The JSE closed softer on Friday in line with global markets which retreated despite robust US jobs numbers.

Concerns over the coronavirus seemed to creep back in as momentum faded across most major global markets. In Shanghai, the main equity benchmark was unchanged at the close, while the Nikkei and Hang Seng retreated 0.19% and 0.33% weaker. Weaker German industrial production numbers released on Friday played a factor in the weakness recorded in Europe where all the major indices retreated. The main equity bourses in the USA also opened lower to start off the session.

With speculators betting on the possibility of a US Fed rate hike given the better than expected jobs numbers, the greenback advanced against most emerging market currencies. The rand was not spared as it breached R15/$ to reach a session low of R15.10/$. At 17.00 CAT, the rand was trading 1.32% weaker at R15.09/$.

US Non-Farm Payrolls 225K vs expected 165k 🇺🇸 Previously 147K. Unemployment Rises 3.6%. #NFP

— GT247.com (@GT_247) February 7, 2020

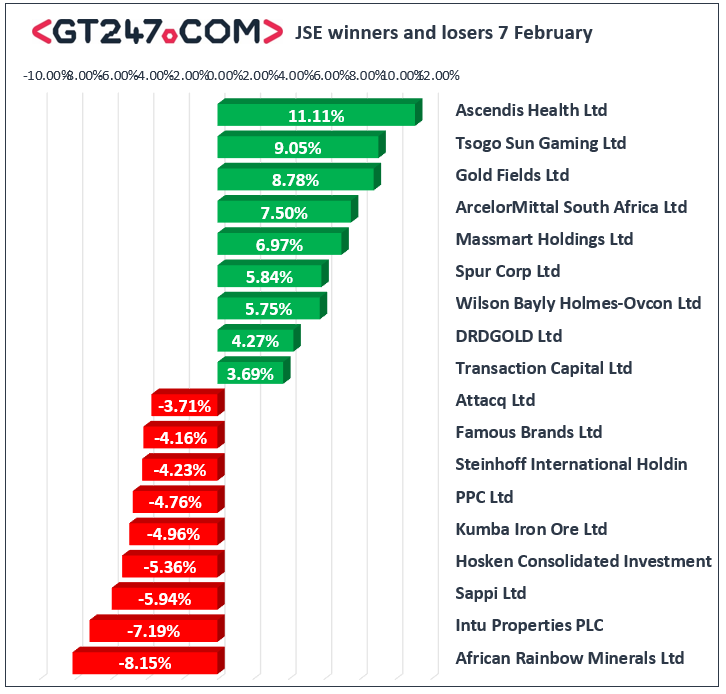

On the local bourse, African Rainbow Minerals [JSE:ARI] led the day’s losses as it slumped 8.15% to close at R152.68, while Kumba Iron Ore [JSE:KIO] fell 4.96% to close at R336.51. Assore [JSE:ASR] lost more ground in today’s session as it dropped 3.46% to close at R224.00, while Northam Platinum [JSE:NHM] weakened by 2.45% to close at R123.81. Intu Properties [JSE:ITU] could not catch a reprieve as it fell 7.19% to close at R2.58, while Accelerate Property Fund [JSE:APF] lost 2.52% to close at R1.55. Rand sensitives traded mostly softer on the back of the weaker rand. Truworths International [JSE:TRU] lost 2.53% to close at R42.70, while Nedbank [JSE:NED] closed 1.51% lower at R202.04. Other significant losses on the day were recorded for Bid Corporation [JSE:BID] which fell 3.13% to close at R320.41, while Sasol [JSE:SOL] closed at R234.00 after dropping 2.9%.

Tsogo Sun Gaming [JSE:TSG] found some traction following four consecutive sessions of losses. The share surged 9.05% to close at R10.96. Gold miners also found some momentum with gains being recorded for Gold Fields [JSE:GFI] which added 8.78% to close at R103.19, while AngloGold Ashanti [JSE:ANG] managed to gain 3.31% to close at R297.02. Mediclinic [JSE:MEI] was buoyed by the announcement that it had gained approval for the acquisition of Matlosana hospitals in the North West. The share eventually closed 1.33% firmer at R74.56. Gains were also recorded for Barloworld [JSE:BAW] which gained 2.43% to close at R101.77, as well as Rand Merchant Investment Holdings [JSE:RMI] which closed at R28.39 after gaining 1.43%.

The JSE All-Share index eventually closed 0.45% lower while the JSE Top-40 index dropped 0.44%. The Resources index was unchanged at the close, while the Industrials and Financials indices dropped 0.16% and 1.22% respectively.

Brent crude lost more ground in today’s session as it was recorded trading 1.09% lower at $54.33/barrel just after the JSE close.

At 17.00 CAT, Palladium was down 2.21% at $2294.59/Oz, Gold was up 0.4% at $1572.87/Oz, and Platinum had risen 0.78% to trade at $968.34/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.