The JSE rallied on Tuesday as global stocks rebounded on the back of hopes that stimulus measures which are being implemented by most governments could cushion the pending economic downturn.

With US Congress inching closer to passing a stimulus bill which could aid the US economy, investors looked to take a bite at riskier assets. The surge started in Asia where the Nikkei jumped 7.13%, while the Hang Seng and Shanghai Composite Index closed 4.46% and 2.69% higher. Strong gains were recorded across all the major indices in Europe while US equity futures hit the 5% limit up band which is permissible before the spot market opens. US markets extended their gains after the open as optimism remained rife.

GT247, South Africa's Top Online Stockbroker, as voted by Intellidex, will continue to operate their powerful MT5 trading platform during the COVID-19 lockdown period. The trading team has assembled their workstations at home and are operational remotely. Clients may experience slight delays in support queries but trading online will resume as normal.

The US dollar eased from its highs which gave some reprieve to emerging market currencies such as the rand. The local unit peaked at a session high of R17.52/$ before it was recorded trading 1.13% firmer at R17.61/$ at 17.00 CAT.

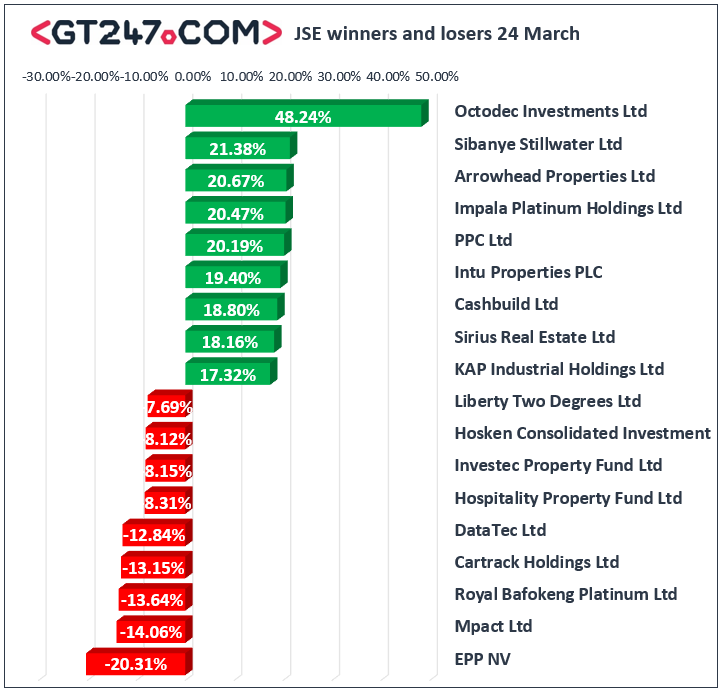

On the local bourse, Octodec Investments [JSE:OCT] which fell sharply at the close on Monday managed to claw back some of its losses on Tuesday as it jumped 48.24% to close at R7.59. Constituents of the resources index recorded the bulk of today’s double-digit percentage increases. Sibanye Stillwater [JSE:SSW] surged 21.38% to close at R22.54, Impala Platinum [JSE:IMP] gained 20.47% to close at R66.86, while BHP Group [JSE:BHP] advanced 13.94% to end the day at R257.89. Arrowhead Properties [JSE:AHB] rocketed 20.67% to close at R1.81, while Intu Properties [JSE:ITU] gained 19.4% to close at R0.80. Imperial Logistics [JSE:IPL] rose 15.69% to close at R29.05, while PPC Ltd [JSE:PPC] closed at R1.25 after gaining 20.19%. Significant gains were also recorded for Sasol [JSE:SOL] which settled at R24.26 after advancing 10.88, as well as Standard Bank [JSE:SBK] which rose 9.63% to close at R97.69.

EPP NV [JSE:EPP] closed as one of the day’s biggest losers after it lost 20.31% to close at R4.63. Other listed property stocks also struggled on the day as losses were recorded for Hospitality Property Fund B [JSE:HPB] which fell 8.31% to close at R3.20, while Investec Property Fund [JSE:IPF] dropped 8.15% to close at R6.20. Royal Bafokeng Platinum [JSE:RBP] struggled compared to its peers as it fell 13.64% to close at R20.51. Significant losses were also recorded for Aspen Pharmacare [JSE:APN] which lost 4.33% to end the day at R91.90, as well as Multichoice Group [JSE:MCG] which closed at R83.13 after losing 6.49%.

The JSE All-Share index eventually closed 7.53% firmer while the JSE Top-40 index gained 8.23%. The Resources index jumped 13.53%, while the Industrials and Financials indices advanced 5.29% and 7% respectively.

Brent crude rebounded with the recovery in global stocks. It was recorded trading 2.59% firmer at $27.73/barrel just after the JSE close.

At 17.00 CAT, Gold was up 3.08% at $1601.00/Oz, Platinum had gained 5.58% to trade at $683.98/Oz, while Palladium spiked up 13.58% to trade at $1924.67/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.