The JSE fell to a six-week low on Wednesday, in a frenzied trading session due to a crash in the share price of Steinhoff after CEO Markus Jooste resigned amid building allegations of accounting indiscretions, with Christo Wiese stepping in as executive chairman.

The All Share index fell 1.64%, matched by the blue-chip Top 40 dropping 1.60% following a -2.21% move in Naspers [JSE:NPN] to R3428.66 as the business continues to track the falling price of Hong Kong listed, Tencent, in which Naspers owns a third.

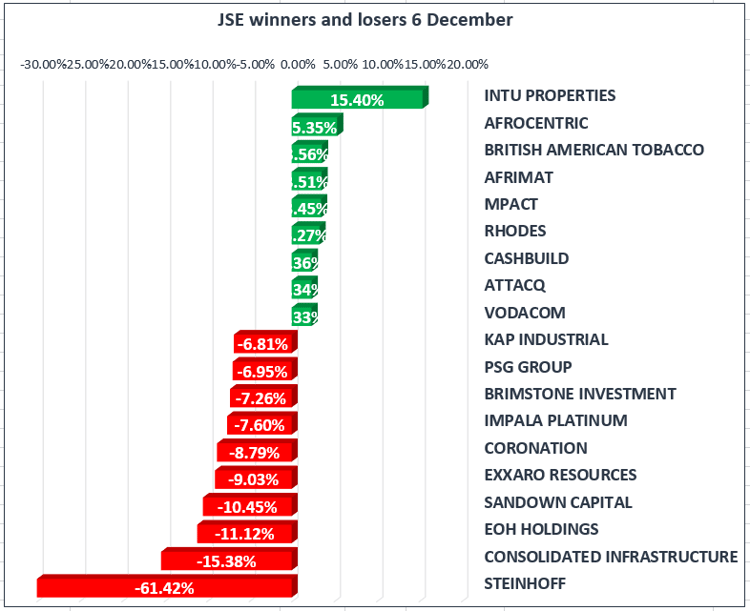

Steinhoff [JSE:SNH] closed 61.42% lower at R15.86 after having fallen 9.15% on Tuesday. Following media reports overnight, Steinhoff released a SENS statement today reporting that it had found new information relating to accounting irregularities, prompting it to cancel its results release today and delay the audited results release until further notice.

Steinhoff lost over R134bn in market cap in a single day, some might not be surprised since the business has long been under scrutiny for allegations of tax-evasion in Germany. News of fresh accusations that Steinhoff have used off-balance sheet related entities to inflate earnings and obscure losses has spooked institutional investors, resulting in a wholesale exit by shareholders.

The bust up with Steinhoff resulted in other casualties in the market as businesses linked to Steinhoff took a hit; Brait [JSE:BAT] falling 5.19% to R42.10, PSG [JSE:PSG] falling 6.95% to R273.89, KAP Industrial holdings [JSE:KAP] falling 6.81%, and Steinhoff Retail Africa (STAR) [JSE:SRR] crumbling 22.76% to R19.00.

In global markets, Australia's economy grew at the fastest annual pace in over a year last quarter, with GDP expanding at a 2.8% annualized rate due to a jump in private business investment.

Brent Crude prices eased to $61.61/bbl due to rising US oil supplies

US markets were firmer today, with the Dow Jones Industrial index gaining 0.08% by the close of the local market.