Stocks across the globe fell on Monday as China announced its planned retaliation to the increase on its exports to the USA which was triggered on Friday.

The Chinese finance ministry announced that it planned to impose tariffs on $US60 billion worth of Chinese goods starting from the 1st of June. With threats looming from both sides it does seem there might be extended weakness for riskier assets such as stocks globally. In mainland China, the Shanghai Composite Index closed 1.65% lower on Monday while the Japanese Nikkei lost 0.72%. In Europe all the major indices traded softer, and in the USA the 3 main indices all opened more than 2% weaker.

A volatile trading session ensued on the currency market especially for the US dollar which fell on the US dollar index to a session low of 97.03 index points. The rand however tracked the Chinese yuan lower as it retreated from Friday’s to a session low of R14.33/$ before retracing briefly to trade 1.12% weaker at R14.30/$ at 17.00 CAT.

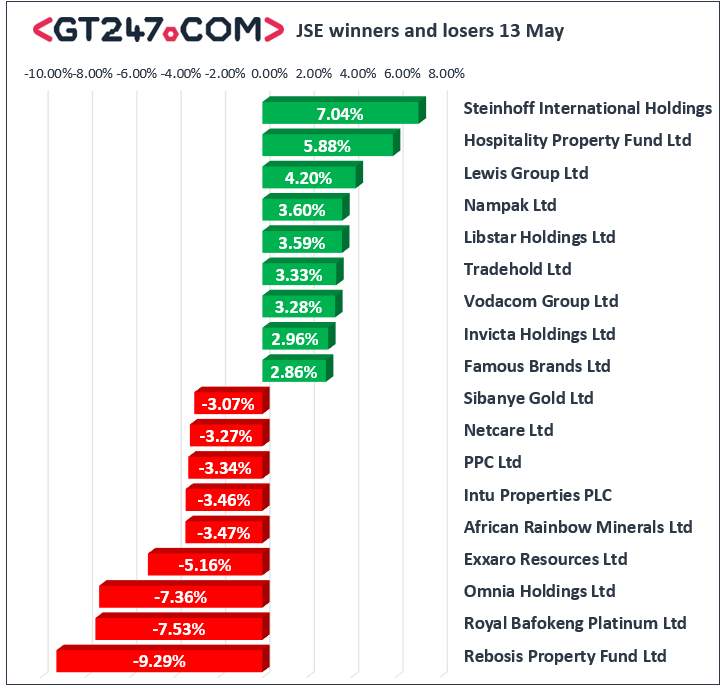

On the JSE most of the blue-chips retreated on the day. Coal miner Exxaro Resources [JSE:EXX] fell 5.16% to close at R154.74, while Kumba Iron Ore [JSE:KIO] lost 2.31% to close at R413.46. Other miners also struggled on the day as losses were recorded for Sibanye Stillwater [JSE:SGL] which lost 3.07% to close at R11.98, Lonmin [JSE:LON] dropped 2.7% to close at R11.52, and Anglo American PLC [JSE:AGL] fell 0.72% to close at R347.73. Listed property stock Intu Properties [JSE:ITU] lost 3.46% to close at R17.32, while Rebosis Property Fund [JSE:REB] weakened by 9.29% to end the day at R1.27. Index giant, Naspers [JSE:NPN] closed at R3355.00 after losing 2.05%, while rand hedge Richemont [JSE:CFR] fell 1.52% to end the day at R98.41.

Steinhoff International [JSE:SNH] staged a rebound in today’s session as it rallied 7.04% to end the day at R1.52 following consecutive sessions of losses. Vodacom [JSE:VOD] managed to close 3.28% firmer at R114.97 following the release of its full year results. It’s sector peer MTN Group [JSE:MTN] managed to gain 1.66% as it closed at R98.80 while retailer Woolworths Holdings [JSE:WHL] added 1.83% to close at R48.91. Gold miner AngloGold Ashanti [JSE:ANG] rose 1.96% to close at R167.05, while British American Tobacco [JSE:BTI] gained 1.02% to close at R533.47.

The JSE Top-40 index eventually closed 0.7% weaker while the broader JSE All-Share index lost 0.72%. All the major indices closed weaker as pressure remained across all sectors. Industrials lost 0.87%, Resources dropped 0.52%, and Financials closed 0.39% weaker.

Brent crude seems to have shrugged off the trade war jitters as it firmed in today’s session. It was trading 0.98% firmer at $71.28/barrel just after the JSE close.

At 17.00 CAT, Gold was up 0.89% to trade at $1297.41/Oz, Platinum had lost 1.18% to trade at $855.95/Oz, and Palladium was 2.15% weaker at $1323.40/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.