Global stocks including those on the JSE plummeted on Monday as the Chinese currency fell to a 3-year low against the greenback.

Speculation remains rife that this is a counter measure to the additional tariffs that were imposed by Donald Trump on $US300 billion worth of Chinese imports. Emerging market currencies and stocks sank on the back of this development, while Treasury bond yields rose as investors fled to safe-haven assets.

Earlier in Asian markets trading, the Hang Seng took a heavy knock as it fell 2.85% while the Shanghai Composite Index lost 1.91%. In Japan the Nikkei fell 1.74%. Most of the major indices in Europe weakened by more than 1.5% on the day while significant losses were also recorded at the open of US equity markets.

The rand had another weak trading session as it narrowly came within breach of R15/$ as it peaked at a session high of R14.95/$. The local currency rebounded marginally before it was recorded trading 0.85% weaker at R14.90/$ at 17.00 CAT.

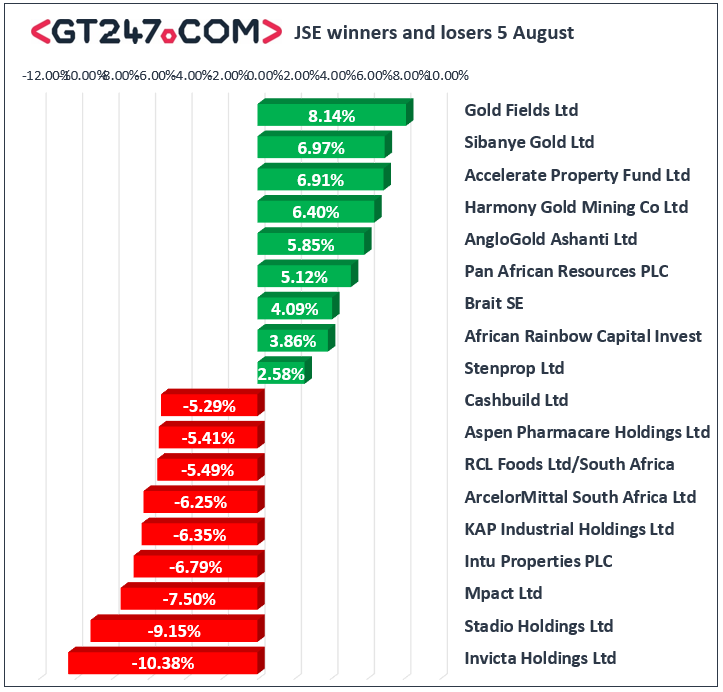

Intu Properties [JSE:ITU] which took a nose-dive last week on the back of weaker earnings, started this trading week on the backfoot as it fell 6.79% to end the day at R7.14. Index heavyweight Naspers [JSE:NPN] also came under significant pressure after its Hang Seng listed Tencent Holdings closed 4.27% lower on Monday. This resulted in Naspers falling 4.58% to end the day at R3350.00. Aspen Pharmacare [JSE:APN] lost further ground as it slipped 5.41% to close at R84.08, while KAP Industrial Holdings [JSE:KAP] lost 6.35% to end the day at R4.72. Diversified mining giant Anglo American PLC [JSE:AGL] fell 2.24% to close at R329.79, while its sector peer BHP Group [JSE:BHP] lost 1.37% to close at R325.85. Other blue-chip stocks which recorded significant losses on the day included Richemont [JSE:CFR] which dropped 4.55% to close at R117.56, Discovery Ltd [JSE:DSY] which fell 4.16% to close at R127.00, and British American Tobacco [JSE:BTI] which closed at R541.46 after falling 3.22%.

Gains were primarily capped to a handful of gold and platinum miners primarily due to higher metal commodity prices. Gold Fields [JSE:GFI] rose 8.14% to close at R85.55, Harmony Gold [JSE:HAR] surged 6.4% to close at R41.37, while AngloGold Ashanti [JSE:AGL] closed at R299.01 after gaining 5.85%. Platinum miner Impala Platinum [JSE:IMP] added 0.99% to end the day at R75.27, while Anglo American Platinum [JSE:AMS] climbed 2.57% to close at R807.74. Brait [JSE:BAT] had a minor reprieve which saw the stock advance 4.09% to close at R13.75.

At 17.00 CAT, Palladium was up 1.24% to trade at $1427.45/Oz, Platinum had rose 1.23% to trade at $855.00/Oz, and Gold was 1.76% higher at $1466.39/Oz.

With the demand outlook looking shaky due to the Sino-US trade war, brent crude slipped further in today’s session. It was recorded trading 2.26% weaker at $60.49/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.