The JSE closed mildly firmer on Thursday as it tracked other global markets higher on the back of the signing of the phase one trade deal between the USA and China.

Locally, focus was on the South African Reserve Bank which announced its interest rate decision today. The MPC decided to cut the repo rate by 25 basis points from 6.50% to 6.25% as the central bank highlighted that the risks to economic growth are increasing. There was disappointment recorded for South African mining production as indicated by data released by Statistics SA. Mining production YoY for the month of November contracted 3.1% which was much worse than the forecasted contraction of 0.2%. Mining production MoM was recorded at -3.5% from a prior recording of 1.0%.

The rand fluctuated around the time the SARB governor was delivering the MPC statement. The local unit slipped to a session low of R14.44/$ after having peaked at a session high of R14.35/$ in earlier trading. At 17.00 CAT, the rand was trading 0.28% weaker at R14.41/$.

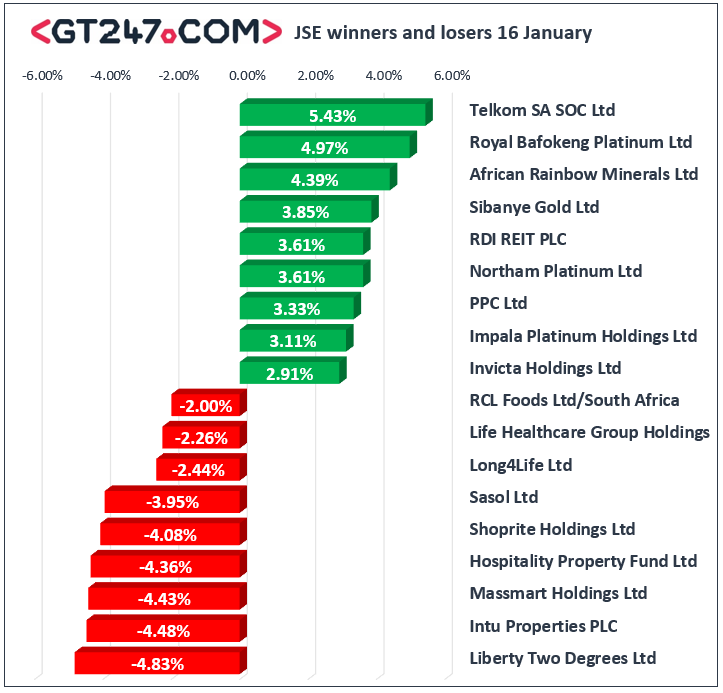

On the JSE, Telkom [JSE:TKG] led the day’s gains as it advanced 5.43% to close at R36.49. This was mainly on the back of reports that the company may embark on an extensive cost-cutting exercise. Sibanye Gold [JSE:SGL] announced that it had cut some jobs at some of the platinum mines that it acquired from Lonmin in order to maintain the viability of those mines. The stock closed 3.85% higher at R37.22. Diversified mining giant, Anglo American PLC [JSE:AGL] gained 1.91% to close at R410.64, while BHP Group [JSE:BHP] rose 1.57% to close at R340.86. Coal miner, Exxaro Resources [JSE:EXX] managed to rise 1.94% to close at R136.43, while Glencore [JSE:GLN] advanced 2% to close at R45.50. Gains were also recorded for RDI REIT [JSE:RPL] which climbed 3.61% to close at R24.97, while Aspen Pharmacare [JSE:APN] closed at R121.00 after gaining 1.02%.

The softer rand resulted in declines being recorded for Massmart [JSE:MSM] which lost 4.43% to close at R53.93, Shoprite Holdings [JSE:SHP] which fell 4.08% to close at R117.45, and Woolworths [JSE:WHL] which closed at R50.61 after losing 1.58%. Sasol [JSE:SOL] closed weaker for a 4th consecutive session as it lost 3.95% to close at R279.27. Intu Properties [JSE:ITU] also slipped further in today’s session as it lost 4.48% to close at R4.26, while Accelerate Property Fund [JSE:ACF] fell 1.69% to close at R1.75. Other losses on the day were also recorded for Tiger Brands [JSE:TBS] which lost 1.84% to close at R211.78, Barloworld [JSE:BAW] which closed 1.43% lower at R103.15, and Richemont [JSE:CFR] which closed at R114.58 after losing 0.73%.

The JSE Top-40 index eventually closed 0.25% firmer while the JSE All-Share index managed to gain 0.26%. The Resources index was the only major index to record gains as it climbed 1.16%. The Financials and Industrials indices lost 0.04% and 0.2% respectively.

Brent crude recovered most of its overnight losses as it traded mostly firmer on the day. It was recorded trading1.03% firmer at $64.61/barrel just after the JSE close.

At 17.00 CAT, Platinum was 0.33% softer at $1016.87/Oz, Gold had shed 0.17% to trade at $1553.50/Oz, and Palladium was up 2.3% at $2314.24/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.