The JSE tracked other global markets lower on Thursday as investors increasingly became wary that a deal wouldn’t be reached before Friday’s deadline for tariff hikes.

In Asia, stocks in mainland China are closer to retesting two-month lows as the Shanghai Composite Index fell 1.85% while in Hong Kong, the Hang Seng lost 2.39%. In Japan, the Nikkei lost 0.93%. In Europe, automakers led the weakness across most of the blue-chips as all the major indices traded weaker. In the USA, the Dow Jones and S&P500 also opened significantly weaker as investors shrugged off riskier assets for safe-havens.

On the currency market, the US dollar continued to retreat from its recent highs as the 3-month and 10-year US Treasury yields’ spread narrowed as little as 6 basis points on Wednesday. This did well for emerging market currencies such as the rand which strengthened to a session high of R14.30/$ before it weakened sharply to trade 0.52% weaker at R14.43/$ at 17.00 CAT.

In terms of local economic data, there was a marked improved in mining production MoM for the month of March as it advanced 3.8%, easily beating the forecasted contraction of 3%. Mining production YoY fell 1.1% which was also an improvement from the prior decline of 8.1%. Manufacturing production YoY rose 1.2% from a prior recording of 0.5%, while MoM it advanced 0.8% from a prior contraction of 2%.

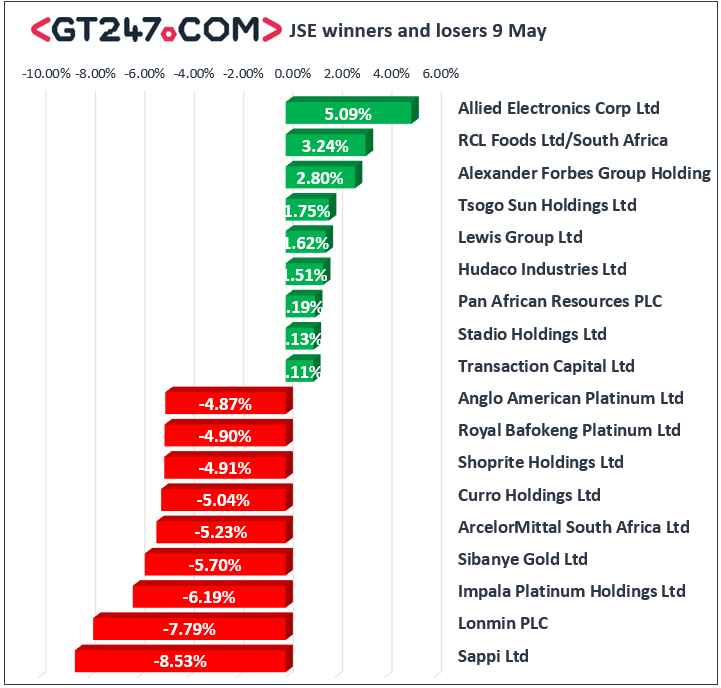

On the JSE, Steinhoff International [JSE:SNH] led the day’s losers following the release of its restated 2017 financial results. The stock fell 20.4% to end the day at R1.60. Miners also struggled on the day with significant losses being recorded for Sibanye Stillwater [JSE:SGL] which stumbled 5.7% to close at R12.40, Impala Platinum [JSE:IMP] which lost 6.19% to end the day at R56.39, and Kumba Iron Ore [JSE:KIO] which fell 3.42% to close at R429.00. Rand hedge, Sappi [JSE:SAP] dropped 8.53% to close at R61.10, while Reinet Investments [JSE:RNI] lost 3.87% to end the day at R228.01. Index giant Naspers [JSE:NPN] lost 3.76% to close at R3410.00 after Tencent Holdings closed lower on the Hang Seng.

Gains were elusive for blue-chip stocks in today’s trading session. Hospitality group Tsogo Sun Holdings [JSE:TSH] managed to gain 1.75% to end the day at R22.08, while Allied Electronics [JSE:AEL] added 5.09% to close at R21.49. Brait [JSE:BAT] gained 0.65% to close at R23.15, while Multichoice [JSE:MCG] inched up 0.48% to end the day at R125.50. Mediclinic [JSE:MEI] managed to gain 0.17% as it closed at R63.55, while Transaction Capital [JSE:TCP] firmed to R19.18 after adding 1.11%.

The JSE All-Share index dropped even further towards the close eventually closing 2.5% lower while the JSE Top-40 index dropped 2.62%. Another downtrend session ensued for all the major indices as they all closed weaker. The Industrials index lost 2.63%, Financials fell 2.59%, and Resources slumped 2.7%.

At 17.00 CAT, Gold was up 0.33% to trade at $1285.10/Oz, Platinum was 1.21% weaker at $850.95/Oz, and Palladium was down 2.94% to trade at $1282.91/Oz.

More weakness was recorded for brent crude which was trading 0.97% weaker at $69.69/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.