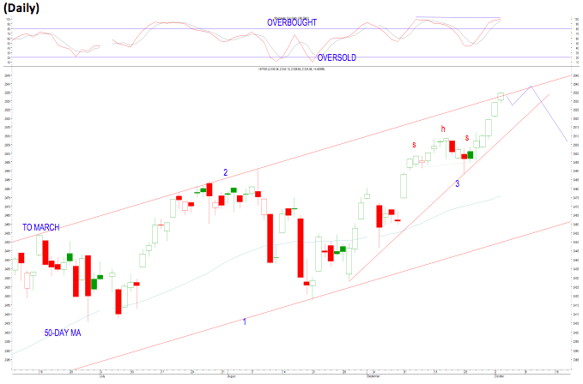

Recommendation: LOOK TO SELL SHORT

Current Trend: Up on all main timeframes, but overbought.

Strategy: Sell short a reversal week down, or aggressive traders to short a reversal day down from 2540.

Chart Setup: The S&P broke out to the upside to confirm a small head and shoulders continuation pattern, which we showed last week. It reached and exceeded its upside target. It’s raced up sharply to also reach line 2 resistance of a large channel with line 1. Right now, I’m looking for a one to two day pullback and then another small leg up, as drawn in. And then the long-awaited correction to begin.

- Its short-term Stochastic is overbought and giving a negative divergence, pointing to a drop to come.

Strategy Details: Sell short on a reversal week down. However, aggressive traders can sell short on a clear reversal day/candle down after the minor drop and retest of the high (as drawn in). (It is risky though because it will be going against the current uptrend).

Target: Minor pullback then a retest of the high of this rally at or above line 2 (2536-2540). Note, the most conservative short signal would be a close below line 3. (Line 3 is at 2508 on Weds 4th and it’s rising by 3pts per trading day thereafter). Once the short is triggered, look for a drop to 1491 to take half profits, and more at 2477.

Stop-loss: A close above the high of the current rally. (After the short signal is triggered). From 2491 lower the stop to a breaking of its prior two-day high.

Download GT247.com MobiTrader app and start trading from your mobile phone immediately with R100 000 demo money:

To subscribe to more research by Colin please go to his website www.themarket.co.za

COPYRIGHT:

THIS NEWSLETTER IS TO BE READ ONLY BY CLIENTS OF GLOBAL TRADER. UNDER NO CIRCUMSTANCES IS IT TO BE SHOWN (OR GIVEN) IN PHYSICAL OR ELECTRONIC FORM TO ANY OTHER PERSON, WITHOUT THE PRIOR CONSENT OF THEMARKET.CO.ZA. FURTHERMORE, ELECTRONIC TRANSMISSION (EMAIL), REPRODUCING, AND/OR DISSEMINATING THIS DOCUMENT (OR PART THEREOF) IN ANY OTHER MANNER WITHOUT THE WRITTEN CONSENT OF THEMARKET.CO.ZA IS A VIOLATION OF THE COPYRIGHT LAW - AND IS ILLEGAL.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108