Local stocks remained buoyant on Tuesday, extending their gains from the prior session where positive sentiment was driven by optimism of trade deal between USA and China.

Similar fundamentals continued to spur global markets on Tuesday as global participants placed bets that an amicable resolution was close given headlines surrounding the talks. In Asia, markets were inspired by record highs recorded in US trading in the prior session. The Nikkei reopened after having been closed on Monday for holiday to end the day 1.76% higher, while the Hang Seng and Shanghai Composite Index managed to add 0.49% and 0.62% respectively.

Although gains were more modest in Europe, the trend remained mostly firmer. In the USA, the Dow Jones and S&P 500 looked to retest their all-time highs as they also traded firmer.

Locally, the FNB/BER Consumer Confidence index for the 3rd quarter fell from a prior recording of 5 to be recorded at -7. The Standard Bank PMI reading for October improved marginally to 49.4 from a prior recording of 49.2. This did not deter the rand which held on to its gains against the greenback. At 17.00 CAT, the rand was trading 0.41% firmer at R14.74/$.

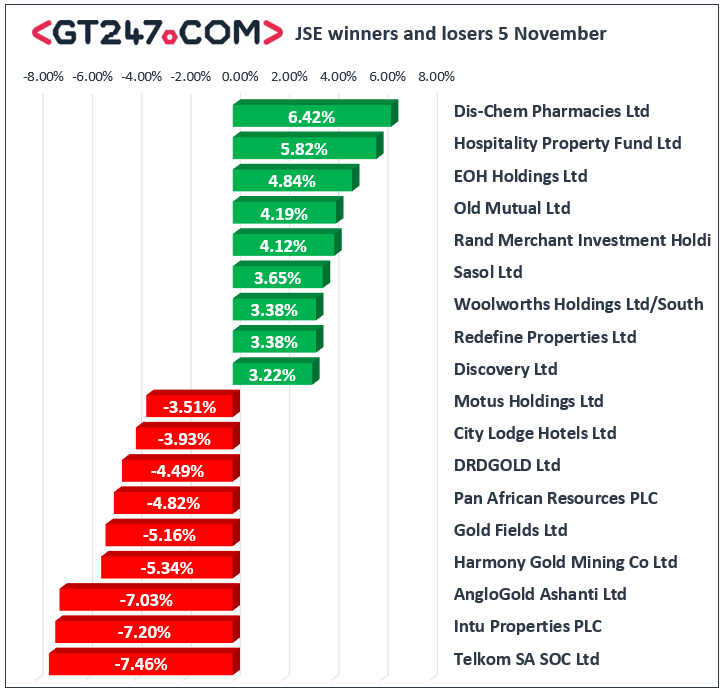

On the JSE, Dis-Chem Pharmacies [JSE:DCP] staged a rebound following a slump in the prior session which was caused by the release of a weak trading statement. The stock surged 6.42% in today’s session to close at R22.88. Financial services provider, Old Mutual [JSE:OMU] gained 4.19% as it closed at R20.41, while Sanlam [JSE:SLM] rallied 2.96% to end the day at R83.35. Coal miner, Exxaro Resources [JSE:EXX] rose 3.19% to close at R130.87, while oil & gas producer, Sasol [JSE:SOL] climbed 3.65% to close at R290.89. Diversified mining giant BHP Group [JSE:BHP] managed to rally 2.26% as it closed at R333.98, while Kumba Iron Ore [JSE:KIO] added 2.47% to close at R386.41. The firmer rand saw stocks such as Massmart [JSE:MSM] rise 1.66% to close at R47.20, while news of Shoprite [JSE:SHP] potentially exiting unprofitable markets saw the stock close at R139.20 after gaining 3%.

Telkom [JSE:TKG] quickly etched its name amongst the day’s biggest losers following the release of a weaker half-year trading statement which saw the stock fall 7.46% to close at R62.52. UK focused listed property stock, Intu Properties [JSE:ITU] came under pressure as it lost 7.2% to close at R7.86. Gold miners had a tough session as well with declines being recorded for AngloGold Ashanti [JSE:ANG] which lost 7.03% to close at R291.95, Gold Fields [JSE:GFI] added 5.16% to close at R84.22, and DRD Gold [JSE:DRD] ended the day 4.49% firmer at R7.02. Losses were also recorded for Motus Holdings [JSE:MTH] which fell 3.51% to close at R71.50 and The Foschini Group [JSE:TFG] which closed at R171.00 after dropping 1.58%.

The JSE ALL-Share index closed 0.53% firmer while the JSE Top-40 index added 0.6%. All the major indices advanced in today’s session with the biggest gainer being the Financials index which gained 1.79%. The Industrials and Resources indices gained 0.16% and 0.27% respectively.

Brent crude extended its gains from the prior session as it was recorded trading 1.32% firmer at $62.95/barrel just after the JSE close.

At 17.00 CAT, Platinum was 0.69% weaker at $931.30/Oz, Palladium was down 0.67% at $1765.05/Oz, and Gold was trading 1.16% lower at $1491.12/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.