The JSE extended its gains on Friday as the optimism surrounding stocks on the back of on the ongoing Sino-US trade talks continued.

Reactions to the headlines about the trade war have become fickle as the tension has been drawn out, however there seems to be an elevated sense of optimism that the current talks will yield a partial deal. In Europe, there was optimism over Brexit as the European Union’s chief negotiator hinted that talks with the United Kingdom could begin in earnest. With markets having recorded extensive declines over the past couple of weeks, any positive outcome has the potential to be a catalyst for a significant rally.

On the currency market, the rand jolted against the greenback to a session high of R14.76/$ despite the US dollar holding steady against a basket of major currencies. At 17.00 CAT, the rand was trading 1.61% firmer at R14.80/$.

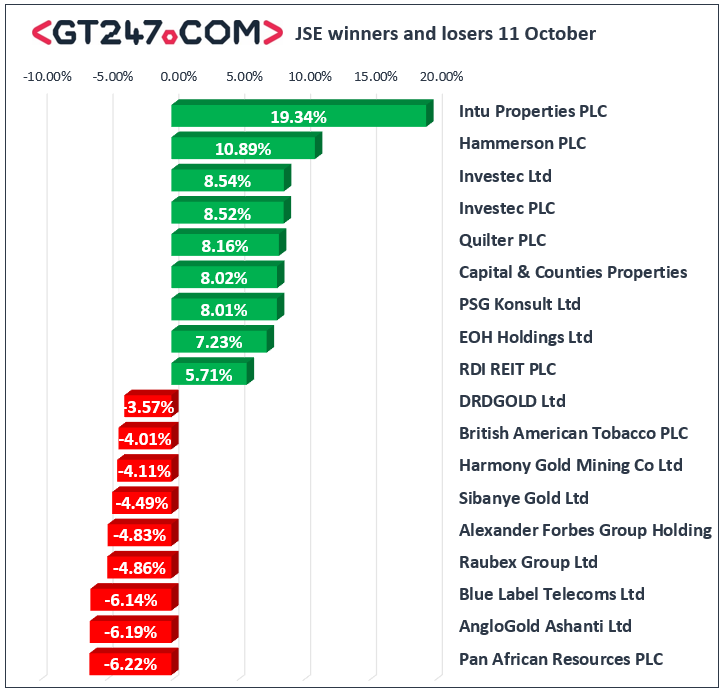

On the local bourse, positive news over Brexit saw UK focused listed property stocks rise on the day. Intu Properties [JSE:ITU] surged 19.34% to close at R8.27, Hammerson PLC [JSE:HMN] climbed 10.89% to close at R56.70, and Capital & Counties [JSE:CCO] rallied 8.02% to close at R45.12. Investec Limited [JSE:INL] was also buoyant on the back of the positive UK sentiment as it climbed 8.54% to close at R81.81. EOH Holdings [JSE:EOH] gained 7.23% to close at R12.76 following the release of an updated trading statement in which the company indicated that it is expecting a smaller loss than initially forecasted. Gains were also recorded for Imperial Logistics [JSE:IPL] which added 5.31% to close at R54.89, Mediclinic International [JSE:MEI] firmed 5.19% to close at R64.82, and Nedbank [JSE:NED] rose 3.38% to close at R237.10.

Miners recorded another session of losses with Pan African Resources [JSE:PAN] falling 6.22% to close at R2.11 as it closed amongst the day’s biggest losers. AngloGold Ashanti [JSE:ANG] fell 6.19% to close at R295.50, Harmony Gold [JSE:HAR] dropped 4.11% to R44.11, and Sibanye Gold [JSE:SGL] lost 4.49% to close at R23.40. Blue Label Telecoms [JSE:BLU] came under significant pressure eventually closing 6.14% lower at R2.60, while Raubex Group [JSE:RBX] weakened by 4.86% to end the day at R18.60. Other significant losses were recorded for Pick n Pay [JSE:PIK] which lost 2.63% to close at R60.27, British American Tobacco [JSE:BTI] which retreated 4.01% to R500.07, and Exxaro Resources [JSE:EXX] which closed at R120.79 after losing 0.98%.

The JSE ALL-Share index eventually closed 0.84% firmer while the JSE Top-40 index gained 0.76%. The Industrials index recorded modest gains of 0.07%, however the Financials and Resources indices rose 2.37% and 0.75% respectively.

Brent crude surged on the back of the attack on an Iran oil tanker. The commodity was trading 1.91% firmer at $60.23/barrel just after the JSE close.

At 17.00 CAT, Platinum was down 1.05% at $888.90/Oz, Gold was 0.93% weaker at $1479.68/Oz, and Palladium had shed 0.14% to trade at $1700.30/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.