The JSE began the week on a positive note as it surged along with other global markets after Donald Trump agreed to ease a ban on US companies which trade with Huawei.

The major US indices quickly surged to new all-time highs led by gains in tech stocks on the Nasdaq. In Hong Kong markets were closed while in mainland China the Shanghai Composite Index rallied to close 2.88% higher, and in Japan the Nikkei gained 2.13%. It also was a sea of green in Europe as all the major indices advanced. This move from the US president has been taken as a positive move in potentially lowering tensions between the US and China.

On the currency market the rand had a volatile session which saw strengthen as high as R14.03/$ earlier, before it fell to a session low of R14.17/$. At 17.00 CAT the rand was trading flat at $14.07/$.

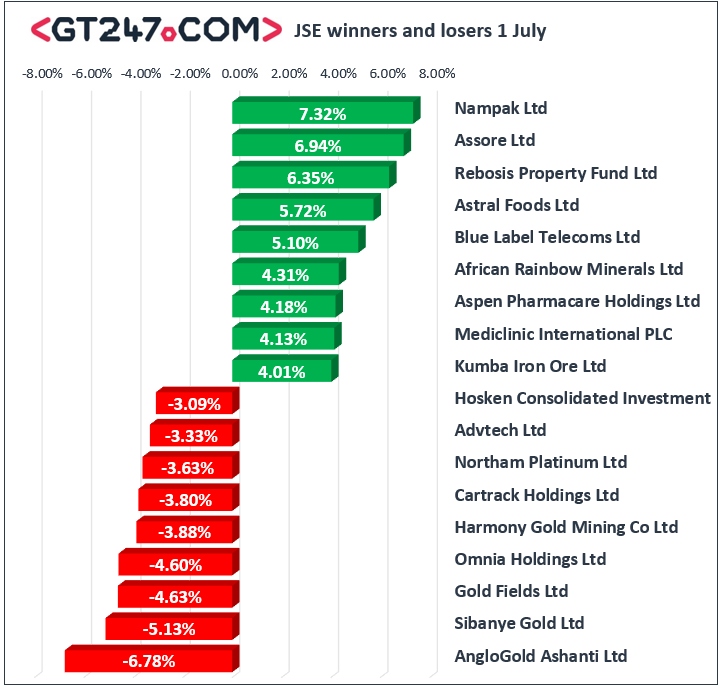

On the JSE, blue-chips traded mostly firmer with significant gains being recorded for Aspen Pharmacare [JSE:APN] which rallied 4.18% to close at R104.65. British American Tobacco [JSE:BTI] rose 3.19% to end the day at R510.26, Naspers [JSE:NPN] climbed 2.92% to close at R3519.20, and Mediclinic [JSE:MEI] posted gains of 4.13% to close at R56.70. Nampak [JSE:NPK] closed as one of the day’s biggest advancers after it gained 7.32% to close at R11.00, while Blue Label Telecoms [JSE:BLU] rose 5.1% to R4.95. Retailers remained resilient despite the slip up in the rand with stocks such as Truworths [JSE:TRU] adding 3.57% to close at R72.50, while Massmart [JSE:MSM] closed at R62.97 after gaining 1.24%.

Gold stocks retreated on the day mainly on the back of the weaker gold metal price. AngloGold Ashanti [JSE:ANG] was one of the day’s biggest losers as it tumbled 6.78% to close at R236.79. Sibanye Stillwater [JSE:SGL] fell 5.13% to R15.90, Harmony Gold [JSE:HAR] dropped 3.88% to close at R30.51, and Gold Fields [JSE:GFI] lost 4.63% to close at R73.20. Other significant losers on the day included Life Healthcare [JSE:LHC] which dropped 2.85% to close at R21.80, Imperial Logistics [JSE:IPL] which lost 1.77% to close at R50.52, while Sappi [JSE:SAP] lost 1.77% to close at R53.92.

After having advanced more than a percent earlier the JSE All-Share index eventually closed 0.61% firmer, while the blue-chip JSE Top-40 index gained 0.51%. Gold stocks weighed on the Resources index as it lost 0.41%, however the Industrials and Financials indices gained 1.15% and 0.13% respectively.

Brent crude advanced as OPEC pledged to continue output cuts well into the following year. Brent crude was trading 1.65% firmer at $65.80/barrel just after the JSE close.

At 17.00 CAT, Gold was down 1.04% at $1394.90/Oz, Platinum was 0.4% firmer at $838.70/Oz, and Palladium was up 1.12% to trade at $1555.70/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.