Stocks plummeted across most global market equity markets on Monday as the trade war claimed its first major casualty.

The USA made good on its threats against Chinese telecom giant Huawei, as US tech giant Google announced that it would be restricting Huawei’s access to its android operating system due to the company being blacklisted. This move presents a higher probability of the trade talks between the USA and China completely breaking down which would be more adverse for global growth prospects.

In mainland China the Shanghai Composite Index lost 0.85% while in Hong Kong the Hang Seng lost 0.57%. All the major indices in Europe tracked lower while US equity futures also pointed lower which led to a weaker opening on the USA.

After weakening considerably on Friday, the rand advanced marginally in today’s session. The local currency peaked at a session high of R14.34/$ before it was recorded trading 0.32% firmer at R14.36/$ at 17.00 CAT.

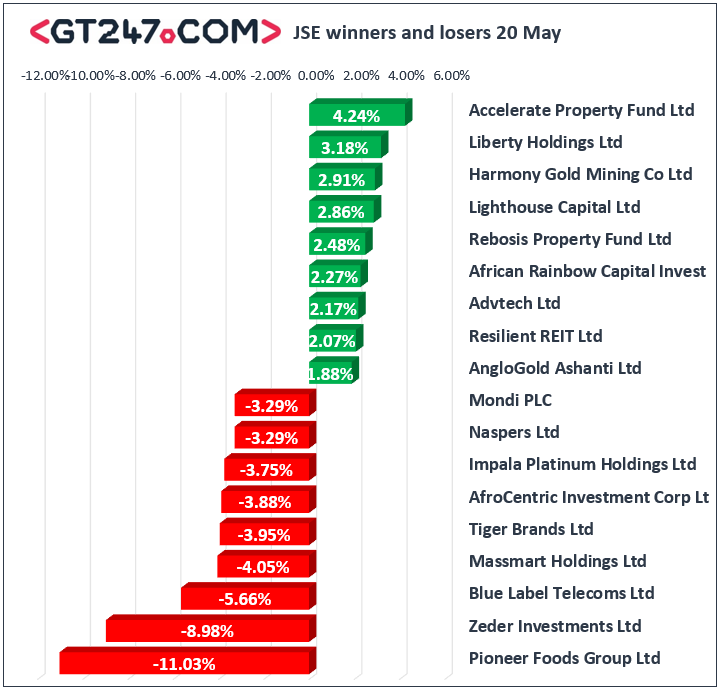

Losses were led by Pioneer Foods Group [JSE:PFG] which came under pressure following the release of its half-year financial statements. The stock fell 11.03% to close at R73.90. Zeder Investmenst [JSE:ZED] also struggled significantly as it lost 8.98% to close at R3.85. There was broad based weakness across most technology stocks in Asia including the Tencent Holdings on the Hang Seng. Subsequently, Naspers [JSE:NPN] also traded under pressure eventually closing 3.29% lower at R3210.00. Diversified mining giant, Anglo American PLC [JSE:AGL] fell 1.55% to close at R354.67, while Kumba Iron Ore [JSE:KIO] dropped 2.41% to close at R417.04. Other significant losers on the day included Massmart [JSE:MSM] which lost 4.05% to close at R78.20, Tiger Brands [JSE:TBS] which fell 3.95% to R237.98, and Mondi PLC [JSE:MNP] which closed at R302.94 after dropping 3.29%.

Gold miners advanced on the day with gains being recorded for Harmony Gold [JSE:HAR] which gained 2.91% to close at R23.32, while AngloGold Ashanti [JSE:ANG] added 1.88% to close at R166.53. Barloworld [JSE:BAW] climbed 1.83% to close at R128.75 following the release of its half-year results. Listed property stocks had reprieve in today’s session as most of them recorded gains. Accelerate Property Fund [JSE:APF] gained 4.24% to close at R3.44, Liberty Holdings [JSE:LBH] added 3.18% to close at R106.00, and Lighthouse Capital [JSE:LTE] closed at R7.20 after gaining 2.86%.

The JSE All-Share index eventually closed 1.1% weaker while the blue-chip JSE Top-40 index 1.06%. The Financials index barely closed in the green as it gained 0.08%. The Resources and Industrials indices fell 0.84% and 1.83% respectively.

At 17.00 CAT, Palladium was up 1.28% to trade at $1332.95/Oz, Platinum had lost 0.34% to trade at $815.70/Oz, and Gold was 0.02% firmer at $1278.01/Oz.

Brent crude advanced on the back of the news that OPEC does not plan to change its strategy with regards to output cuts. The commodity was up 0.57% to trade at $72.62/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.