The JSE recorded a relatively mixed trading session on Wednesday as it struggled for momentum ahead of the US Fed’s interest rate decision.

The South African benchmark 10-year Treasury yield pointed lower to reach a session low of 8.180% while the rand traded mostly flat against the US dollar. US Treasuries also slipped along with other major global Treasury bond yield benchmarks. With the US Fed expected to strike a more dovish tone in its latest policy statement, yields are falling on the back of bets that the Fed could cut rates at its next policy meeting in July. Initial estimates suggest that the Fed will leave rates unchanged at 2.50% on Wednesday.

Locally, Statistics SA released South Africa’s inflation data for the month of May. CPI YoY was recorded at 4.5% which was marginally higher than the prior recording of 4.4% but well within the SARB’s target range of between of 3% and 6%. CPI MoM slowed down to 0.3% from a prior recording of 0.6%. The was limited reaction to this data in the rand which remained range bound between R14.46/$ and R14.58/$ for the duration of today’s session. At 17.00 CAT, the rand was trading 0.11% weaker at R14.52/$.

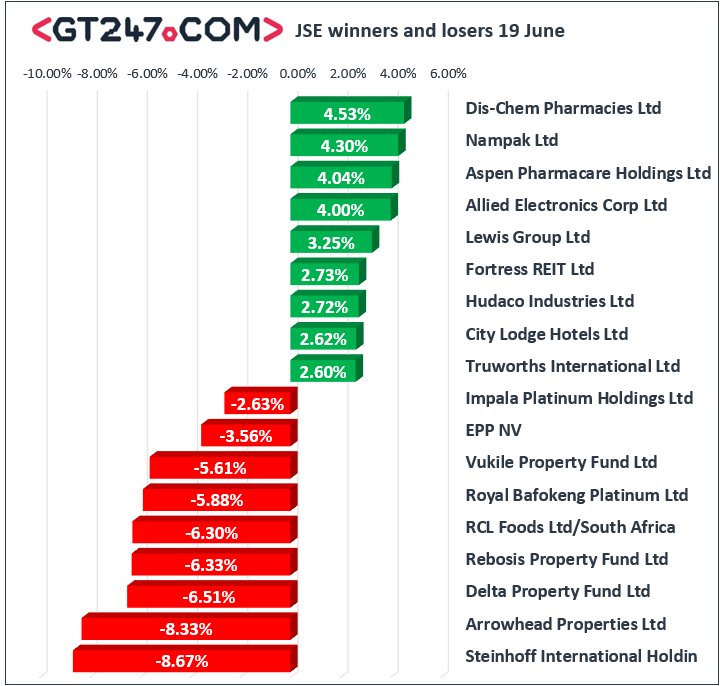

On the local bourse, Dis-Chem Pharmacies [JSE:DCP] recorded another session of gains as it surged 4.53% to close at R27.01 as it finished amongst the day’s biggest gainers. Nampak [JSE:NPK] advanced 4.3% to end the day at R9.70, while cement maker PPC Limited [JSE:PPC] added 1.05% to close at R4.80. Some of the listed property stocks were upbeat on the day as gains were recorded for Equities Property Fund [JSE:EQU] which climbed 2.49% to close at R20.62, as well as Fortress REIT [JSE:FFB] which gained 2.73% to close at R12.05. Retailer Truworths [JSE:TRU] advanced 2.6% to close at R74.90, financial services provider Old Mutual [JSE:OMU] gained 0.79% to close at R21.79, and Mediclinic [JSE:MEI] rose 2.57% to close at R56.36.

Steinhoff International [JSE:SNH] fell mainly on the back of the release of its 2018 annual report which highlighted significant losses. The stock eventually closed 8.67% lower at R1.37. Miners remained subdued with losses being recorded for Impala Platinum [JSE:IMP] which lost 2.63% to close at R67.50, Kumba Iron Ore [JSE:KIO] fell 2.3% to R473.74, and Sibanye Stillwater [JSE:SGL] closed 1.89% weaker at R14.53. Index heavyweight Naspers [JSE:NPN] dropped 1.48% to close at R3464.16, while diversified mining giant Anglo American PLC [JSE:AGL] closed at R387.88 after falling 1.15%.

The JSE All-Share index eventually closed 0.13% lower while the blue-chip JSE Top-40 index dropped 0.11%. The Financials recorded another buoyant session as it climbed 1.29%, however the Resources and Industrials lost 0.62% and 0.38% respectively.

Brent crude was steady in today’s session following the prior session’s surge. The commodity was trading 0.1% firmer at $62.17/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.17% weaker at $1344.35/Oz, Palladium was 0.96% firmer at $1497.45/Oz, and Platinum had shed 0.17% to trade at $1344.35/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.