The JSE firmed on Tuesday on the back of broad-based optimism fueled by positive news for Brexit and US earnings.

With the US earnings reporting season having kicked off today following the release of earnings from some of the major banks, investors shifted their focus to the health of the US companies. With the Fed officially in a rate cutting cycle, the biggest negative impact was expected to be seen in the net interest margin reported by the banks. Other upcoming major earnings releases could potentially reflect the impact of the protracted trade war between China and the USA.

In Europe, the European Union continues to be optimistic on the prospect of a Brexit deal. Optimism swept across the bloc except for the FTSE 100 which struggled to maintain momentum. The International Monetary Fund threw a spanner into the works as it flagged that the global growth would decelerate as trade tensions continue to undermine expansion. The IMF also cut its global growth forecast for 2019 to 3.0%.

The rand was milder in today’s session as it retreated against the greenback as emerging market currencies weakened on the prospects of heavy retaliation by the US to Turkey. The rand slumped to a session low of R14.91/$ before it rebounded to be recorded trading 0.17% weaker at R14.84/$ at 17.00 CAT.

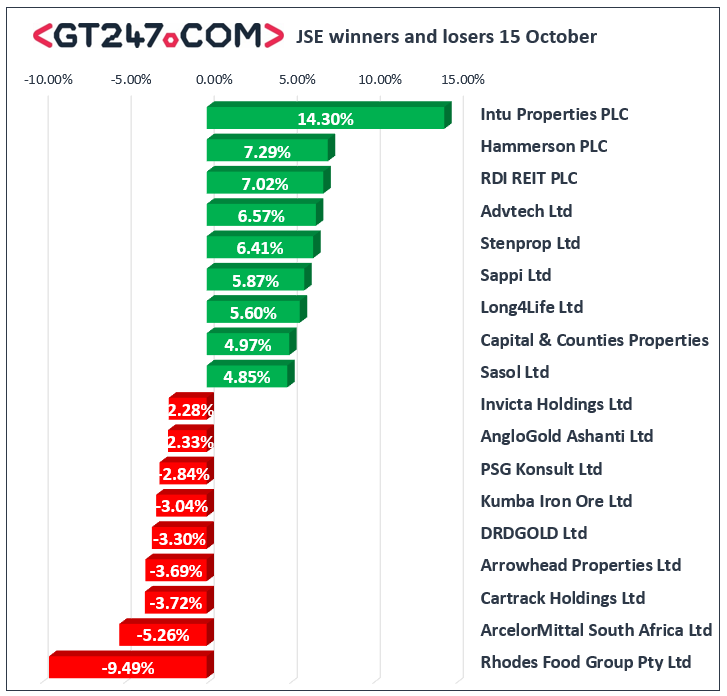

Gains on the JSE were led by UK focused listed property stocks which rose on the back of positive Brexit deal news. Intu Properties [JSE:ITU] surged 14.3% to end the day at R9.35, Hammerson PLC [JSE:HMN] climbed 7.29% to close at R60.20, while Capital & Counties [JSE:CCO] rose 4.97% to close at R46.69. Rand hedge Sappi [JSE:SAP] rallied 5.87% as it closed at R40.02, while Mondi PLC [JSE:MNP] added 3.595 to close at R308.11. Mediclinic [JSE:MEI] rose 3.19% to close at R67.90, while pharma giant Aspen Pharmacare [JSE:APN] managed to record gains of 3.16% to end the day at R99.78. Gains were also recorded for Sasol [JSE:SOL] which rose 4.85% to close at R287.93, Quilter [JSE:QLT] gained 4.18% to close at R26.67, and The Foschini Group [JSE:TFG] closed at R166.40 after gaining 1.8%.

Rhodes Food Group [JSE:RFG] came under significant pressure as it tumbled 9.49% to close at R14.02. Miners struggled on the day as most if them retreated on the day. Kumba Iron Ore [JSE:KIO] fell 3.04% to close at R353.43, while Anglo American Platinum [JSE:AMS] lost 2.2% to close at R1053.10. Retailer, Shoprite [JSE:SHP] retreated 1.18% to close at R131.09, while Massmart [JSE:MSM] lost 0.98% to close at R43.52. Other significant losers on the day included AngloGold Ashanti [JSE:ANG] which lost 2.33% to close at R294.00, Harmony Gold [JSE:HAR] fell 1.8% to close at R43.20, and Discovery Ltd [JSE:DSY] which closed at R120.43 after losing 1.35%.

The JSE Top-40 index eventually closed 0.51% firmer while the broader JSE All-Share index rose 0.57%. Although modest, all the major indices advanced in today’s session. The Financials index rose 0.63%, Industrials added 0.5%, while Resources added 0.4%.

Brent crude was recorded trading flat at $59.37/barrel just after the JSE close.

At 17.00 CAT, Palladium had rallied 1.33% to trade at $1733.70/Oz, Platinum was 1.06% softer at $884.20/Oz, and Gold was 0.94% lower at $1479.24/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.