Global stocks fell on Friday following surprise reports that Donald Trump would be increasing tariffs on US$300 billion worth of Chinese imports into the USA.

This news shuddered any hopes of a truce between the world’s two largest economies which have not been able to come to an amicable solution with regards to trade between them. The Hang Seng plummeted 2.35% on Friday while in mainland China, the Shanghai Composite Index lost 1.47%. The Nikkei also recorded substantial losses as it fell 2.11%. Stocks in Europe traded significantly weaker on the day, while in the USA the S&P500 index is set to close lower for a 5th consecutive session after it opened lower on Friday.

In the USA, the non-farm payrolls numbers for July came in mostly in line with expectations however the downward momentum from the additional 10% tariff announcement usurped any reaction to this jobs data. The jobs data released today stated a solid case for the current strength of the US economy.

The US dollar has continued to advance against a basket of major currencies over the past week and it surged even further today. The rand continues to bear the brunt of this move in conjunction with the announcement of an increase in SA treasury bond issuance. The local currency slipped to a session low of R14.75/$ before it was recorded trading 0.73% lower at R14.75/$ at 17.00 CAT.

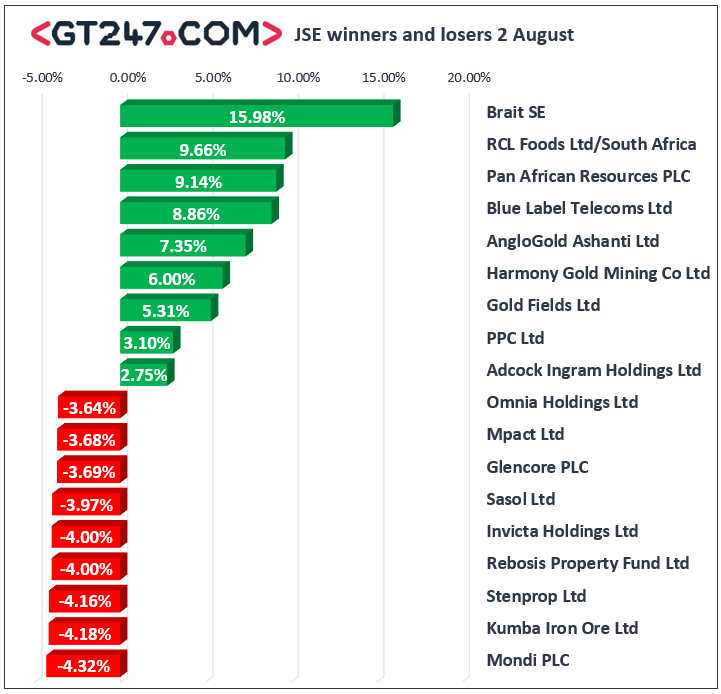

Losses were led by index giant Naspers [JSE:NPN] which fell 3.63% to close at R3510.94, while diversified mining giant BHP Group [JSE:BHP] fell 2.67% to end the day at R330.38. Mondi PLC [JSE:MNP] also struggled on the day as it lost 4.32% to close at R288.50, while Kumba Iron Ore [JSE:KIO] dropped 4.18% to close at R434.00. Oil and gas producer Sasol [JSE:SOL] retreated to close 3.97% weaker at R304.21, while coal miner Exxaro Resources [JSE:EXX] lost 2.79% to close at R153.90. Luxury retailer Richemont [JSE:CFR] closed at R123.16 after losing 1.83%, while banker Standard Bank [JSE:SBK] weakened by 2.22% to close at R174.71.

It was good session for gold miners on the JSE as they traded mostly firmer on the day. AngloGold Ashanti [JSE:ANG] surged 7.35% to close at R282.48, Gold Fields [JSE:GFI] which also released a positive trading statement also gained 5.31% to close at R79.11, while smaller miner DRD Gold [JSE:DRD] rocketed 10.77% to end the day at R5.04. Brait [JSE:BAT] was one of the day’s biggest advancers after the stock gained 15.98% to close at R13.21. Hammerson PLC [JSE:HMN] had a reprieve as it added 2.32% to close at R37.96, while Capital and Counties [JSE:CCO] managed to post gains of 1.94% to close at R34.66.

The JSE All-Share index closed 1.84% lower while the blue-chip JSE Top-40 index lost 1.95%. It was another tough session for all the major indices on the JSE with the Industrials coming under the most pressure as it fell 2.25%. The Resources and Financials indices lost 1.79% and 1.32% respectively.

At 17.00 CAT, Palladium was down 2.17% to trade at $1397.55/Oz, Platinum was 0.88% softer at $846.00/Oz, and Gold had inched up 0.1% to trade at $1445.98/Oz.

Brent crude recovered from its overnight slump to surge on Friday. It was trading 2.93% firmer at $62.29/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.