The JSE rallied along with other global markets on Monday on the back of positive sentiment that there were lower reported coronavirus related deaths over the weekend from the main hotspots.

This gave some investors hope that this might be the first sign of the virus levelling off as health experts and governments battle to contain the virus. The local bourse started on the front foot as the positive momentum from the Hang Seng and the Nikkei which rallied 2.21% and 4.24% respectively, filtered through. The Shanghai Composite Index was closed for a holiday. Strong gains were recorded for all the major European benchmarks as well as the US indices. Global sentiment remains mostly bearish given weak economic data but any headlines on decreasing fatalities and monetary stimulus could potentially lift stocks on a session by session basis.

On the currency market, the rand started the day well above R19/$ as it reached a session low of R19.35/$. The weakness has been as a result of the further downgrade of South Africa’s sovereign rating to two notches below junk by Fitch ratings. However, the local unit found some traction in the afternoon session as it pared all losses and ultimately strengthened against the greenback. At 17.00 CAT, the rand was trading 1.79% firmer at R18.69/$.

GT247, South Africa's Top Online Stockbroker, as voted by Intellidex, will continue to operate their powerful MT5 trading platform during the COVID-19 lockdown period. The trading team has assembled their workstations at home and are operational remotely. Clients may experience slight delays in support queries but trading online will resume as normal. Please use our FAQ self-help portal or email supportdesk@gt247.com if you require assistance.

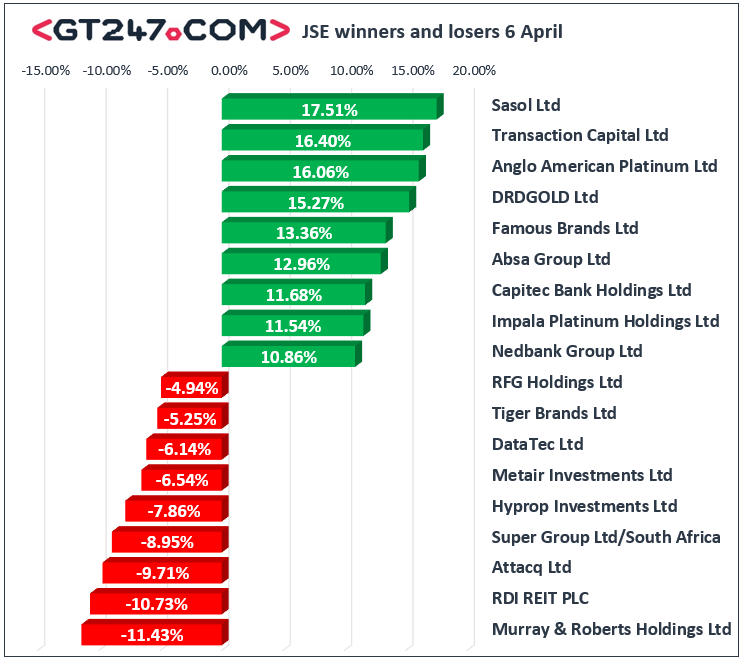

On the JSE, Sasol [JSE:SOL] managed to close amongst the day’s biggest gainers after it advanced 17.51% to close at R46.65. Transaction Capital [JSE:TCP] also rallied 16.4% to close at R14.55, while Famous Brands [JSE:FBR] jumped 13.36% to close at R27.66. Although there were broad gains recorded across all the major indices, the bulk of the day’s biggest movers were from miners. Anglo American Platinum [JSE:AMS] surged 16.06% to end the day at R877.56, Impala Platinum [JSE:IMP] rocketed 11.54% to close at R87.00, while Northam Platinum [JSE:NHM] gained 9.76% to close at R76.00. Commodity trading giant Glencore [JSE:GLN] advanced 4.86% to close at R29.37, while Sibanye Stillwater [JSE:SSW] closed at R25.43 after rising 9.9%. Significant gains were also recorded for Nedbank [JSE:NED] which rose 10.86% to close at R91.58, as well as MTN Group [JSE:MTN] which closed at R51.70 after adding 9.42%.

Murray & Roberts [JSE:MUR] came under considerable pressure on the day as it lost 11.43% to close at R5.58, while Super Group [JSE:SPG] slumped 8.95% to close at R11.70. Some listed property stocks retreated as declines were recorded for RDI REIT [JSE:RPL] which dropped 10.73% to close at R12.81, Hyprop Investments [JSE:HYP] which weakened by 7.86% to close at R15.60, as well as Intu Properties [JSE:ITU] which lost 2.25% to close at R0.87. Declines were also recorded for Tiger Brands [JSE:TBS] which fell 5.25% to close at R178.00, as well as RFG Holdings [JSE:RFG] which closed at R15.02 after losing 4.94%.

The JSE All-Share index eventually closed 3.68% higher while the blue-chip JSE Top-40 index gained 4.06%. The Resources index surged 5.01% while the Industrials and Financials advanced 2.65% and 5.63% respectively.

Brent crude started the week on the back-foot as it eased from Friday’s highs. The commodity was trading 4.13% lower at $32.70/barrel just after the JSE close.

At 17.00 CAT, Palladium was down 1.28% at $2131.33/Oz, Platinum was up 1.29% at $734.49/Oz, and Gold was trading 1.7% higher at $1645.86/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.